South Africa Biosensors Market Analysis

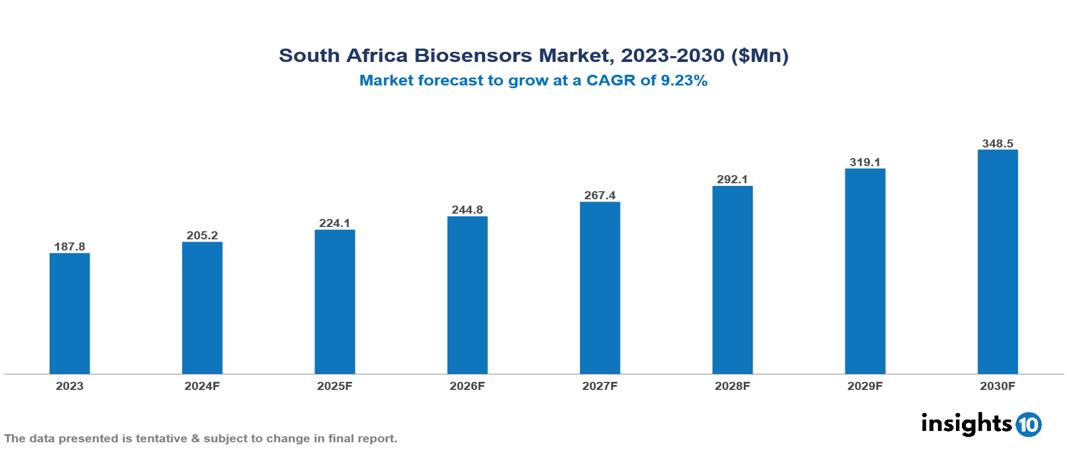

The South Africa Biosensors Market was valued at $187.8 Mn in 2023 and is predicted to grow at a CAGR of 9.23% from 2023 to 2030, to $348.5 Mn by 2030. The key drivers of the market include increasing burden of chronic diseases, emphasis on preventative care, and increasing demand for accurate disease diagnosis. The prominent players of the South Africa Biosensors Market are Masimo Corporation, Meridian Bioscience, Biosensors International, Nix Biosensors, and Abbott Laboratories, among others.

Buy Now

South Africa Biosensors Market Executive Summary

The South Africa Biosensors market is at around $187.8 Mn in 2023 and is projected to reach $348.5 Mn in 2030, exhibiting a CAGR of 9.23% during the forecast period.

A biosensor is defined as a self-contained integrated device that consists of a biological recognition system and a transducer for signal processing which is used to provide quantitative or semi-quantitative information about a particular analyte in a sample. There is a wide range of applications of biosensors with the aim to improve the quality of life. A few of the fields in which biosensors are used include the healthcare, environmental monitoring, food safety, defense, and many more. Biosensors are gaining enormous attention from its application in the medical field as they are effectively used for patients’ health surveillance and management. One of the main applications of biosensors in this field is the detection of biomolecules which are either disease indicators or drug targets which aids in early disease diagnosis.

South Africa has a high burden of both communicable diseases such as malaria, tuberculosis, HIV/AIDS and non-communicable disease (NCDs) such as cardiovascular disease, chronic respiratory disease, cancer, and diabetes. Due to this, multi-morbidity is a major public health challenge given the high burden of both types of diseases. The South Africa Biosensors Market is thus driven by significant factors such as the increasing burden of chronic diseases, emphasis on preventative care, and increasing demand for accurate disease diagnosis. However, high costs and limited reimbursement, technical challenges, and data management issues restrict the growth and potential of the market.

The prominent players of the South Africa Biosensors Market are Masimo Corporation, Meridian Bioscience, Biosensors International, Nix Biosensors, and Abbott Laboratories, among others.

Market Dynamics

Market Growth Drivers

Increasing Burden of Chronic Diseases: Non-Communicable Diseases (NCDs) are a significant health problem in South Africa. According to the WHO, the age-standardised mortality rate across major NCDs including malaria, tuberculosis, HIV/AIDS, cardiovascular disease, chronic respiratory disease, cancer, and diabetes was 772 per 100,000 in males and 579 in females in 2021. Biosensors enable real time monitoring of various health parameters, which allows for better chronic managements and timely diagnosis and treatment of these conditions. This prevents potential complications and leads to long-term health outcomes. Due to the significant role of biosensors in chronic disease treatment, the Biosensors Market is at its full potential growth.

