Singapore Chronic Pain Therapeutics Market Analysis

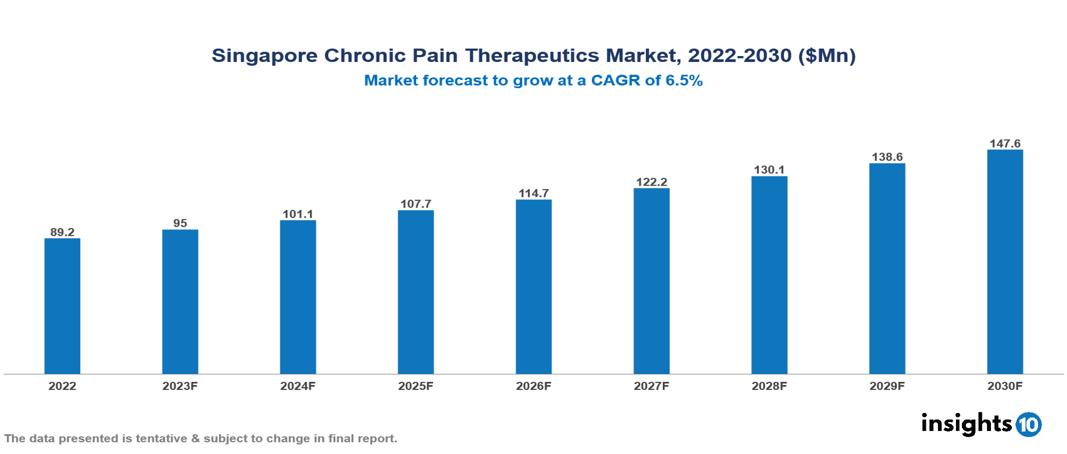

The Singapore Chronic Pain Therapeutics Market is anticipated to experience a growth from $89 Mn in 2022 to $148 Mn by 2030, with a CAGR of 6.5% during the forecast period of 2022-2030. The key drivers influencing the market growth in Singapore include the aging population leading to a surge in chronic conditions, advancements in medicine fuelling innovative pain management solutions, and increased investment in research and development within Singapore's healthcare hub. The Singapore Chronic Pain Therapeutics Market encompasses various players across different segments, including Pfizer, AbbVie, Sanofi, Merck, Roche, Mylan, Biocon, Cipla, Dr Reddy’s, Sun Pharma, etc., among various others.

Buy Now

Singapore Chronic Pain Therapeutics Market Analysis Executive Summary

The Singapore Chronic Pain Therapeutics Market is anticipated to experience a growth from $89 Mn in 2022 to $148 Mn by 2030, with a CAGR of 6.5% during the forecast period of 2022-2030.

Chronic pain is characterized by persistent discomfort extending beyond the usual recovery period, typically arising from conditions such as arthritis, fibromyalgia, nerve damage, or prior injuries. A diverse range of factors contributes to its onset, encompassing physical trauma, inflammation, nerve-related issues, and diseases affecting the musculoskeletal system. Psychological elements, such as stress and depression, can further amplify the experience of chronic pain. Treatment strategies focus on symptom management and overall improvement in the patient's quality of life. Pharmacological interventions involve the use of analgesics, anti-inflammatories, and antidepressants to alleviate pain and address associated mood disorders. Physical therapy plays a crucial role in enhancing mobility and functional capabilities, while alternative therapies like acupuncture and massage therapy offer supplementary relief. Cognitive-behavioral therapy aids individuals in coping with pain and cultivating healthier adaptive strategies. Interventional procedures like nerve blocks or spinal cord stimulation may be considered in specific cases. An integrated, multidisciplinary approach, combining medical, psychological, and lifestyle interventions, proves most effective in alleviating the impact of chronic pain and promoting holistic well-being.

In Singapore, 19.5% of the elderly, aged 60 and over, experience pain. People in lower socioeconomic strata, women, and the elderly are more prone to suffer from illnesses that cause chronic pain. Chronic lower back pain and migraines are two prominent kinds of chronic pain in Singapore.

The key drivers propelling the market include the aging population leading to a surge in chronic conditions, advancements in medicine fueling innovative pain management solutions, and increased investment in research and development within Singapore's healthcare hub.

Pfizer and AbbVie are well-known in Singapore for their pain management products. Merck & Co. and Novartis have distinct capabilities in various pain sectors such as post-herpetic neuralgia and over-the-counter medications. Other manufacturers, such as Johnson & Johnson, provide both over-the-counter and prescription choices but may place less emphasis on specialist pain management than competitors.

Market Dynamics

Market Growth Drivers

Aging population: An aging population in Singapore contributes to an increased prevalence of chronic conditions such as arthritis and neuropathic pain, driving the demand for pain therapeutics. Additionally, the rising awareness and diagnosis of pain-related disorders play a pivotal role in market growth.

Evolution in the field of medicine: Advancements in medical research and technology contribute to the development of innovative pain management solutions, fostering market expansion. The government's commitment to healthcare infrastructure and accessibility also plays a key role, ensuring that pain therapeutics are readily available and affordable.

Increasing investment in R&D: Singapore's status as a regional healthcare hub attracts pharmaceutical companies to invest in research and development, further enhancing the availability of diverse pain management options. Moreover, a growing emphasis on holistic approaches to healthcare, including integrative pain management strategies, is influencing the market.

Market Restraints

Regulatory challenges: Regulatory challenges present a substantial impediment to the Singaporean pain therapeutics market. Stringent regulations govern the approval and commercialization of pain medications, exerting influence on the market entry strategies of pharmaceutical companies. The complex regulatory landscape necessitates meticulous compliance, which can extend the time and resources required for product approval and market penetration.

Affordability: Financial considerations significantly impact patients' accessibility to advanced pain treatments and medications. The reimbursement landscape and insurance coverage dynamics add another layer of complexity, exacerbating financial barriers for both patients and healthcare providers. This economic aspect poses a challenge to the widespread adoption and availability of cutting-edge pain therapies.

Public awareness: An increasing awareness of the potential side effects and risks associated with prolonged use of specific pain medications has led to cautious prescribing practices and patient reluctance. This heightened vigilance, while promoting patient safety, may also limit the adoption of certain pharmaceutical interventions within the pain therapeutics market, influencing prescribing patterns and patient preferences.

Healthcare Policies and Regulatory Landscape

The Health Sciences Authority (HSA) of Singapore is responsible for regulating drugs, and ensuring their safety, quality, and efficacy through a risk-based and confidence-based approach. The HSA adopts international standards, adapts best practices to meet Singapore's unique situation, and fosters strategic partnerships regionally and internationally. The authority has achieved the highest maturity level in the World Health Organization's classification of regulatory authorities for medical products, a significant milestone that affirms Singapore's excellence in regulatory science. The HSA also regulates medical devices, provides guidance on bringing personal medications into Singapore, and ensures the safety and efficacy of medications sold in the country. By developing and implementing innovative policies, the HSA continues to play a crucial role in promoting public health in Singapore.

Competitive Landscape

Key Players:

- Pfizer

- AbbVie

- Sanofi

- Merck

- Roche

- Mylan

- Biocon

- Cipla

- Dr Reddy’s

- Sun Pharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Chronic Pain Therapeutics Market Segmentation

By Indication

- Neuropathic Pain

- Back Pain

- Headaches

- Arthritis Pain

- Muscular Pain

- Idiopathic Pain

- Others

By Drug Class

- Analgesics

- Opioids

- NSAIDs

- Anaesthetics

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.