Singapore Lipid Disorder Therapeutics Market Analysis

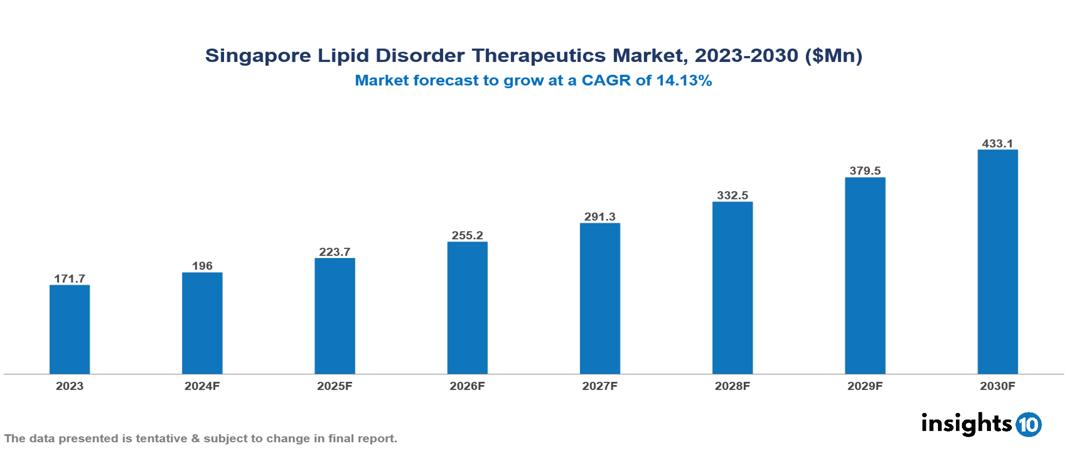

The Singapore Lipid Disorder Therapeutics Market was valued at $171.7 Mn in 2023 and is predicted to grow at a CAGR of 14.13% from 2023 to 2030, to $433.1 Mn by 2030. Singapore Lipid Disorder Therapeutics Market is growing due to the Prevalence of Cardiovascular Diseases, Growing Awareness, and Advancements in Therapeutics. The industry is primarily dominated by players such as Sanofi, GlaxoSmithKline plc, Pfizer, Inc., Novartis AG, Merck & Co., Inc., Amgen Inc., Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., AbbVie Inc., Viatris, AstraZeneca PLC, and Dr. Reddys Laboratories Ltd.

Buy Now

Singapore Lipid Disorder Therapeutics Market Executive Summary

Singapore Lipid Disorder Therapeutics Market is at around $171.7 Mn in 2023 and is projected to reach $433.1 Mn in 2030, exhibiting a CAGR of 14.13% during the forecast period.

Lipids, also known as lipoproteins, are the types of fats that are present in the blood. A wide range of metabolic illnesses that impact blood lipid levels are referred to as lipid disorders. Their common characteristic is the presence of elevated blood levels of lipoproteins, triglycerides, and/or cholesterol, which are linked to a higher risk of (or existence of) cardiovascular disease. Lowering low-density lipoproteins (LDLs) can be achieved in several simple ways, such as avoiding foods rich in saturated fat, dietary cholesterol, and excess calories; exercising; keeping a healthy weight; and giving up smoking. The most widely recommended medications for treating lipids are statins.

The prevalence of dyslipidemia was 45% in the Singapore. specifically, dyslipidemia is notable with a higher occurrence among females and the elderly (aged 50-69 years). Factors such as socio-economic status also influence these rates, with wealthier individuals more likely to have high cholesterol levels. The healthcare system in Singapore is robust, featuring high standards and universal coverage, and it is anticipated that healthcare expenditures could rise to $43 billion by 2030, driven by an aging population and increased healthcare service consumption. The market, therefore, is driven by significant factors like rising prevalence of cardiovascular diseases, growing awareness, and advancements in therapeutics. However, the high cost of newer therapies, and adverse effects, regulatory hurdles restrict the growth and potential of the market.

In March 2023, the US Food and Drug Administration (FDA) authorized the extended use of Regeneron Pharmaceuticals, Inc.'s Evkeeza medication in children aged 5 to 11 years to treat an extremely rare condition that raises cholesterol levels.

