Singapore Dental Fluoride Treatment Market Analysis

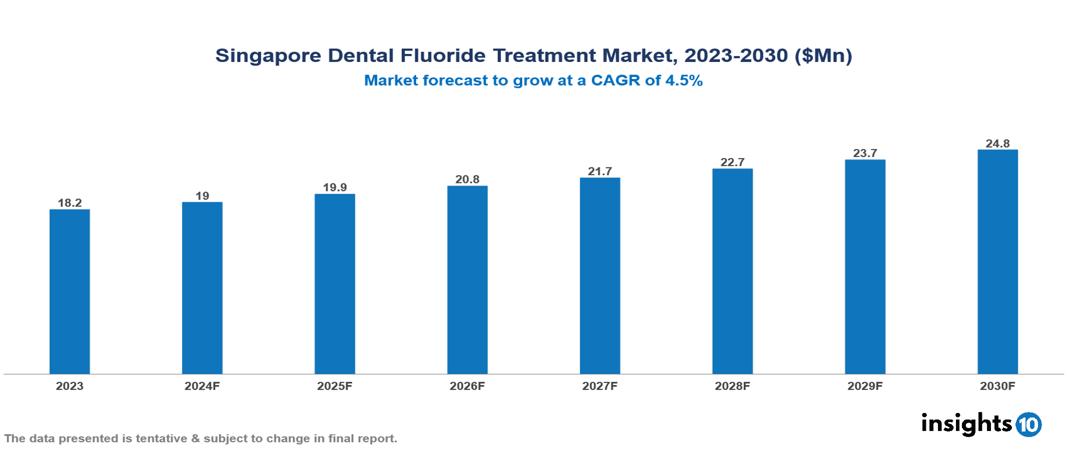

The Singapore Dental Fluoride Treatment Market was valued at $18.2 Mn in 2023 and is projected to grow at a CAGR of 4.5% from 2023 to 2023, to $24.8 Mn by 2030. The key drivers of this industry are growing prevalence of dental caries coupled with increasing awareness regarding oral health and hygiene, increasing the intake of sugary drinks and food, projected to drive the market. The industry is primarily dominated by players such as Pearlie White, Zenyum, Pigeon Singapore, Unilever, P & G among others

Buy Now

Singapore Dental Fluoride Treatment Market Executive Summary

The Singapore Dental Fluoride Treatment Market is at around $18.2 Mn in 2023 and is projected to reach $24.8 Mn in 2030, exhibiting a CAGR of 4.5% during the forecast period 2023-2030.

Dental hygienists and dentists professionally apply high-concentration fluoride products to teeth in order to build enamel and prevent tooth decay. This procedure is known as a dental fluoride treatment. During routine dental appointments, they are usually applied as a gel, foam, varnish, or solution. Fluoride fortifies enamel and increases teeth's resistance to bacterial acid attacks by enhancing the absorption of minerals like calcium and phosphate. It also inhibits the growth of cavity-causing bacteria, slowing or stopping their destructive effects. Fluoride is a valuable tool in the fight against tooth decay and enamel deterioration.

Irritation, allergic reactions, and transient discolouration are possible adverse effects. Fluorosis can result from excessive consumption, especially in young infants. However, because over-the-counter drugs have modest concentrations, it is difficult to reach harmful amounts. Supplement acute poisoning can result in vomiting, diarrhoea, and in extreme circumstances, even death.

According to the Oral Health Country Profile for Singapore, the prevalence of untreated dental caries in deciduous teeth among children aged 1-9 years was 41.7% in 2019. The prevalence of untreated caries in permanent teeth for people aged 5 years and above was 28.5% in 2019. The market therefore is driven by significant factors like growing prevalence of dental caries coupled with increasing awareness regarding oral health and hygiene, increasing the intake of sugary drinks and food, cosmetic dentistry boom, technological advancements etc.

Some of the major players operating in the market are Pearlie White, Zenyum, Pigeon Singapore, Unilever, P&G among others.

