Singapore Cardiac Resynchronization Therapy Market

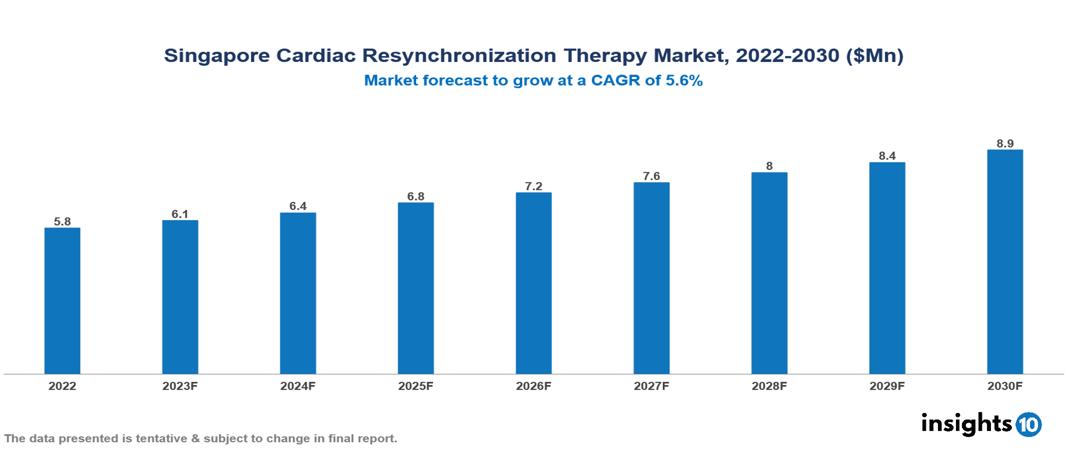

Singapore Cardiac Resynchronization Therapy Market valued at $6 Mn in 2022, projected to reach $9 Mn by 2030 with a 5.6% CAGR. The notable increase in heart failure cases worldwide, propelled by aging demographics and lifestyle-associated cardiovascular ailments, stands as a pivotal factor fuelling the growth of the Cardiac Resynchronization Therapy (CRT) market. Presently, key players in this market encompass Abbott, Biotronik, Boston Scientific, Medtronic, St. Jude Medical, Sorin Group, Siemens Healthineers, Philips Healthcare, GE Healthcare, and Esaote.

Buy Now

Singapore Cardiac Resynchronization Therapy Market Executive Summary

Singapore Cardiac Resynchronization Therapy Market valued at $6 Mn in 2022, projected to reach $9 Mn by 2030 with a 5.6% CAGR.

Cardiac resynchronization therapy (CRT) is a medical procedure that employs a pacemaker to correct the heart's rhythm through a minimally invasive surgical approach. Positioned beneath the skin, the CRT pacemaker synchronizes the timing between the upper and lower heart chambers, ensuring coordination between the left and right sides of the heart. This treatment is particularly beneficial for individuals with heart failure, addressing inadequate pumping and fluid retention in the lungs and legs caused by the asynchronous beating of the heart's lower chambers. In cases of severe heart rhythm irregularities, CRT therapy may be supplemented by the inclusion of an implantable cardioverter-defibrillator (ICD). The CRT device connects wires from the pacemaker to both sides of the heart, utilizing biventricular pacing to ensure synchronized contractions and optimize overall heart function.

In 2023, Singapore faced a significant cardiovascular health challenge, with an average of 34 daily heart attacks leading to 23 deaths from heart disease. This concerning number is largely caused by risk factors such as high blood pressure, high cholesterol, diabetes, obesity, smoking, and advanced age. Notably, in 2022, cardiovascular disease, which includes stroke and heart disease—accounted for 31.4% of all deaths, or 23 deaths per day on average. These alarming figures highlight the pressing need for all-encompassing public health programs that address risk factor reduction, and lifestyle changes and raise awareness to lower the death rates linked to cardiovascular illnesses and address the prevalence of heart attacks in Singaporean society.

In January 2024, Abbott introduced the Encora II pacemaker in Singapore, a significant advancement in cardiac care known for its smaller, lighter, and more durable design, with added Bluetooth connectivity for remote monitoring. Concurrently, in December 2023, Temasek Life Sciences invested $100 Mn in Affectis, a US-based company developing a surgery-free pacemaker. This strategic investment highlights the commitment to innovative technologies revolutionizing cardiovascular health interventions, positioning Affectis as a leader in pacemaker technology innovation.

Market Dynamics

Market Growth Drivers

Advancements in Medical Technology: Ongoing advancements in medical technology globally have a positive impact on the accessibility and effectiveness of CRT devices in Singapore. The integration of cutting-edge technologies in cardiac care enhances treatment options and outcomes for patients.

Rising Prevalence of Cardiovascular Diseases and Heart Failure: Singapore is witnessing a rise in the prevalence of cardiovascular diseases and heart failure, resulting in an expanding demographic of patients requiring advanced cardiac treatments such as Cardiac Resynchronization Therapy (CRT).

Aging Population and Increased Awareness: The demographic shift towards an aging population contributes to a higher prevalence of cardiac issues. Additionally, heightened awareness among Filipinos about heart-related disorders encourages individuals to seek timely and advanced treatments, including CRT.

Market Restraints

Regulatory Hurdles: Obstacles arise in the form of regulatory hurdles and bureaucratic procedures, posing barriers to the swift approval and entry of new CRT devices into the market. The demanding regulatory standards have the potential to impede the timely introduction of innovative technologies within the Philippine market.

Cost Constraints: The substantial expenses linked to Cardiac Resynchronization Therapy (CRT) devices and procedures could pose a considerable obstacle in Singapore. The issue of affordability emerges as a prominent concern for a segment of the population, leading to restricted access to state-of-the-art cardiac care.

Infrastructure Challenges in Rural Areas: Singapore faces infrastructure challenges, particularly in rural areas, which can hinder the effective delivery of cardiac care, including CRT. Limited access to modern medical facilities and specialized healthcare professionals may impede market growth in these regions.

Healthcare Policies and Regulatory Landscape

The Health Sciences Authority (HSA), a pivotal regulatory body ensuring the safety and quality of health products, plays a crucial role in overseeing Singapore's regulatory landscape and healthcare directives governing pharmaceutical treatments. Collaborating with the Ministry of Health (MOH), the HSA is instrumental in formulating standards and policies within the healthcare sector. The Pharmacy Practice Act delineates guidelines for drug distribution, governing both pharmacy practices and the sale of therapeutic items. Integrated into the broader healthcare policy framework, the National Medicines Policy (NMP) guides the distribution and regulation of pharmaceuticals. Additionally, health insurance coverage, such as the Central Provident Fund (CPF) and various health insurance plans, may impact payment regulations, influencing patients' accessibility to specific treatment medications.

Competitive Landscape

Key Players

- Abbott

- Biotronik

- Boston Scientific

- Medtronic

- St. Jude Medical

- Sorin Group

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Esaote

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Cardiac Resynchronization Therapy Market Segmentation

By Product

- CRT-Defibrillator

- CRT-Pacemaker

By Age

- Below 44 years

- 45-64 years

- 65-84 years

- Above 85 years

By End-Users

- Hospitals

- Cardiac care Centres

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.