Singapore Cholesterol Therapeutics Market Analysis

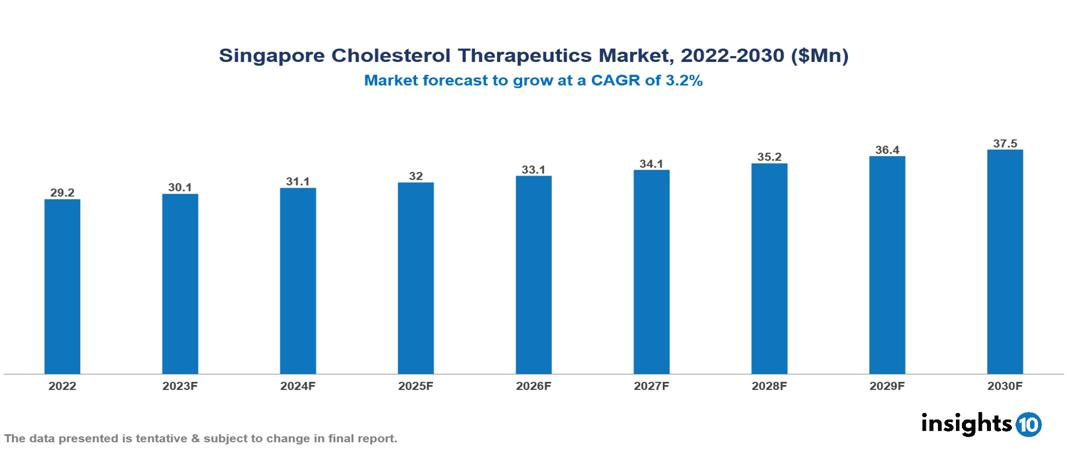

The Singapore Cholesterol Therapeutics Market is anticipated to experience a growth from $29 Mn in 2022 to $38 Mn by 2030, with a CAGR of 3.2 % during the forecast period of 2022-2030. The key drivers of the market include the rising prevalence of abnormal cholesterol and CVDs due to unhealthy lifestyles, coupled with increased government initiatives investing in healthcare, awareness campaigns, and screening programs, further fueled by a growing public awareness and proactive approach towards preventive healthcare. The Singapore Cholesterol Therapeutics Market encompasses various players across different segments such as AbbVie, Amgen, AstraZeneca, Pfizer, Mylan, Teva, Apotex, Biocon, Cipla, Dr Reddy’s, etc., among various others.

Buy Now

Singapore Cholesterol Therapeutics Market Analysis Executive Summary

The Singapore Cholesterol Therapeutics Market is anticipated to experience a growth from $29 Mn in 2022 to $38 Mn by 2030, with a CAGR of 3.2 % during the forecast period of 2022-2030.

Cholesterol is a fatty molecule in the body that is necessary for numerous metabolic activities. Cholesterol moves through the bloodstream on proteins known as "lipoproteins." Two kinds of lipoproteins transport cholesterol throughout the body. LDL (low-density lipoprotein) cholesterol, sometimes known as "bad" cholesterol, makes up most of the body's cholesterol. High levels of LDL cholesterol increase the risk of heart disease and stroke. HDL (high-density lipoprotein) cholesterol, sometimes known as "good" cholesterol, absorbs cholesterol in the blood and transports it back to the liver. The liver then flushes it out of the body. High HDL cholesterol levels may reduce the risk of heart disease and stroke. Statins are the most commonly prescribed medications for high cholesterol. If statins are ineffective, other medications may be utilized. Other tablet options include ezetimibe, fibrates, bile acid sequestrants (also known as resins), bempedoic acid, and injectables like alirocumab, evolocumab, and inclisiran. Recent research on cholesterol-lowering medications has continued to provide useful information on their efficacy and safety. PCSK9 inhibitors are one such class of medications that have received interest. These medications act by inhibiting a protein that lowers the liver's capacity to eliminate LDL cholesterol from the blood.

Hypercholesterolemia is a rather prevalent disease in Singapore. The frequency in Singapore was estimated to be approximately 39% in the past few years. Alternatively, the prevalence of cardiovascular diseases (CVDs) in Singapore is high, making it a major public health problem.

The key drivers of the market include the rising prevalence of abnormal cholesterol and CVDs due to unhealthy lifestyles, coupled with increased government initiatives investing in healthcare, awareness campaigns, and screening programs, further fueled by a growing public awareness and proactive approach towards preventive healthcare.

