Singapore Oncology Clinical Trials Market Analysis

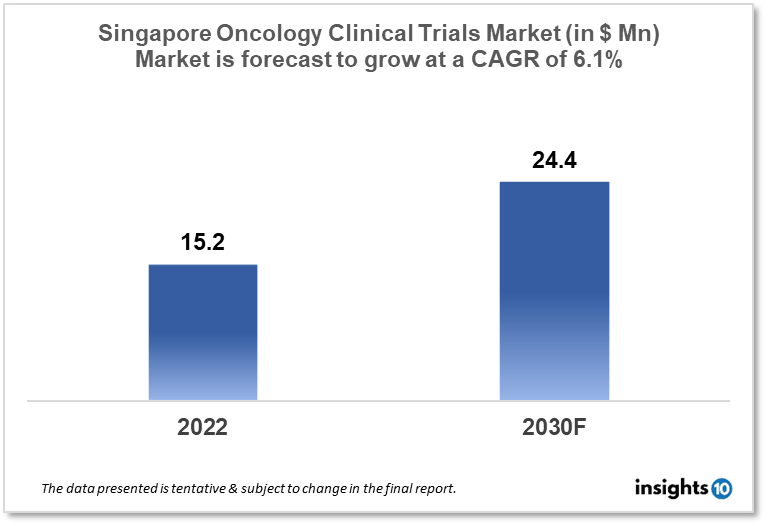

Singapore's oncology clinical trials market is projected to grow from $15.2 Mn in 2022 to $24.4 Mn by 2030, registering a CAGR of 6.1% during the forecast period of 2022-30. The market will be driven by the rising number of cancer cases and a favorable regulatory climate for clinical trials. The market is segmented by phase, by study design & by indication. Some of the major players include Pfizer Inc., Novartis International AG & Aslan Pharmaceuticals.

Buy Now

Singapore Oncology Clinical Trials Market Executive Summary

Singapore's oncology clinical trials market is projected to grow from $15.2 Mn in 2022 to $24.4 Mn by 2030, registering a CAGR of 6.1% during the forecast period of 2022-30. Singapore has lately emerged as the epicenter of Asia-Pacific clinical research activities. The country is a perfect choice for businesses and professionals. It also features one of the region's most modern healthcare infrastructure networks. Singapore is Asia's third-largest clinical trial market. The federal government has been very helpful in developing clinical research efforts. Singapore's Health Sciences Administration (HSA) had approved 146 clinical investigations for 2021. Cancer is the leading cause of mortality in Singapore, accounting for over one-third of all fatalities in the population with Breast cancer, Colorectal cancer, prostate cancer, and lung cancer amongst the top cancers.

The Health Sciences Administration (HSA) of Singapore has simplified clinical trial application and approval procedures, making it simpler for pharmaceutical and biotechnology businesses to conduct clinical studies in the nation. The government has also made significant investments in expanding its clinical research capacity, with many measures geared at fostering clinical research, such as tax breaks for clinical research and the formation of the Singapore Clinical Research Institute (SCRI). Singapore's oncology clinical trials landscape is quite promising, especially due to the country's well-established clinical research infrastructure, favorable regulatory environment, and government funding for clinical research. Singapore has a great reputation for clinical research expertise and is one of Asia's top clinical trial nations.

Market Dynamics

Market Growth Drivers

One of the chief factors is the country's favorable regulatory climate, which makes clinical trials simpler and more efficient for pharmaceutical and biotechnology businesses. Moreover, Singapore has a well-established clinical research infrastructure, with numerous world-class hospitals and research institutes providing cutting-edge facilities and clinical trial experience. The government has launched many steps to promote clinical research, including tax breaks for clinical researchers and the formation of the Singapore Clinical Research Institute (SCRI). These programs seek to bring clinical research funding and expertise to Singapore, as well as to provide a conducive atmosphere for clinical trials.

Market Restraints

There are however several obstacles that might stymie the country's rise in oncology clinical trials. One of the most significant hurdles is the high expense of conducting clinical trials in Singapore, which might be prohibitively expensive for smaller enterprises with few resources. Moreover, other nations in the area, including as South Korea and Japan, have robust clinical research infrastructures and favorable regulatory regimes. Singapore has a scarcity of skilled clinical research workers, which may jeopardize the country's capacity to perform complicated and specialized clinical trials.

Competitive Landscape

Key Players

- Pfizer Inc.

- Novartis International AG

- AstraZeneca plc

- Merck & Co., Inc.

- Roche Holding AG

- AUM Biosciences (SGP)

- Aslan Pharmaceuticals (SGP)

- Clearbridge BioMedics (SGP)

- InvitroCue (SGP)

Notable Insights

- In January 2023, The United States Food and Drug Administration cleared EBC-129, an antibody-drug conjugate (ADC) developed in Singapore, to start clinical studies (FDA)

- June 2022, ETC-159, a cancer medication manufactured in Singapore, has entered the dosage expansion phase of its Phase 1B clinical study. The Phase 1B dosage expansion research examines ETC-159's early effectiveness and safety in a subgroup of genetically identified patients with microsatellite stable (MSS) malignancies

- March 2022, AUM Biosciences A Singapore-based biotechnology firm has begun clinical trials for a novel oral cancer drug, which they claim might lead to cheaper and more focused cancer therapy

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Singapore's Oncology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.