Singapore Asthma and COPD Therapeutics Market Analysis

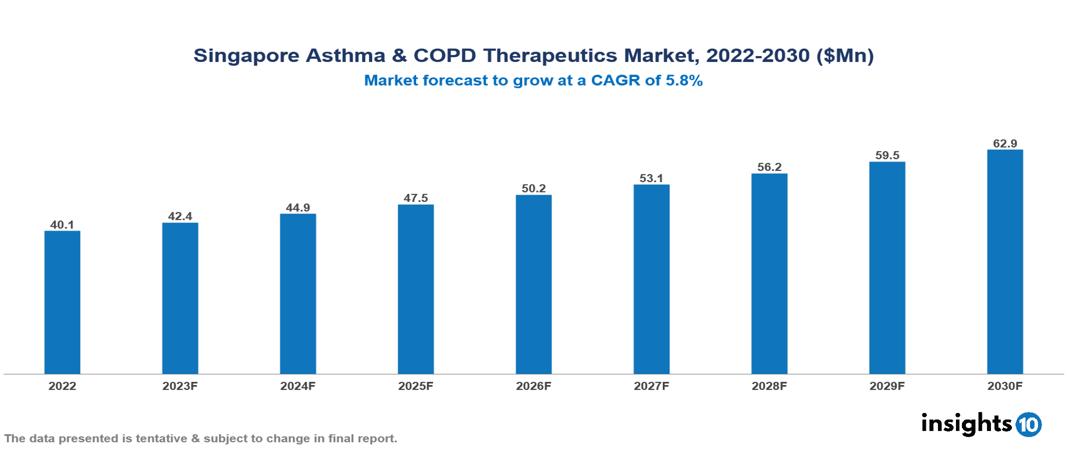

The Singapore Asthma and COPD Therapeutics Market was valued at US $40 Mn in 2022, and is predicted to grow at (CAGR) of 5.80% from 2023 to 2030, to US $63 Mn by 2030. The key drivers of this industry include the rise in the prevalence of COPD and asthma, growth in disposable income, increased awareness, and others. The industry is primarily dominated by players such as AstraZeneca, Teva, Novartis, GlaxoSmithKline, and Boehringer Ingelheim, among others.

Buy Now

Singapore Asthma and COPD Therapeutics Market Analysis: Executive Summary

The Singapore Asthma and COPD Therapeutics Market is at around US $40 Mn in 2022 and is projected to reach US $63 Mn in 2030, exhibiting a CAGR of 5.80% during the forecast period.

Asthma and chronic obstructive pulmonary disease (COPD) are respiratory disorders that impact the airways, resulting in difficulties breathing. Asthma is characterized by inflammation and constriction of the airways, often triggered by irritants, allergens, or physical exertion. Common symptoms include wheezing, shortness of breath, chest tightness, and coughing, along with risk factors such as respiratory infections and a family history of asthma. Conversely, COPD encompasses emphysema and chronic bronchitis, both of which cause obstruction of the airways. Smoking is a primary risk factor for COPD, leading to symptoms like fatigue, increased mucus production, and a persistent cough. Treatment for both conditions typically involves bronchodilators to alleviate airway constriction and anti-inflammatory medications to reduce inflammation. Pharmaceutical companies such as GlaxoSmithKline, AstraZeneca, and Boehringer Ingelheim are widely acknowledged for providing treatments for both COPD and asthma.

Singapore boasts one of the highest asthma prevalence rates worldwide, estimated to be around 20%, while the prevalence of COPD is estimated to be approximately 6%. These statistics are directly proportional to the rising incidence of smoking, air pollution, and other factors. The market is being fuelled by factors such as the upward trend in prevalence of asthma and COPD, growing disposable income, increased awareness, and others. However, limited affordability due to high costs and poor patient adherence are a few factors that limit the market's potential.

Market Dynamics

Market Growth Drivers

Rising prevalence: The estimated prevalence of COPD is around 6% for adults in Singapore. Subsequently, the prevalence of asthma is steadily rising and is as high as 20% for children, making it the country with one of the highest prevalence rates of asthma around the globe. The elevated prevalence of asthma in Singapore is influenced by factors such as air pollution, indoor allergens, smoking, and a family history of the condition.

Rising disposable income: Singapore's robust economy and increasing disposable incomes empower patients, making them more inclined and financially capable of affording advanced and costly medications for COPD and asthma. Government efforts to enhance healthcare access and insurance coverage, exemplified by initiatives like Medisave and Medishield, additionally bolster affordability and contribute to the growth of the market.

Strong potential market space: Singapore's appeal to prominent pharmaceutical companies with research and development facilities results in enhanced accessibility to innovative and advanced treatment options for patients. Additionally, local pharmaceutical companies play a role in the market by providing generic versions of medications at more affordable prices, catering to patients who prioritize cost-effectiveness.

Growing awareness: Groups such as the COPD Association Singapore and initiatives like the Singapore National Asthma Programme actively work to raise awareness about asthma and COPD through public health campaigns and educational initiatives, promoting early diagnosis and treatment, thereby increasing demand in the market.

Market Restraints

High cost and limited affordability: Branded medications for COPD and asthma, despite receiving subsidies from Singapore's healthcare system, can still be costly, posing a financial burden for certain patients and potentially affecting their adherence, thereby impacting outcomes. The focus on cost-effectiveness within the Singaporean healthcare system puts pressure on pharmaceutical companies to provide competitive pricing, potentially restricting access to newer, innovative medications.

Regulatory hurdles: The Health Sciences Authority (HSA) of Singapore follows a stringent approval process for new medications, which could lead to potential delays in making newer treatment options available for patients.

Low patient adherence: Maintaining consistent adherence to prescribed medication regimens can be challenging, influenced by factors such as cost, side effects, or inconvenient administration methods.

Notable Updates

April 2022, scientists at the National University of Singapore (NUS) identified a new characteristic of a protein present in human lungs, potentially paving the way for the creation of biologic drugs to address COPD.

Healthcare Policies and Regulatory Landscape

Singapore's healthcare policy and regulatory structure involve several essential authorities and agencies. The Ministry of Health (MOH) is the primary entity responsible for overseeing healthcare regulations and licensing in the country. The MOH is tasked with formulating national health policies, coordinating and advancing medical and healthcare reforms, and overseeing the administration of healthcare services throughout Singapore.

To secure a license for healthcare products in Singapore, compliance with the regulations established by the MOH is necessary. For pharmaceuticals and medical devices, companies must obtain registration and marketing authorization from the Health Sciences Authority (HSA), which operates as a statutory board under the MOH. This process involves submitting technical and scientific data to validate the product's safety, quality, and effectiveness.

Competitive Landscape

Key Players

- GlaxoSmithKline

- Novartis

- AstraZeneca

- Teva Pharmaceutical Industries

- Boehringer Ingelheim Pharmaceuticals

- Merck Sharp & Dohme

- Chiesi Pharmaceutical

- Sanofi

- Pfizer

- Abbott Laboratories

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Singapore Asthma and COPD Therapeutics Market Segmentation

By Disease Type

- Asthma

- COPD

By Medication Class

- Combination drugs

- Short Acting Beta Agonists (SABA)

- Long Acting Beta Agonists (LABA)

- Leukotriene Antagonists (LTA)

- Anticholinergics

- Others

By Delivery Device

- Metered dose inhalers (MDI)

- Dry Powder inhalers (DPI)

- Nebulizers

By Route of Administration

- Inhaled

- Oral

- Others

By End User

- Asthma Patients

- COPD Patients

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.