Saudi Arabia Hypersomnia Therapeutics Market Analysis

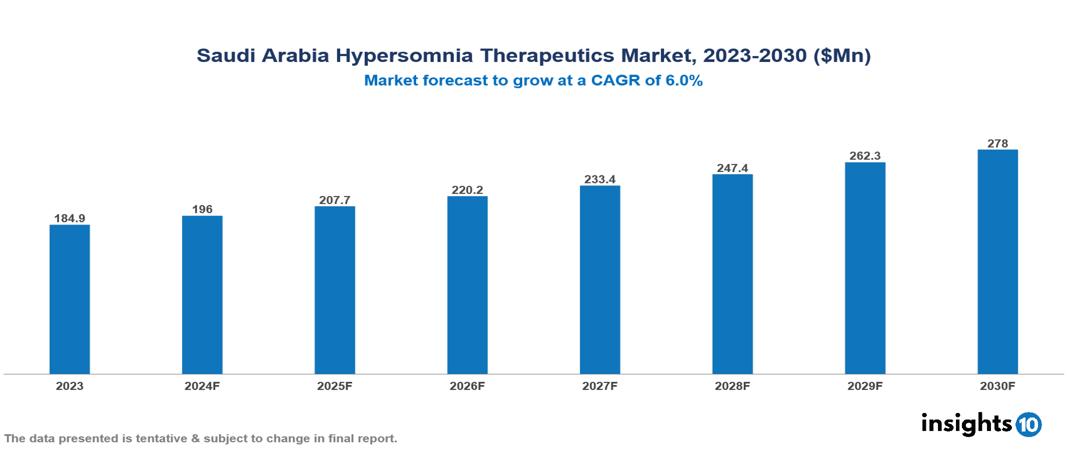

The Saudi Arabia Hypersomnia Therapeutics Market was valued at $184.89 Mn in 2023 and is predicted to grow at a CAGR of 6.0% from 2023 to 2030, to $278.01 Mn by 2030. The key drivers of this industry include the rising prevalence of sleep disorders, expanding geriatric population, early detection, and advancement in diagnostic tools. The key players in the industry are Pfizer, Sanofi, Teva, GSK, and Novartis among others.

Buy Now

Saudi Arabia Hypersomnia Therapeutics Market Executive Summary

The Saudi Arabia Hypersomnia Therapeutics Market is at around $184.89 Mn in 2023 and is projected to reach $278.01 Mn in 2030, exhibiting a CAGR of 6% during the forecast period.

Hypersomnia is a group of neurological disorders characterized by excessive daytime sleepiness, despite getting enough sleep at night. This can significantly impair daily functioning and reduce quality of life. While the exact causes are still being researched, hypersomnia can be linked to underlying medical conditions, neurological disorders, or disruptions in sleep regulation mechanisms. People with hypersomnia often experience symptoms such as not feeling refreshed upon waking, feeling groggy and slow for extended periods after waking, and an excessive need for sleep despite sleeping for long periods. Chronic headaches, loss of appetite, excessive sweating, and depression have also been reported. Treatment for hypersomnia focuses on managing daytime sleepiness. This can involve adopting healthy lifestyle practices like eating well and exercising regularly. Medications like stimulants can also be prescribed to promote wakefulness. In some cases, cognitive behavioral therapy for insomnia (CBT-I) can help address underlying sleep habits that contribute to hypersomnia.

The prevalence of excessive daytime sleepiness, a key symptom of hypersomnia, is 20% in Saudi Arabia. The market therefore is driven by significant factors like the increasing awareness about hypersomnia disorders, growing aging population, and lifestyle changes. However, high costs of treatment, limited accessibility to specialized healthcare services, and strict regulatory approval restrict the market growth.

The leading pharmaceutical companies include Pfizer for the treatment of hypersomnia disorders in Saudi Arabia. Sanofi, Novartis, and Mepha are also significant contributors to the hypersomnia therapeutics landscape, with continuous research and development activities.

Market Dynamics

Market Growth Drivers

Increasing Awareness about Hypersomnia Disorders: Increased public awareness campaigns and healthcare professional education are leading to more accurate diagnoses, raising the potential patient pool for these medications. Saudi Arabia has participated in World Sleep Day celebrations organized by the World Sleep Society. Awareness campaigns are organized in Riyadh that involve setting up counters to educate the public about the importance of healthy sleep practices and common sleep disorders.

Expanding Geriatric Population: Hypersomnia may be more common in elderly individuals because of alterations in sleep structure and existing health issues. As the elderly population makes up 3% of the total population, the occurrence of hypersomnia disorders is projected to increase, leading to a higher need for specialized treatment options designed for the specific requirements of older individuals.

Lifestyle changes: Saudi Arabia is undergoing a transition towards city living and adjustments in work-life harmony. A growing number of people working in the service industry face shift work and long hours, impacting circadian rhythms and resulting in a rise in hypersomnia cases.

Market Restraints

High costs of treatment: Hypersomnia treatments pose a significant financial barrier for many patients, especially those in lower socioeconomic circumstances. These costs significantly burden patients and healthcare systems financially. Although these medicines have increased effectiveness, their high price hinders access for certain individuals.

Strict Regulatory Approval Process: Saudi Arabia has a lengthy and challenging regulatory process for approving new drugs. This slows down the entry of potentially more effective medications into the market, limiting treatment options for patients and hindering market expansion.

Limited Accessibility to Specialized Healthcare Services: In rural districts, particularly those in less populated regions, the availability of sleep disorder clinics, neurologists, and sleep medicine doctors is scarce. In Saudi Arabia, hypersomnia often goes unidentified due to the challenges in diagnosing, treating, and managing the condition.

Regulatory Landscape and Reimbursement Scenario

The regulatory obligations are overseen primarily by the Saudi Food and Drug Authority (SFDA). SFDA aims to minimize health risks associated with the consumption or use of unsafe or substandard products. It educates and informs consumers about health and safety issues related to food, drugs, and other regulated products. It also collaborates with international regulatory agencies, organizations, and stakeholders to exchange information and harmonize standards.

The Council of Health Insurance in Saudi Arabia oversees health insurance regulations and policies for the private sector. At the same time, the Ministry of Health (MOH) is responsible for providing healthcare services and implementing healthcare policies for citizens through its healthcare facilities and programs.

Obtaining a license for drugs and pharmaceuticals in Saudi Arabia involves gathering all the necessary information, including comprehensive pre-clinical and clinical trial data demonstrating the drug's safety and efficacy. The SFDA will thoroughly review your application and all submitted data. The approval process can be lengthy, potentially taking several months to a year or more.

Competitive Landscape

Key Players

Here are some of the major key players in the Saudi Arabia Hypersomnia Therapeutics Market:

- Pfizer

- Sanofi

- Novartis

- Teva

- Takeda Pharmaceuticals

- Merck

- Mepha

- Novo Nordisk

- Fisher and Paykel Healthcare

- GlaxoSmithKline

- Hikma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Hypersomnia Therapeutics Market Segmentation

By Application

- Idiopathic Hypersomnia

- Narcolepsy Type-1

- Narcolepsy Type-2

By Product

- Anti-depressants

- Stimulants

- Sodium oxybate

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.