Singapore Digital Therapeutics Market Analysis

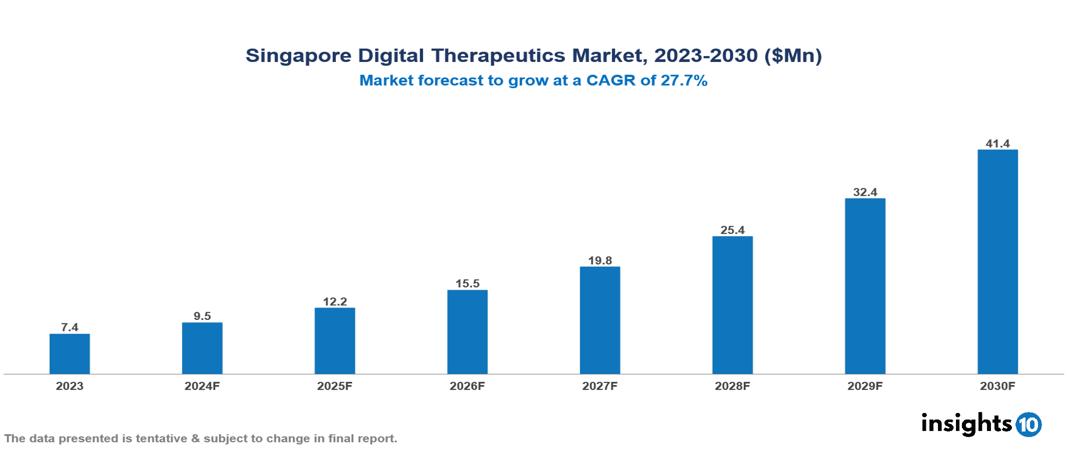

Singapore Digital Therapeutics Market is at around $7 Mn in 2023 and is projected to reach $38.98 Mn in 2030, exhibiting a CAGR of 27.8 % during the forecast period. The market is being driven by rising chronic disease burden, healthcare infrastructure, and government initiatives and support. The market is dominated by key players like BioMind Labs, DoctorOnCall, FitBit Health Solutions, Omada Health Inc., 2Morrow Inc., Livongo Health Inc., WellDoc, Propeller Health, Canary Health, and Noom Inc.

Buy Now

Singapore Digital Therapeutics Market Executive Summary

Singapore Digital Therapeutics Market is at around $7 Mn in 2023 and is projected to reach $38.98 Mn in 2030, exhibiting a CAGR of 27.8 % during the forecast period.

The growing field of digital therapeutics in Singapore is the application of digital technology, like software and mobile apps, to the delivery of evidence-based therapeutic interventions. These interventions, which frequently support conventional healthcare methods, are intended to prevent, manage, or treat a variety of medical conditions. Singapore's digital therapeutics market is anticipating expansion and innovation in enhancing patient outcomes, with an emphasis on utilizing technology to provide individualized and effective healthcare solutions.

The growing use of digital health solutions is fueling the robust expansion of the Singapore digital therapeutics market. Growing awareness among healthcare professionals and consumers, government funding for healthcare innovation, and the prevalence of chronic diseases on the rise are all important considerations. The market is seeing an increase in the number of digital therapeutic products designed to treat different medical issues.

The remarkable expansion of the digital therapy sector is demonstrated by the $6.2 Bn in revenue it generated globally in 2023. The dramatic transformation brought about by current technology and cost-effective manufacturing procedures is responsible for this company's exceptional rise. This illustrates how the use of digital medications in the healthcare industry is expanding. New developments are expected to support the industry's ongoing success as the market trend indicates that more changes might be in store.

With its focus on neurological and mental health disorders, BioMind Labs is a growing player in the rapidly expanding Singaporean digital therapeutics market, exhibiting considerable potential. It creates and offers clinically validated digital therapy packages for ailments like depression, anxiety, ADHD, and cognitive decline. It received money from renowned investors like Monk's Hill Ventures and Y Combinator and was highlighted in Forbes 30 Under 30 Asia (2021).

Market Dynamics

Market Growth Drivers:

Government Initiatives and Support: The development of the digital therapeutics industry is greatly aided by government efforts and assistance.

Infrastructure for Healthcare: The adoption of digital health technologies is facilitated by sophisticated healthcare facilities, strong telecommunication networks, and a mature healthcare ecosystem.

Growing Burden of Chronic Diseases: There is a growing need for practical and scalable solutions due to the rising incidence of chronic illnesses like diabetes, heart disease, and mental health issues. People with chronic diseases can benefit from individualized and ongoing treatment, which digital therapies can deliver.

Market Restraints:

Cost of Implementation: For healthcare practitioners, particularly in settings with limited resources, the upfront setup costs and continuing expenditures linked with integrating digital therapeutics solutions can be a major obstacle.

Issues with Interoperability: The smooth integration of digital treatments into the larger healthcare ecosystem may be hampered by a lack of compatibility with current healthcare systems and electronic health records (EHRs).

Technological Obstacles: Widespread adoption of digital treatments may be hampered by limited access to technology, such as smartphones and internet connectivity, particularly in some demographic groups or geographic locations.

Healthcare Policies and Regulatory Landscape

In Singapore, the statutory board under the Ministry of Health is the Health Sciences Authority (HSA). It is the responsibility of this multidisciplinary institution to safeguard and improve public health and safety by utilizing expertise in science, medicine, and pharmacy. As part of the HSA's technical evaluation of the application, the drug's effectiveness, safety, and quality will be evaluated. It can take up to 180 working days to complete the screening process. Following international standards, the HSA upholds stringent requirements for efficacy, safety, and quality (ICH). This might result in demanding and time-consuming standards for pre-clinical and clinical trials, especially for new medications.

Competitive Landscape

Key Players:

- BioMind Labs

- DoctorOnCall

- FitBit Health Solutions

- Omada Health Inc.

- 2Morrow Inc.

- Livongo Health Inc.

- WellDoc

- Propeller Health

- Canary Health

- Noom Inc.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Digital Therapeutics Market Segmentation

By Solution

- Software

- Services

By Deployment

- Cloud-based

- On-premises

By Application

- Therapy

- Diabetes

- Obesity

- CNS

- Respiratory

- CVD

By End-use

- Diagnostic Centres

- Healthcare Players

- Healthcare Research Centres

- Hospitals & Clinics

- Nursing Care Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.