Multinational pharmaceutical corporations such as AbbVie, Amgen, AstraZeneca, Merck & Co., Novartis, and Pfizer use their considerable R&D skills, brand familiarity, and worldwide reach to gain a significant market share. They frequently focus on novel medications and meet a wide spectrum of patient demands. Local pharmaceutical businesses such as Biocon, Cipla, and Dr. Reddy's Laboratories specialize in providing generic copies of well-known pharmaceuticals at lower rates.

Market Dynamics

Market Growth Drivers

Increase in the prevalence: The prevalence of dyslipidemia, characterized by abnormal cholesterol and triglyceride levels, is on the rise in Singapore. This trend is attributed to various factors, including the adoption of unhealthy diets, sedentary lifestyles, and the increasing incidence of obesity. Additionally, the aging population contributes to a higher risk of developing dyslipidemia, and genetic factors play a role for those predisposed to elevated cholesterol or triglycerides.

Increased screening: The Singapore government has proactively invested in healthcare initiatives, particularly focusing on the management of chronic conditions like dyslipidemia, CVDs, etc. These efforts encompass public awareness campaigns emphasizing the importance of cholesterol management and healthy living. Screening programs are also in place to identify individuals at risk early on, allowing for timely intervention. Moreover, the government has implemented subsidies and reimbursements to enhance the affordability of cholesterol-lowering medications for patients, aiming to make treatment more accessible.

Increasing public awareness: The awareness of preventive healthcare is growing among Singaporeans, leading to a proactive approach to health management. Citizens are increasingly mindful of the significance of preventive measures, willingly adopting healthier lifestyles, and seeking regular checkups and screenings from healthcare professionals. This collective awareness and engagement contribute to a more informed and health-conscious society in Singapore.

Market Restraints

Cost issues: The elevated cost of cholesterol-lowering medications remains a significant concern for certain patients in Singapore, despite the presence of government subsidies and reimbursement programs. This financial burden is particularly notable for the latest and more innovative drugs, which may not be as economically accessible for some individuals. As a result, the accessibility of cutting-edge cholesterol-lowering treatments becomes a pertinent issue that requires further attention and potential policy adjustments to ensure equitable healthcare access for all.

Low long-term adherence: Some patients may encounter difficulties in adhering to their prescribed medication regimens due to factors such as forgetfulness, concerns about ongoing costs, or experiencing undesirable side effects. Addressing this adherence issue involves not only financial considerations but also the implementation of educational initiatives to underscore the importance of consistent treatment for optimal health outcomes.

Competition from alternative therapies: Certain individuals may choose alternative approaches, such as dietary modifications or herbal supplements, as substitutes for conventional medications. While these alternatives may be appealing to some, it is crucial to recognize that their effectiveness may not be as extensively validated as established pharmaceutical interventions.

Healthcare Policies and Regulatory Landscape

Renowned for its efficiency, user-friendly nature, and strong focus on preventive care, Singapore's healthcare system revolves around the pivotal Health Sciences Authority (HSA). As the regulatory body overseeing pharmaceuticals, medical devices, and health-related products, the HSA meticulously ensures the quality and adherence to international standards of these critical items. This commitment to stringent regulations plays a crucial role in instilling confidence among the public in the reliability and safety of Singapore's healthcare system. At the heart of the government's proactive healthcare management approach is an emphasis on health promotion and disease prevention. The seamless integration of both public and private healthcare providers creates a comprehensive and patient-centric healthcare environment. This ensures that a wide range of medical treatments is not only accessible to all Singaporean citizens but also delivered with thoroughness and inclusivity. Furthermore, the incorporation of technology-driven solutions, such as electronic health records and telemedicine, adds a layer of innovation to Singapore's healthcare landscape. These advancements contribute to heightened effectiveness and efficiency in the delivery of healthcare services.

Competitive Landscape

Key Players:

- AbbVie

- Amgen

- AstraZeneca

- Pfizer

- Teva

- Apotex

- Mylan

- Biocon

- Cipla

- Dr Reddy’s

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Cholesterol Therapeutics Market Segmentation

By Indication

- Hypercholesterolemia

- Hyperlipidaemia

- Cardiovascular Diseases

- Others

By Drug Class

- Statins

- Bile Acid Sequestrants

- Lipoprotein Lipase Activators

- Fibrates

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Academics & Research Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.