South Africa Adult Malignant Glioma Therapeutics Market Analysis

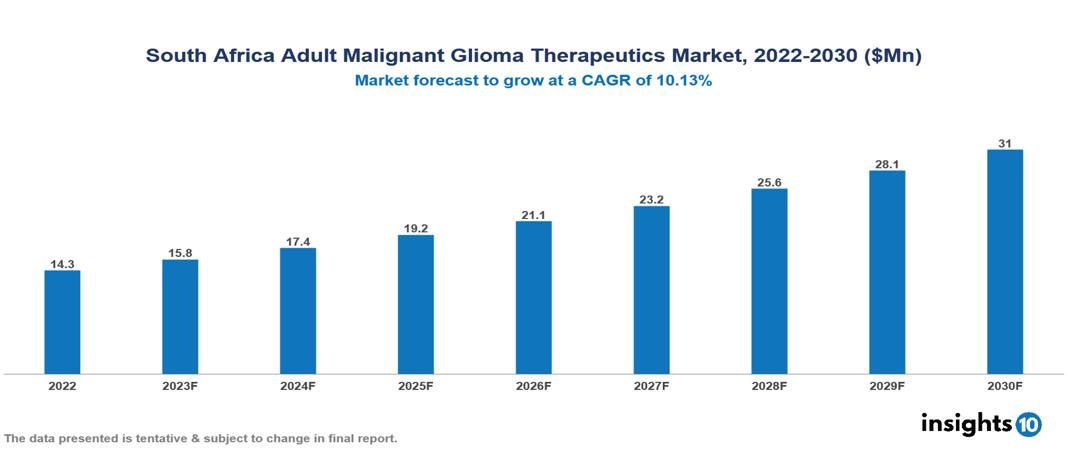

The South Africa Adult Glioma Therapeutics Market is valued at around $14 Mn in 2022 and is projected to reach $31 Mn by 2030, exhibiting a CAGR of 10.13% during the forecast period. There is potential for higher demand for therapies as glioma diagnosis and treatment become more accessible in South Africa due to advancements in glioblastoma awareness, changing demographics, growing healthcare infrastructure, and changing treatment choices. Key players in the South Africa Adult Malignant Glioma Therapeutics Market include companies like Roche, Novartis, Merck & Co., Pfizer, Bristol-Myers Squibb, AbbVie, Aspen, Spectrum Pharmaceuticals, Adcock Ingram, Pharmatrans etc among others

Buy Now

South Africa Adult Malignant Glioma Therapeutics Market Executive Summary

The South Africa Adult Glioma Therapeutics Market is valued at around $14 Mn in 2022 and is projected to reach $31 Mn by 2030, exhibiting a CAGR of 10.13% during the forecast period.

Adult Cancer Glial cells, which sustain neurons and aid in the operation of the central nervous system, are the source of gliomas, a kind of brain tumour. They may be classified into several subtypes based on the cells they come from and how they appear under a microscope. The three main types of gliomas are ependymomas, oligodendrogliomas, and astrocytomas. The most serious kind of Astrocytoma is called Glioblastoma Multiforme (GBM). Recently, glioma treatment has evolved via the use of several tactics, including as targeted therapy, virotherapy, and the potential discovery of new drugs. Promising treatments for gliomas include virotherapy, which targets tumour cells with viruses that have been genetically altered. Surgery, chemotherapy, and radiation therapy are available for the treatment of gliomas. In specific clinical trials, drugs used in targeted therapy, including Vorasidenib, have demonstrated promise in halting the growth of gliomas.

South Africa's age-standardized incidence rate is lower than the world average. In terms of numbers, South Africa has a 5-year survival rate of mere 3%. The incidence of gliomas is anticipated to differ between areas of South Africa. Glioblastoma multiforme (GBM) is the most frequent and severe kind of malignant glioma. Glioma risk can be influenced by variables such as socioeconomic level, healthcare accessibility, and environmental exposures. There is potential for higher demand for therapies as glioma diagnosis and treatment become more accessible in South Africa due to advancements in glioblastoma awareness, changing demographics, growing healthcare infrastructure, and changing treatment choices.

Significant shares in the South Africa Adult Malignant Glioma Therapeutics Market are held by F. Hoffmann-La Roche, which has Avastin, and Merck & Co., which has Keytruda. However, regional firms with significant market positions in generic chemotherapeutic medications, such as Adcock Ingram and Aspen Pharmacare, have a lesser total market share than multinationals.

