Singapore Constipation Therapeutics Market Analysis

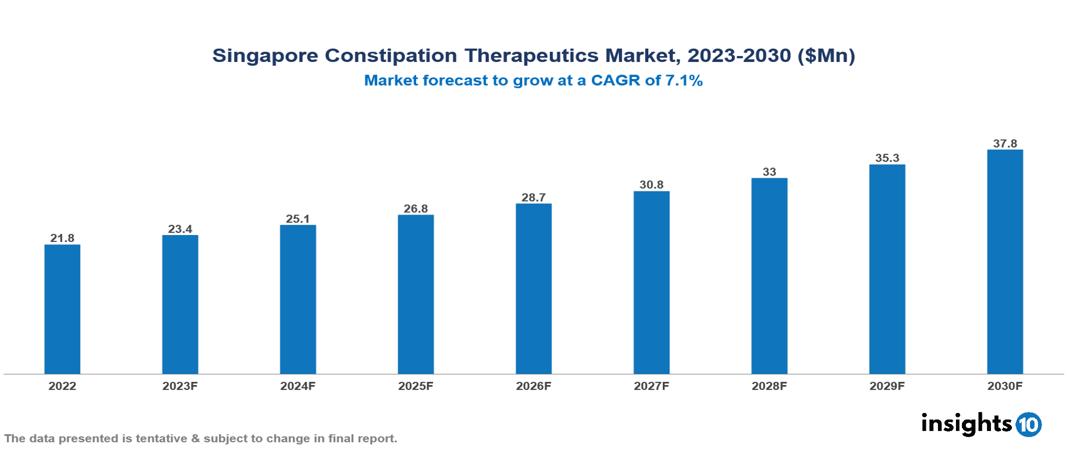

Singapore Constipation Therapeutics Market was valued at $22 Mn in 2022 and is estimated to reach $38 Mn in 2030, exhibiting a CAGR of 7.1% during the forecast period. The global growth of the constipation therapeutics market is driven by factors such as aging, sedentary lifestyles, and unhealthy dietary habits. The increasing elderly population, susceptible to chronic conditions, notably contributes to this expansion. Major players in this sector comprise GlaxoSmithKline, Johnson & Johnson, Sanofi, Abbott, Bayer, AstraZeneca, Pfizer, Merck Sharp & Dohme, Boehringer Ingelheim, and United Laboratories.

Buy Now

Singapore Constipation Therapeutics Market Executive Summary

Singapore Constipation Therapeutics Market was valued at $22 Mn in 2022 and is estimated to reach $38 Mn in 2030, exhibiting a CAGR of 7.1% during the forecast period.

Constipation is a digestive disorder characterized by infrequent, challenging, or hardened bowel movements resulting from the slowed movement of stool through the colon, leading to increased water absorption and solidification of stool. This condition arises from a reduction in the speed at which feces traverse the large intestine. Common symptoms of constipation include exertion during bowel movements, a feeling of incomplete evacuation, abdominal discomfort, and irregular or infrequent bowel patterns. Various factors, including a low-fiber diet, insufficient fluid intake, lack of physical activity, specific medications, and underlying medical conditions, can contribute to the development of constipation. Managing constipation typically involves making lifestyle adjustments, modifying dietary habits, increasing physical activity, and, when necessary, using medications to address and alleviate symptoms.

Constipation is a prevalent digestive issue in Singapore, impacting individuals across various age groups. Manifested by infrequent bowel movements, difficulty passing stool, and discomfort, chronic constipation affects 7.4% of the population, with a higher prevalence in women (11.3%) compared to men (3.6%). Contributing factors encompass lifestyle choices such as inadequate water intake, low dietary fiber, and sedentary behavior. Additionally, stress, certain medications, and underlying health conditions play a role in constipation. Singapore's urban lifestyle, characterized by long working hours and limited physical activity, may exacerbate the issue. Management strategies involve over-the-counter laxatives, dietary adjustments, and lifestyle modifications. While generally manageable, persistent symptoms necessitate medical attention for an accurate diagnosis and appropriate treatment. Public health initiatives advocating for a balanced diet, hydration, and regular exercise are pivotal in addressing and preventing constipation in Singapore.

Historically, laxatives have been the conventional approach to treating constipation; however, contemporary medications are focusing on specific mechanisms associated with constipation, potentially providing a more precise and efficient treatment. A notable example is Elobixibat, developed by Albireo, which stands as a first-in-class ileal bile acid transporter inhibitor. Approved in Japan in 2021, this medication is currently undergoing clinical trials for potential approval in other regions. Elobixibat operates by enhancing fluid secretion in the intestine, facilitating the production of softer stools, and promoting easier passage, showcasing a promising advancement in constipation therapeutics.

Market Dynamics

Market Growth Drivers

Growing Prevalence of Constipation: There is a prevalence of approximately 11.6% to 24.8% of the Singaporean population experiencing constipation within a year, with a higher prevalence among women and the elderly. This large and growing patient pool creates a significant demand for treatment options.

Technological Advancements and Innovation: Pharmaceutical companies are actively developing new and innovative constipation treatments, offering more targeted and effective options compared to traditional laxatives. This continuous innovation pipeline fuels market growth.

Lifestyle Changes: Contemporary living styles, marked by low physical activity levels and nutritional aspects, lead to a rise in instances of constipation. As a result of this transformation in behavioral trends, there is an expanding demand for treatments aimed at resolving such gastrointestinal problems.

Market Restraints

Limited Access to Healthcare: A considerable segment of the population, especially those living in rural regions, faces challenges in accessing adequate healthcare facilities and qualified medical practitioners. This restricted access may impede the prompt diagnosis and treatment of constipation, potentially resulting in complications.

Preference for Self-Medication and Traditional Remedies: Individuals frequently turn to self-medication using over-the-counter laxatives or traditional herbal remedies before consulting a medical professional. This behavior carries potential risks, particularly when individuals have underlying medical conditions that may deteriorate with unmonitored treatments.

Low Healthcare Awareness: Stigma and cultural beliefs surrounding bowel movements often prevent individuals from seeking medical help for constipation. Additionally, a lack of awareness about the condition and its treatment options can further hinder market growth.

Healthcare Policies and Regulatory Landscape

The Health Sciences Authority (HSA), a key regulatory body ensuring the safety and quality of health products, plays a pivotal role in monitoring Singapore's regulatory landscape and overseeing healthcare regulations related to pharmaceutical treatments. Collaborating closely with HSA, the Ministry of Health (MOH) is crucial in establishing standards and policies within the healthcare sector. The Pharmacy Practice Act provides guidelines for drug distribution, governing both pharmacy practices and the sale of therapeutic items. The National Medicines Policy (NMP), integrated into the broader healthcare policy framework, guides the distribution and regulation of pharmaceuticals. Additionally, payment regulations may be influenced by health insurance coverage, including the Central Provident Fund (CPF) and various health insurance plans, impacting patients' access to specific treatment medications.

Competitive Landscape

Key Players

- GlaxoSmithKline

- Johnson & Johnson

- Sanofi

- Abbott

- Bayer

- AstraZeneca

- Pfizer

- Merck Sharp & Dohme

- Boehringer Ingelheim

- United Laboratories

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Constipation Therapeutics Market Segmentation

By Therapeutic

- Laxatives

- Chloride Channel Activators

- Peripherally Acting Mu-Opioid Receptor Antagonists

- GC-C Agonists

- 5-HT4 Receptor Agonists

By Disease

- Chronic Idiopathic Constipation

- Irritable Bowel Syndrome with Constipation

- Opioid-Induced Constipation

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.