Emphasis on Preventative Care: As chronic diseases become more common, preventative care is becoming increasingly important in healthcare. Biosensors are valuable tools in this context, as they enable individuals to monitor their health and identify risk factors for chronic conditions. Early detection through biosensors allows for preventative actions, like lifestyle changes or medications, which can delay the development of chronic diseases. Therefore, the focus on preventative care is driving the growth of the Biosensors Market.

Increasing Demand for Accurate Disease Diagnosis: For effective treatment and improved patient outcomes, early and accurate diagnosis is essential. Biosensors can quickly, accurately, and conveniently detect a range of diseases, including diabetes, cancer, and infections, often before symptoms arise. Early detection is critical for many diseases, increasing the likelihood of successful treatment and enhancing the quality of life for patients. This growing need for precise disease diagnostics is driving the growth of the biosensors market, as they offer faster, more convenient, and potentially more affordable diagnostic options, leading to better patient care.

Market Restraints

High Costs and Limited Reimbursement: Developing and manufacturing biosensors can be expensive. This could lead to a lack of innovation and high initial costs for the equipment needed to offset the expenses of making them. Additionally, if biosensors are more expensive than conventional techniques, healthcare facilities and providers might be hesitant to invest in or endorse them. Furthermore, insurance companies' rules for paying for these services might not fully cover the costs, potentially limiting patients' ability to use biosensor technologies. As a result, the high cost and limited availability of biosensors could hinder the expansion of the Biosensors Market.

Technical Challenges: Ensuring long-term stability and shelf-life is vital for consistent and accurate results. Issues such as temperature fluctuations, enzyme breakdown, and calibration changes impact stability and must be addressed. Additionally, creating smaller versions is key for wearable biosensors and point-of-care diagnostics, but integrating them with current healthcare systems poses challenges, requiring further development. These technical obstacles hinder the growth of the Biosensors Market.

Data Management Issues: Biosensors generate a wealth of health data, necessitating effective storage, organization, and analysis. Achieving this requires a strong data management infrastructure and advanced solutions, which can be expensive and challenging to maintain. Accurate and precise data is crucial for effective analysis and decision-making, especially in the medical field, where poor data quality can lead to incorrect and harmful decisions for patients. Additionally, integrating data from multiple biosensors can be difficult due to varying formats, standards, and protocols, hindering data sharing and interoperability across departments. Consequently, these data management challenges can limit the growth of the biosensors market.

Regulatory Landscape and Reimbursement Scenario

The regulatory body for pharmaceuticals in South Africa is the South African Health Products Regulatory Authority (SAHPRA), operating under the National Department of Health. SAHPRA ensures the safety, efficacy, and quality of all health products in South Africa, including human and veterinary medicines, medical devices, and complementary medicines.

Before new drugs can be sold in South Africa, SAHPRA evaluates applications and authorizes their commercialization. Additionally, they grant licenses to producers, distributors, and wholesalers of pharmaceuticals and medical devices. When evaluating novel drugs, SAHPRA examines and approves clinical trial applications to guarantee participant safety and ethical research procedures. Moreover, SAHPRA gathers and analyses information on adverse reactions reported by patients and healthcare professionals in order to actively monitor the safety of pharmaceuticals once they are placed on the market. Overall, the rigorous review process of SAHPRA helps ensure that only safe and effective medications reach the market, thus safeguarding the public health in South Africa.

South Africa's National Health Insurance (NHI) is a proposed reform aiming to transform the country’s healthcare financing system. Regardless of employment or income level, the NHI aims to provide all South African citizens and permanent residents with universal access to high-quality healthcare services. By establishing a unified funding source for the public and private healthcare sectors, the NHI seeks to overcome current disparities in healthcare access.

Competitive Landscape

Key Players

Here are some of the major key players in the South Africa Biosensors Market:

- Nova Biomedical Corporation

- Bio-Rad International

- Masimo Corporation

- Meridian Bioscience

- Biosensors International

- Nix Biosensors

- Abbott Laboratories

- Medtronic

- Siemens Healthcare

- F. Hoffmann-La Roche

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Biosensors Market Segmentation

By Technology

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Thermal Biosensors

- Nanomechanical Biosensors

By Product

- Wearable Biosensors

- Non-wearable Biosensors

By Application

- Medical Diagnostics

- Food Safety

- Environmental Monitoring

- Agriculture and Bioreactor Monitoring

- Other

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.