Singapore Blood Group Typing Market Analysis

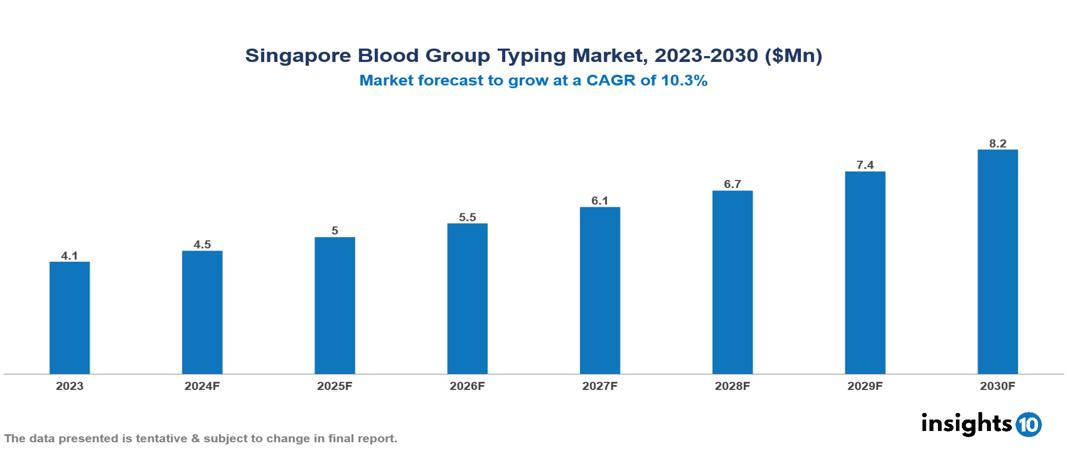

The Singapore Blood Group Typing Market was valued at $4.13 Mn in 2023 and is predicted to grow at a CAGR of 10.30% from 2023 to 2030, to $8.20 Mn by 2030. The key drivers of this industry are increase in prevalence of chronic diseases, public initiatives, and rising number of surgical procedures. The key players in the industry are Grifols S.A., Parkway Laboratory Services, Raffles Medical Group, and Beckman Coulter Life Sciences.

Buy Now

Singapore Blood Group Typing Market Executive Summary

The Singapore Blood Group Typing Market is at around $4.13 Mn in 2023 and is projected to reach $8.20 Mn in 2030, exhibiting a CAGR of 10.30% during the forecast period.

Blood typing is a method to tell what type of blood the individual has. Blood typing is done so they can safely donate or receive a blood transfusion. Blood group determination helps understand a person’s blood group and determine the presence of Rh factor in RBCs. ABO and Rh blood group typing procedures are used to determine an individual’s blood type, which is essential for safe blood transfusions. The presence or lack of specific proteins on RBCs known as antigens shape a person’s blood type, which is inherited from their parents. Four main blood types are distinguished using the ABO blood typing system: Type A, Type B, Type AB, and Type O.

Blood typing is important for several reasons like, safe blood transfusions and matching donor and recipient blood types prevent potentially life-threatening transfusion reactions. Pregnant women must know their blood type, especially the Rh factor. This helps prevent complications like hemolytic disease in the newborn. Blood typing can provide information for genetic studies and inheritance patterns. It also plays a key factor in organ transplant matching to reduce the risk of organ rejection.

About 3-8% population has thalassemia. The market therefore is driven by significant factors like the increase in prevalence of chronic diseases, technological advancements, and prenatal testing procedures. However, cost constraints, workforce shortage, and regulatory challenges restrict the growth of the market.

The prominent companies for blood group typing include Grifols S.A. and Bio-Rad Laboratories. Ortho Clinical Diagnostics, Quest Laboratories, and QuidelOrtho Corporation are also significant contributors to Singapore Blood Group Typing Market.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Chronic Diseases: The increasing incidence of blood cancers like leukemia and lymphoma, as well as chronic conditions requiring regular blood transfusions such as anemia and cancer, is driving demand for blood group typing in Singapore. According to the Singapore Cancer Registry, leukemia is one of the top 10 most common cancers in Singapore.

Technological Advancement: The development of automated blood typing technologies, such as polymerase chain reaction (PCR) based on microarray techniques, has enhanced the speed, standardization, and safety of transfusion diagnostics, driving market growth.

Increase Prenatal Testing: In Singapore, blood typing is a standard part of prenatal care, usually conducted around the seventh week of pregnancy. This test is included in a comprehensive antenatal profile that also screens for conditions like anemia and thalassemia, which are particularly relevant in the local population due to genetic predispositions.

Market Restraints

Cost Constraint: Utilizing advanced blood typing methods like polymerase chain reaction (PCR) and next-generation sequencing (NGS) is expensive, especially for smaller healthcare facilities and blood banks. The significant expenses linked to these technologies might restrict their usage, especially in settings with limited resources.

Skilled Personnel Shortage: Modern blood typing methods, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), require specialized knowledge and expertise for accurate implementation and interpretation. Singapore's healthcare sector faces a shortage of professionals with the necessary skills to perform and interpret advanced blood typing tests, this affects the quality of blood typing services provided.

Regulatory Challenge: The blood typing market is subject to stringent regulatory standards that govern blood transfusions and testing procedures. Compliance with these regulations requires substantial investments in training, quality control, and technology, which can be challenging for smaller organizations to sustain. The complexity of maintaining compliance may deter some facilities from adopting advanced blood typing methods

Regulatory Landscape and Reimbursement Scenario

Health Sciences Authority (HSA) is the primary regulatory authority responsible for overseeing the quality, safety, and efficacy of blood products. Health Products Act (HPA), 2007 categorizes health products, including blood components, and establishes a framework for their regulation. It ensures that blood products are manufactured, imported, and distributed in compliance with safety standards. Singapore aligns its blood safety regulations with international standards set by organizations like the World Health Organization (WHO) and the International Society of Blood Transfusion (ISBT).

Patients receiving blood typing and transfusion services in public hospitals are benefitted from subsidies under various healthcare financing schemes, such as Medisave and MediShield Life, which help cover the costs associated with medical procedures. The National Blood Programme ensures that all patients have access to safe blood products when needed. While the program focuses on securing a sufficient blood supply, it indirectly supports the reimbursement of necessary blood typing services as part of the overall transfusion process

Competitive Landscape

Key Players

Here are some of the major key players in the Singapore Blood Group Typing Market:

- Grifols S.A.

- Bio-Rad Laboratories

- Ortho Clinical Diagnostics

- Raffles Medical Group

- Healthway Medical Group

- Quest Laboratories

- Innovative Diagnostics

- Parkway Laboratory Services

- QuidelOrtho Corporation

- Beckman Coulter Life Sciences

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Blood Group Typing Market Segmentation

By Product

- Consumables

- Instruments

- Services

By Techniques

- PCR-based and Microarray Techniques

- Assay-based Techniques

- Massively Parallel Sequencing Techniques

- Other Techniques

By Test Type

- Antibody Screening

- HLA Typing

- Cross-matching Tests

- ABO Blood Tests

- Antigen Typing

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.