Singapore Central Nervous System (CNS) Therapeutics Market Analysis

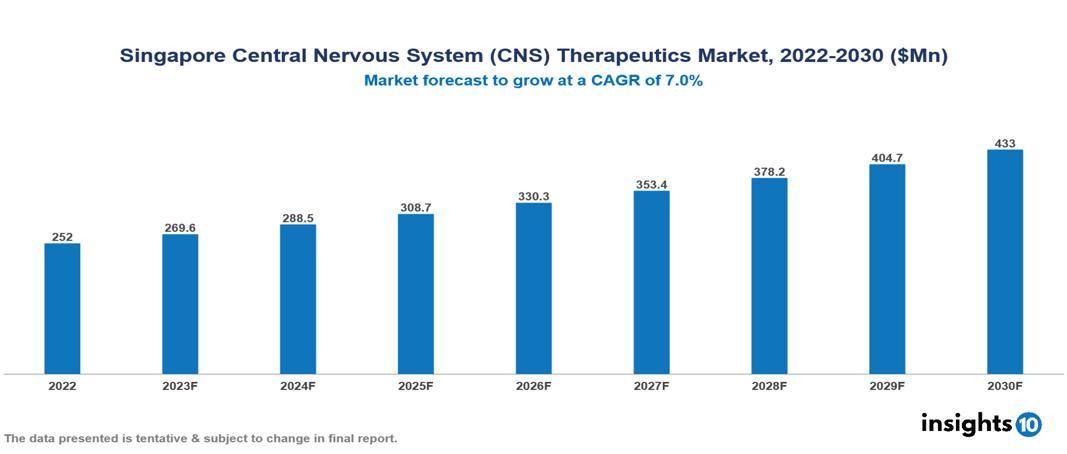

The Singapore Central Nervous System (CNS)Therapeutics Market was valued at $252 Mn in 2022 and is predicted to grow at a CAGR of 7% from 2023 to 2030, to $433 Mn by 2030. The key drivers of this industry include the increasing prevalence of CNS disorders, increasing government initiatives, and growing awareness and diagnoses. The industry is primarily dominated by players such as AbbVie, Novartis, Merck, AstraZeneca, Teva, and Eli Lilly among others.

Buy Now

Singapore Central Nervous System (CNS) Therapeutics Market Executive Summary

The Singapore Central Nervous System (CNS)Therapeutics Market is at around $252 Mn in 2022 and is projected to reach $433 Mn in 2030, exhibiting a CAGR of 7% during the forecast period.

Diseases affecting the Central Nervous System (CNS) and restricting normal brain function are categorized as CNS disorders. These conditions are divided into several areas, which include multiple sclerosis and epilepsy, psychological conditions like depression and schizophrenia, and neurodegenerative disorders like Alzheimer's and Parkinson's. Different risk factors for CNS diseases include infections, traumas, autoimmune reactions, and environmental and hereditary factors. Symptoms commonly affect mood, motor abilities, cognitive function, or sensory perception. Treatments for CNS disorders now focus on managing complications, reducing disease progression, or symptomatic relief. Medication, psychotherapy, and, in certain situations, surgery are available as forms of treatment. Major pharmaceutical companies in this domain include Pfizer, Eli Lilly, and Johnson & Johnson. For example, Pfizer is involved in producing medications for Alzheimer's disease, while Eli Lilly is recognized for its contributions to psychiatric drugs.

Singapore faces a significant public health challenge due to neurological disorders, with a prevalence estimated to reach 17%. The market therefore is propelled by major contributors like an increase in the prevalence of CNS disorders, supportive government policies and funding, and growing awareness and diagnoses. However, high costs of treatment, complex regulatory landscape, and limited reimbursement restrict the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising prevalence of CNS conditions: The aging population in Singapore is facing a rising prevalence of more than 17% of neurodegenerative disorders such as Alzheimer's and Parkinson's, contributing to an elevated healthcare burden. The rise in mental health conditions such as depression and anxiety, attributable to causes such as urbanization and stress, contributes to the healthcare challenges. The rising demand for CNS medicines is a crucial driver propelling market growth.

Supportive government initiatives: The Singapore government prioritizes primary treatment for these diseases and has established organizations and strategies such as the National Neuroscience Institute and the National Mental Health Blueprint. These undertakings involve financial support for the exploration and advancement of novel CNS therapeutics, thereby encouraging the expansion of the market. Additionally, the Singapore Biomedical Sciences Agency (SBG) administers diverse grant programs aimed at promoting research and development in the field of CNS.

Growing awareness and diagnoses: Increased public awareness initiatives and enhanced healthcare accessibility are resulting in the earlier identification of neurological disorders. This early detection enables prompt intervention and treatment, ultimately enhancing patient outcomes and generating a heightened demand for CNS therapeutics. The Singapore Mental Health Alliance (SMHA) actively promotes awareness regarding mental health conditions and offers resources to individuals seeking treatment.

Market Restraints

Affordability challenges: Central nervous system (CNS) drugs frequently rank as some of the priciest pharmaceuticals, imposing a notable financial strain on both patients and healthcare systems. These high treatment costs are not affordable to many patients restricting their accessibility.

Stringent regulatory landscape: Singapore's complex regulatory system that ensures the safety and efficacy of pharmaceuticals is a lengthy and costly approval process. This may inhibit pharmaceutical companies from entering the market, especially for specialized or innovative medicines. The labor and financial resources required to manage regulatory barriers can significantly raise development costs, thereby creating delays in market launch and impacting overall profitability.

Limited reimbursement: Singapore has difficulty in providing comprehensive coverage for certain CNS medicines, particularly those that are new or more expensive. This constraint may prevent patients from receiving therapies, impeding market expansion.

Notable Updates

August 2023, Specialised Therapeutics Asia Pte Ltd, an independent biopharmaceutical company in Singapore, has agreed to partner with Treeway BV, a biotechnology firm in the Netherlands. Their collaborative endeavor aims to bring a novel medication for Amyotrophic Lateral Sclerosis (ALS), the dominant type of Motor Neurone Disease (MND), to the market.

Healthcare Policies and Regulatory Landscape

The Health Sciences Authority (HSA) is Singapore's primary regulatory authority in charge of medication, pharmaceutical, and other health product approval and licensing. The HSA is critical to ensure that these goods are safe, effective, and of high quality for public health. The regulatory system is thorough and adheres to worldwide standards, including processes such as pre-market evaluation, post-market surveillance, and quality control to ensure high pharmaceutical industry standards.

In Singapore, the process of getting medicine and pharmaceutical licenses usually requires numerous steps. Companies must submit complete applications to the HSA, including information about the product's safety, efficacy, and quality. Navigating the regulatory environment requires new entrants to follow established criteria, and the HSA provides information to help them enter the market smoothly.

Competitive Landscape

Key Players

- AbbVie

- Johnson & Johnson

- Novartis

- Roche

- Pfizer

- Merck & Co

- Eli Lilly and Company

- AstraZeneca

- Bristol Myers Squibb

- Teva Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Central Nervous System (CNS) Therapeutics Market Segmentation

By Drug

- Biologics

- Non-Biologics

By Drug Class

- Antidepressants

- Analgesics

- Immunomodulators

- Interferons

- Decarboxylase Inhibitors

- Others

By Disease

- Neurovascular Disease

- Degenerative Disease

- Infectious Disease

- Mental Health

- CNS Cancer

- Others

By Distribution Channel

- Hospital-based pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.