Saudi Arabia Genomic Diagnostics Market Analysis

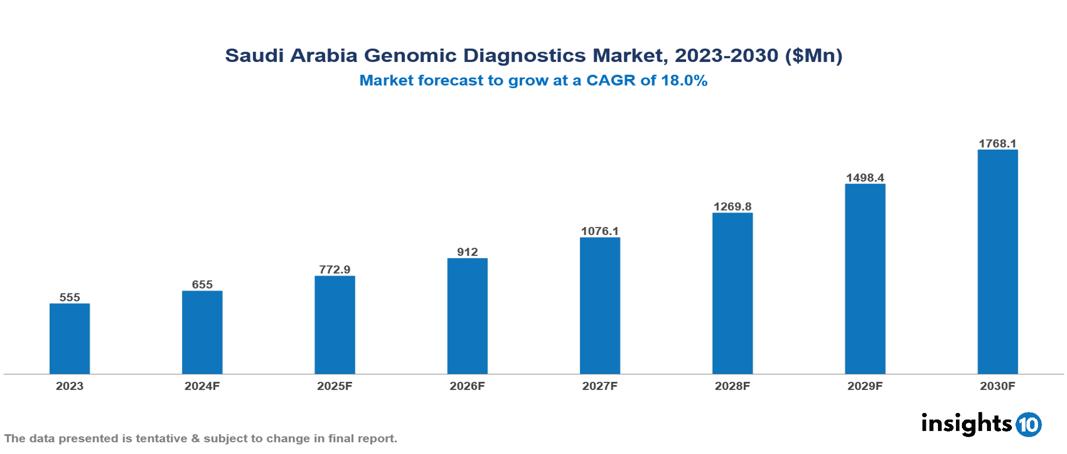

Saudi Arabia Genomic Diagnostics Market was valued at $555.05 Mn in 2023 and is predicted to grow at a CAGR of 18% from 2023 to 2030, to $1,768.10 Mn by 2030. The key drivers of this industry include increasing prevalence, government initiatives, and personalized medicine. The industry is primarily dominated by Illumina, 23andMe, Myriad Genetics, and Amgen among others.

Buy Now

Saudi Arabia Genomic Diagnostics Market Executive Summary

Saudi Arabia Genomic Diagnostics Market was valued at $555.05 Mn in 2023 and is predicted to grow at a CAGR of 18% from 2023 to 2030, to $1,768.10 Mn by 2030.

Genomic diagnostics is a rapidly evolving field that uses an individual's genetic information to diagnose diseases, assess predisposition to future health problems, and guide treatment plans by analyzing DNA or RNA for disease-linked variations. This includes karyotyping to examine chromosome abnormalities, targeted mutation analysis for specific disease-related genes, and next-generation sequencing (NGS) for a comprehensive genetic analysis. Applications encompass disease diagnosis, carrier testing for informed family planning, predictive testing for disease risk assessment, and pharmacogenomics for personalized medication treatments. The benefits of genomic diagnostics include early disease detection, personalized medicine, and improved disease management and prognosis.

Chronic diseases are a major health concern in Saudi Arabia, with non-communicable diseases (NCDs) dominating the health landscape. Approximately 25% of adults suffer from hypertension, with prevalence increasing in the elderly, while around 25% of the adult population has diabetes in 2020. Cardiovascular diseases account for 35% of deaths, and coronary heart disease affects about 6% of adults. Cancer incidence is rising due to demographic and lifestyle changes. Although the age-adjusted mortality rate improved from 2010 to 2017, reaching 286 per 100,000 population in 2018, NCDs still account for 74% of deaths, with a high rate of 3428 per 100,000 in those aged 65 and older.

Market is therefore driven by significant factors like increasing prevalence, government initiatives, and personalized medicine. However, high costs of genetic testing, limited awareness and education, and ethical and privacy concerns restrict the growth and potential of the market.

A prominent player in this field is Illumina, which has partnered with AstraZeneca to leverage genomics and AI for faster drug development by identifying new therapeutic targets and biomarkers, 23andMe acquired Lemonaid Health to enhance its personalized healthcare offerings through telehealth and prescription drug delivery services based on genetic information. Other contributors include Myriad Genetics, and Amgen among others.

Market Dynamics

Market Growth Drivers

Increasing Prevalence: The rising incidence of genetic disorders like sickle cell anemia and thalassemia is boosting demand for genetic testing and diagnostics, supported by heightened awareness of genetic risks.

Government Initiatives: The Saudi government’s initiatives, including the Saudi Human Genome Project and Saudi Biobank, aim to advance genomic research and personalized medicine as part of Saudi Vision 2030, enhancing healthcare outcomes.

Personalized Medicine: Rising consumer interest in personalized medicine is accelerating the adoption of genomic diagnostics, with patients seeking treatments tailored to their genetic profiles.

Market Restraints

High Costs of Genetic Testing: Despite decreasing sequencing costs, the overall expense of genomic diagnostics remains high, potentially limiting access and adoption for some patients and providers.

Limited Awareness and Education: A gap in public understanding of the benefits and applications of genomic diagnostics can hinder patient uptake and integration into standard healthcare practices.

Ethical and Privacy Concerns: Privacy and ethical issues related to genetic data can deter individuals from opting for genomic testing, impacting market growth.

Regulatory Landscape and Reimbursement Scenario

In Saudi Arabia, the Saudi Food and Drug Authority (SFDA) is the primary regulatory body responsible for overseeing medical devices, drugs, and food products, including genomic tests. The SFDA ensures that genomic tests meet safety and efficacy standards before they are approved for use.

Reimbursement for genomic diagnostics in Saudi Arabia involves multiple factors. The Saudi Ministry of Health sets the reimbursement policies for genomic tests, while private health insurance plans offer varying levels of coverage. Additionally, direct-to-consumer (DTC) genetic testing is becoming more popular, but its regulatory and reimbursement status is still evolving.

Competitive Landscape

Key Players

Here are some of the major key players in the Saudi Arabia Genomic Diagnostics

- Illumina, Inc.

- Myriad Genetics, Inc.

- Amgen, Inc.

- 23andMe

- NoorDx

- Al Farabi Labs

- Novo Genomics

- Anwa Labs

- Saudi Advanced Medical Lab

- Saudi Aramco Medical Services Hospital

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Genomic Diagnostics Market Segmentation

By Technology

- Next Generation Sequencing

- Array Technology

- PCR-based Testing

- FISH

- Others

By Application

- Ancestry & Ethnicity

- Traits Screening

- Genetic Disease Carrier Status

- New Baby Screening

- Health and Wellness-Predisposition/Risk/Tendency

By Product

- Consumables

- Equipment

- Software & Services

By End-user

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.