Singapore Anti Aging Therapeutics Market Analysis

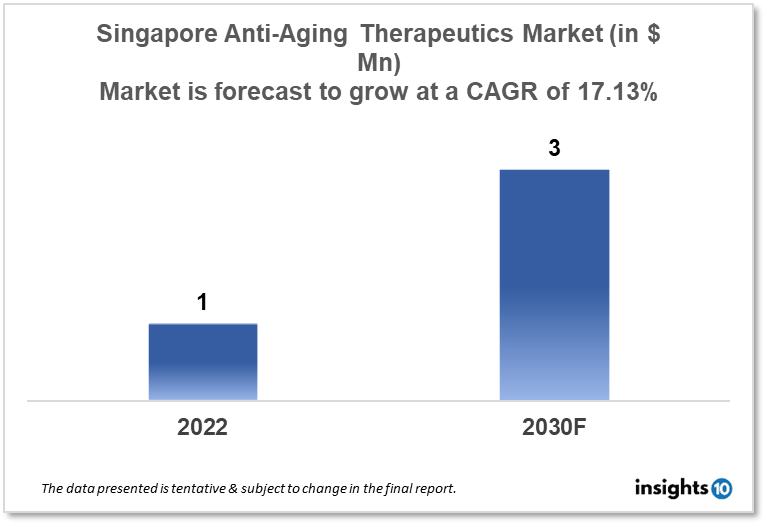

Singapore's anti-aging therapeutics market is projected to grow from $1 Mn in 2022 to $3 Mn in 2030 with a CAGR of 17.13% for 2022-30. The rising geriatric population and supportive government policies in Singapore are driving the expansion of the market. The Singapore anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Some of the key competitors in the market are Coformula, UpperMed, and Shiseido.

Buy Now

Singapore Anti-Aging Therapeutics Market Executive Summary

Singapore's anti-aging therapeutics market is projected to grow from $1 Mn in 2022 to $3 Mn in 2030 with a CAGR of 17.13% for 2022-30. The departments with the highest expected budgets are Defence ($13.41 Bn total projected expenditure), Education ($10.89 Bn total projected expenditure), and Health ($12.59 Bn total projected expenditure). Total spending across all ministries in Singapore is anticipated to grow from 2022 to $77.76 Bn in FY 2023. The Singapore General Hospital's Emergency Medicine Building and Elective Center, as well as IT infrastructure for new healthcare facilities and other significant IT initiatives, will all receive funding totaling $1.02 Bn from the Health Ministry. To guarantee efficient healthcare delivery at hospitals, specialist centers, polyclinics, and community hospitals, the Health Ministry will also concentrate on hiring, training, and retaining healthcare workers as well as expanding clinical services.

Many people think of aging as solely a chronological occurrence; it is unavoidable that we all age. This, however, is a simplification because biological aging, as opposed to chronological aging, is more pertinent because everyone ages effectively differently. Numerous chronic diseases, such as Alzheimer's disease (AD), cancer, cardiovascular disease, and diabetes, have a significant effect on both individuals and society. Age is a major risk factor for many of these conditions. It may be wise to take into account systemic therapies, widely dispersed targets, or organ systems that can have widespread effects. Modulation of processes that are widespread, systemic, and possibly have multiple effects, such as targeting the plasma proteome, cellular senescence, proteostasis, and metabolic processes, are strategies with the potential for broad value.

Cardiovascular and neurological diseases are both severely incapacitating and, in many instances, fatal. Melatonin, an endogenous substance produced naturally by many cell types including the pineal gland, may play a significant role in the modulation of various aging-related processes in this context. This indoleamine can be used therapeutically and can be given exogenously with little risk. Because of this, melatonin may develop into a desirable and affordable option for slowing the effects of aging and diseases linked to it, such as cardiovascular and neurodegenerative conditions.

Market Dynamics

Market Growth Drivers Analysis

With a median age of 42, Singapore's population is among the oldest in the globe. People are more vulnerable to chronic illnesses like cancer, heart disease, and diabetes as they get older, which can cause accelerated aging. Thus, there is a large demand for anti-aging therapies in Singapore. The regulatory climate in Singapore is ideally suited for the development and marketing of anti-aging therapeutics. The nation's governing bodies are renowned for their effectiveness and openness, which has aided in luring investment and fostering the Singapore anti-aging therapeutics expansion.

Market Restraints

Anti-aging treatments are generally not covered by medical insurance in Singapore, which can further restrict their accessibility for many people. The use of anti-aging treatments raises some ethical questions, especially when stem cells and other biologics are involved. These worries might restrict the use and accessibility of some anti-aging treatments. With numerous businesses seeking market share, Singapore anti-aging therapeutics market is becoming more and more competitive. Due to this, it might be more challenging for new competitors to join the market and for established competitors to hold onto their positions.

Competitive Landscape

Key Players

- ImmunoScape (SGP)

- Hummingbird Bioscience (SGP)

- Gero (SGP)- The company strives to improve its patented AI platform and find treatments for complicated disorders and problems associated with chronic aging.

- Coformula (SGP)

- UpperMed (SGP)

- Shiseido

- Estée Lauder

- Lumenis

- Alma Lasers

- Cynosure

- Beiersdorf

- Solta Medical

Healthcare Policies and Regulatory Landscape

The Health Sciences Authority (HSA) is Singapore's regulatory authority in charge of approving and monitoring anti-aging medications. Drugs, medical equipment, and dietary supplements are all subject to regulation by the HSA, a statutory body that reports to the Ministry of Health. Anti-aging medications are controlled as pharmaceuticals in Singapore and must pass stringent clinical studies and testing before being authorized for use. The HSA examines requests for clinical trials and drug registration, assesses data on safety and effectiveness, and keeps track of the market safety of medications through post-marketing surveillance. To make sure that anti-aging medications adhere to international standards for quality, safety, and efficacy, the HSA also works with foreign regulatory organizations. This makes it easier to develop and get novel drugs approved while continuing to adhere to high safety and efficacy standards.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.