Saudi Arabia Pharmacy Market Analysis

Saudi Arabia Pharmacy Market is projected to grow from $xx Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022 - 2030. Pharmacy market is growing due to the increasing number of people suffering from diseases, increasing aging population, growing number of prescriptions and technological advancements like electronic health records (EHRs), pharmacy automation systems, medication dispensing technologies, medication therapy management (MTM) platforms and digital health solutions like E- pharmacy which offer advantages including privacy and confidentiality, free shipping, savings, a shorter purchase process, and a variety of deals. Additionally, it is predicted that the increased use of digital technology by the healthcare sector, rising smartphone penetration, and rising numbers of retailers launching online channels would all contribute to the segment's growth. CVS Health, Boots Walgreens, Cigna, Walmart, Kroger, Rite Aid Corp., Lloyd Pharmacy, Well Pharmacy, Humana Pharmacy Solutions and Matsumoto Kiyoshi are the key global market players in pharmacy market.

Buy Now

Saudi Arabia Pharmacy Market Analysis Summary

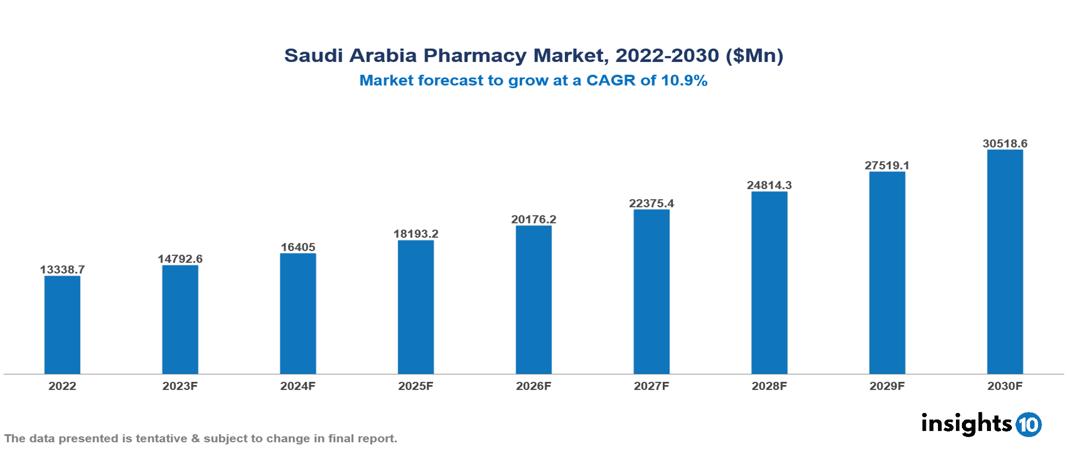

Saudi Arabia Pharmacy Market is valued at around $13338.7 Mn in 2022 and is projected to reach $30518.6 Mn by 2030, exhibiting a CAGR of 10.9% during the forecast period 2023-2030.

The market growth is being positively impacted by the quick expansion and modernization of existing pharmacies to boost market penetration. For instance, Rite Aid Corp. established two new shops in 2020, moved five others, and finished remodeling existing ones, resulting in 1,826 renovated stores for the 2020 fiscal year. The retail pharmacy is defined as the independent avenue that provides branded and generic medicines to the public with or without a prescription. The increase in the retail chains in the pharmacy has helped in the integration of many healthcare components that will increase the purchasing convenience of drugs and other products to the customer. To improve patient safety and offer quick and accurate services to their patients, retail and hospital pharmacies are quickly using various automation systems. E-prescribing, point-of-sale applications, bar code verification, robotic dispensing, automated pill counting, interactive voice response systems, and automated prescription pick-up all make extensive use of automation systems. 84.0% of hospital pharmacies have automated dispensing cabinets in place or plan to, according to a Pharmacy Purchasing and Products survey on pharmacy automation equipment conducted in 2019. Additionally, pharmacies are adopting various digitalization programs to cater to the growing consumer demand and form a profitable business model. Pharmacies are providing various patient care services and introducing various initiatives to promote medication sales. A 2019 article in the National Community Pharmacy Association (NCPA) Digest reported that 77% of pharmacies provided medication therapy management, 76% provided flu vaccinations, 69% provided vaccinations for conditions other than the flu, 57% monitored blood pressure, and 56% provided compounding services. Moreover, collaborative drug therapy agreements were offered by 39% of pharmacies, diabetes training by 33%, ostomy supplies by 32%, smoking cessation by 23%, patient education classes by 16%, asthma management by 13%, and weight management by 11%. Pharmacies are implementing cutting-edge tactics for a variety of tasks, including filling prescriptions. For instance, to meet the demand for prescription deliveries, Walgreens Boots Alliance established micro-fulfillment centers. The retail pharmacy segment held the highest revenue share in the past years. Apart from dispensing a prescription, retail pharmacies are also offering vaccination services and health management services. ePharmacy is estimated to be the fastest-growing segment during the forecast period. CVS Health, Boots Walgreens, Cigna, Walmart, Kroger, Rite Aid Corp., Lloyd Pharmacy, Well Pharmacy, Humana Pharmacy Solutions, and Matsumoto Kiyoshi are the key global market players in the pharmacy market

Market Dynamics

Market Growth Drivers

Increasing number of people suffering from diseases, increasing aging population, growing number of prescriptions, and technological advancements like electronic health records (EHRs), pharmacy automation systems, medication dispensing technologies, medication therapy management (MTM) platforms, digital health solutions like E- pharmacy, rising healthcare costs, changing disease profiles, innovative marketing strategies, surge in the construction of hospital-based pharmacies and wellness centers and rising government funding. All these factors are market growth drivers.

Market Restraints

Regulatory Constraints, rising drug costs, reimbursement challenges, drug shortages, changing consumer behavior, and supply chain complexities act as market growth restraints.

Competitive Landscape

Key Players

- CVS Health

- Boots Walgreens

- Cigna

- Walmart

- Kroger

- Rite Aid Corp.

- Lloyd Pharmacy

- Well Pharmacy

- Humana Pharmacy Solution

- Matsumoto Kiyoshi

Notable Deals in the Pharmacy Market

In June 2021, Medly Pharmacy, a digital pharmacy, announced its plans to acquire Pharmaca, a pharmacy chain to expand its presence in thirty different markets.

In May 2021, PharmEasy, an online pharmacy, acquired Medlife, an ePharmacy, to gain a higher market share and expand its presence in the industry. With this acquisition, PharmEasy holds 60% to 70% of the ePharmacy market in India.

In January 2021, AmerisourceBergen and Walgreens Boots Alliance entered into a strategic alliance. Walgreens Boots Alliance Healthcare Business was acquired by AmerisourceBergen, enabling it to increase its focus on growing its retail pharmacy business.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Market Segmentations For Saudi Arabia Pharmacy Market

By Type

- Online

- Offline

By Drug Type

- Generic

- Over-the-counter (OTC)

- Patented

By End-Users

- Equipment Retail

- Drug Retail

- Health Products Retail

- Chemical Medicine Retail

- Medicinal Materials Retail

- Proprietary Chinese Medicine Retail

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.