Market Dynamics

Market Drivers

Increased Awareness and Infrastructure: Improved public knowledge about glioma and cancer treatment choices can stimulate demand for higher-quality medical care. A greater presence of patient advocacy groups and organizations can help disseminate information about glioma treatment choices as well as offer resources and support. Access to glioma diagnosis and treatment may be improved by the growth of healthcare institutions and their increasing reach into distant parts of South Africa.

Demographic Shifts: Increasing life expectancy and an aging population lead to a higher risk of glioma occurrence. Improved diagnostic tools and awareness might lead to a more accurate and timely diagnosis of glioma cases. Environmental and lifestyle factors, such as radiation exposure and unhealthy lifestyles,could contribute to glioma incidence.

Shifting Therapeutic Landscape: The field of glioma treatment is changing, no longer being limited to traditional chemotherapy. Avastin and other targeted medicines focus on certain tumor weaknesses and provide hope for better survival and quality of life. Additionally, gaining popularity are immunotherapies like Keytruda, which use the body's immune system to combat cancer cells. With the support of continuous clinical trials and research, this arsenal of innovative therapies presents a vision of a future where treatment choices are becoming more effective and customized.

Market Restraints

High Cost of Treatment: Even with their great effectiveness, new targeted treatments and immunotherapies such as Avastin and Keytruda are extremely expensive. Patients and healthcare systems, especially those with lower income levels or those who are uninsured, are burdened monetarily by this, which may restrict their accessibility. Even with its recent expansion, South Africa's public healthcare system may not be able to afford these expensive medications for every patient who needs them.

Inadequately trained personnel: South Africa's healthcare personnel are insufficiently prepared to meet the country's expanding need for specialist glioma treatment. Inadequate training of neurosurgeons, oncologists, and oncology nurses in advanced glioma management might impede the provision of efficient patient care and restrict available treatment alternatives. The number of specialist professionals in remote and rural areas is also very low, causing a decreased demand for newer drugs because of the absence of knowledge.

Logistic and Supply Chain Challenges: It can be difficult to guarantee a consistent supply of necessary chemotherapeutic medications and cutting-edge treatments across the nation because of distribution networks and logistical obstacles. For many medical supplies in the nation, this is very typical. Patient outcomes may be impacted by shortages and treatment interruptions as a result of this. To assist in addressing these logistical issues, South Africa's supply chain systems need to be strengthened, and cooperative relationships with regional or global entities need to be investigated.

Healthcare Policies and Regulatory Landscape

South Africa's healthcare system is a complex web comprised of lasting challenges and ambitious laws. Disparities persist despite the National Health Act's promotion of universal access. The Medical Schemes Act, which exempts certain individuals but leaves others behind, governs private insurance. The South African Health Products Regulatory Authority (SAHPRA) is the regulatory agency in South Africa that manages clinical trial conduct and licenses manufacturers, distributors, and retailers of medicines, medical supplies, radiation-emitting devices, and radioactive nuclides. SAHPRA is responsible for licensing all health products intended for use by people and animals. It also assesses applications for market authorization. It also creates and implements guidelines for the manufacture, labelling, packaging, and advertising of medicinal products. After approved medications are put on the market, it monitors their effectiveness and safety and is ready to act if issues arise.

Competitive Landscape

Key Players

- Roche

- Novartis

- Merck & Co.

- Pfizer

- Bristol-Myers Squibb

- AbbVie

- Aspen

- Spectrum Pharmaceuticals

- Adcock Ingram

- Pharmatrans

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

South Africa Adult Malignant Glioma Therapeutics Market Segmentation

By Disease Type

- Glioblastoma Multiforme

- Anaplastic Astrocytoma

- Anaplastic Oligodendroglioma

- Anaplastic Oligoastrocytoma

- Other Types

By Treatment Type

- Chemotherapy

- Targeted Drug Therapy

- Radiation Therapy

- Surgery

- Gene Therapy

- Immunotherapy

- Vaccines

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By Disease Stage

- Early-Stage Tumour

- Late-Stage Tumour

- Palliative Care

By Route of Administration

- Oral

- Parenteral

- Others

By End User

- Hospitals

- Speciality Clinics

- Chemotherapy Centres

- Radiotherapy Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.