Market Dynamics

Market Growth Drivers

Prevalence of Cardiovascular Diseases (CVDs): The rising prevalence of cardiovascular diseases (CVDs) in Singapore is significantly driven by the increasing incidence of dyslipidemia, a major risk factor. 45% of the population suffers from abnormal lipid levels, particularly high levels of LDL cholesterol and triglycerides. This trend is exacerbated by unhealthy lifestyles characterized by diets rich in saturated fats and trans fats, prevalent due to the popularity of fast food and processed foods. Coupled with sedentary habits, where physical activity levels are suboptimal among a significant portion of the population, these factors compound the risk of developing dyslipidemia and subsequently CVDs.

Growing Awareness: Public health initiatives and increased access to information are raising awareness about lipid disorders and their health risks. This motivates individuals to seek diagnosis and treatment, boosting the market for lipid-lowering medications. The healthcare system in Singapore is robust, featuring high standards and universal coverage, and it is anticipated that healthcare expenditures could rise to $43 billion by 2030, driven by an aging population and increased healthcare service consumption.

Advancements in Therapeutics: Recent advancements in lipid-lowering therapeutics, including the development of highly potent statins like Rosuvastatin and novel agents like PCSK9 inhibitors, have significantly improved treatment outcomes. These medications offer better efficacy and safety profiles, making them attractive options for managing lipid disorders. Ongoing research and development in this field continue to introduce new and improved treatments, enhancing the ability of healthcare providers to tailor therapies to individual patient needs, thus driving the market growth.

Market Restraints

High Cost of Newer Therapies: While advancements in medicine have yielded more effective lipid-lowering medications, they often come at a premium price. For instance, statins, the most commonly prescribed lipid-lowering drugs, have shown significant efficacy in reducing cholesterol levels by up to 50%. While highly effective, these newer drugs might be out of reach for a large segment of the population, hindering their widespread adoption and limiting the overall market potential.

Adverse effects: One of the primary challenges confronting the lipid disease therapeutics market is the adverse effects of cholesterol-lowering medications. Common drugs such as statins can have adverse effects that include increased blood sugar, liver damage, and discomfort in the muscles. These consequences might deter patients and limit the expansion of the market. Patients need to be constantly watched over and controlled due to these adverse effects, which increases healthcare costs and complicates treatment plans.

Regulatory Hurdles: Although strict medication approval regulations guarantee patient safety, they also make market entry difficult. The market dynamics may be impacted by the protracted and intricate approval procedure, which may postpone the launch of new lipid-lowering treatments. Post-approval surveillance regulations also increase the expenses and complexity of doing business for pharmaceutical businesses.

Regulatory Landscape and Reimbursement Scenario

The Ministry of Health (MOH) is in charge of overseeing healthcare regulations in Singapore and establishing standards and policies to guarantee high-quality treatment. Medical goods, including prescription drugs and medical equipment, are governed by the Health Sciences Authority (HSA). Physicians' professional behavior is regulated by the Singapore Medical Council (SMC). Statutory boards such as Singapore Health Services (SingHealth) and the National Healthcare Group (NHG) oversee public healthcare facilities. Rules provide a strong emphasis on patient safety, high-quality care, and cost-effectiveness. A combination of public and private healthcare providers guarantees that all inhabitants have widespread access to complete services.

The Ministry of Health in Singapore is implementing the "3 Beyonds" strategy: Beyond hospital to the community; Beyond quality to value; and Beyond healthcare to health. This approach aims to adapt the country's world-class health system to reflect medical progress and serve its aging population, which is expected to double by 2030 and account for a quarter of the population. The system is performing exceptionally well by many measures, including per-capita costs and health outcomes. Delaying the onset of chronic diseases, boosting home-based care for managing chronic diseases, and coordinating care for individuals with expensive disorders are some of the major policy challenges Singapore is addressing.

Competitive Landscape

Key Players

Here are some of the major key players in the Singapore Lipid Disorder Therapeutics Market:

- Sanofi

- GlaxoSmithKline plc

- Pfizer, Inc.

- Sun Pharmaceutical Industries Ltd.

- AstraZeneca PLC

- GlaxoSmithKline plc

- Novartis AG

- Merck & Co., Inc.

- Amgen Inc.

- Takeda Pharmaceutical Company Limited

- AbbVie, Inc.

- Viatris

- Dr. Reddy’s Laboratories Ltd.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Lipid Disorder Therapeutics Market Segmentation

By Drug Type

- Atorvastatin

- Fluvastatin

- Simvastatin

- Pravastatin

- Others

By Indication

- Hypercholesterolemia

- Dysbetalipoproteinemia

- Familial Combined Hyperlipidemia

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.