Market Dynamics

Market Drivers

Rising Incidence of Dental Disorders: According to the Oral Health Country Profile for Singapore, the prevalence of untreated dental caries in deciduous teeth among children aged 1-9 years was 41.7% in 2019. The prevalence of untreated caries in permanent teeth for people aged 5 years and above was 28.5% in 2019. The high burden of dental diseases has increased the demand for preventive treatments like fluoride to maintain oral health.

Increasing Awareness of Oral Health: The Health Promotion Board of Singapore has reported that around 60% of children aged 5-6 years old have experienced tooth decay. Government initiatives, such as the "Healthy Mouth, Healthy Life" campaign, have helped raise public awareness about the importance of regular dental check-ups and fluoride treatments. This increased awareness has driven more Singaporeans to seek out fluoride treatments.

Availability of Cost-Effective Fluoride Products: The availability of affordable fluoride-containing toothpastes, mouthwashes, and other oral care products has made fluoride treatments more accessible to the general population in Singapore. Manufacturers have focused on developing innovative and effective fluoride-based dental products to cater to the growing consumer demand.

Market Restraints

High Cost of Dental Care: The Oral Health Country Profile for Singapore indicates that the total expenditure on dental healthcare in 2019 was USD 1,160 million, with a per capita expenditure of USD 205. Despite government subsidies and insurance coverage, the out-of-pocket expenses for dental care may still be prohibitive for lower-income households, limiting the accessibility of fluoride treatments.

Lack of Awareness about Fluoride Treatment Options: While overall oral health awareness has improved, there may still be a lack of understanding about the specific benefits and availability of professional fluoride treatments among certain segments of the population, which limits the growth of the fluoride treatment market. Educating the public, especially in underserved communities, about the importance of fluoride treatments for preventing dental caries is an ongoing challenge.

Concerns about Excessive Fluoride Exposure: Some patients may be reluctant to undergo fluoride treatments due to concerns about the potential side effects of excessive fluoride exposure, such as dental fluorosis. Addressing these concerns and ensuring the safe and appropriate use of fluoride treatments is crucial for market growth.

Regulatory Landscape and Reimbursement Scenario

The regulatory body for dental services in Singapore is the Singapore Dental Council (SDC), which is responsible for regulating and maintaining the standards of the dental profession in Singapore. The SDC registers and accredits dental professionals, enforces ethical guidelines, and investigates complaints against dental practitioners.

Patient co-payments are an essential component of the healthcare system in Singapore, emphasizing personal health responsibility. Schemes have been formed to assist patients in paying their share of the costs and to ensure that out-of-pocket charges do not limit access to healthcare services, particularly for low-income groups. Many Singapore insurance companies offer dental coverage, including MediShield Life, Integrated Shield Plans, and Private Integrated Shield Plans. Private insurance companies in Singapore that offer dental coverage include AIA, Aviva, Great Eastern, NTUC Income, Prudential, and AXA. Some Singapore insurance companies offer orthodontic-specific insurance plans that cover the cost of orthodontic treatments including braces and aligners. Orthodontic treatment coverage limits in these policies are frequently higher than in standard dental insurance plans.

Competitive Landscape

Key Players

Here are some of the major key players in the Singapore Dental Fluoride Treatment Market:

- Pearlie White

- Zenyum

- Pigeon Singapore

- Amway Vietnam Company Limited

- Colgate Palmolive

- Unilever

- Johnson & Johnson

- GSK

- 3M

- VOCO

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Dental Fluoride Treatment Market Segmentation

By Type

- Toothpaste

- Gel

- Mouthwash

- Varnish

- Supplements

- Other

By Age Group

- Children

- Adolescents

- Adults

By Application

- Dental Caries

- White Spot Lesions

- Dental Hypersensitivity

- Others

By Distributional Channel

- Dental Clinics

- Hospitals

- Retail Pharmacies & Drug Stores

- Online Sales

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.