Saudi Arabia Financial Assistance Programs Market Analysis

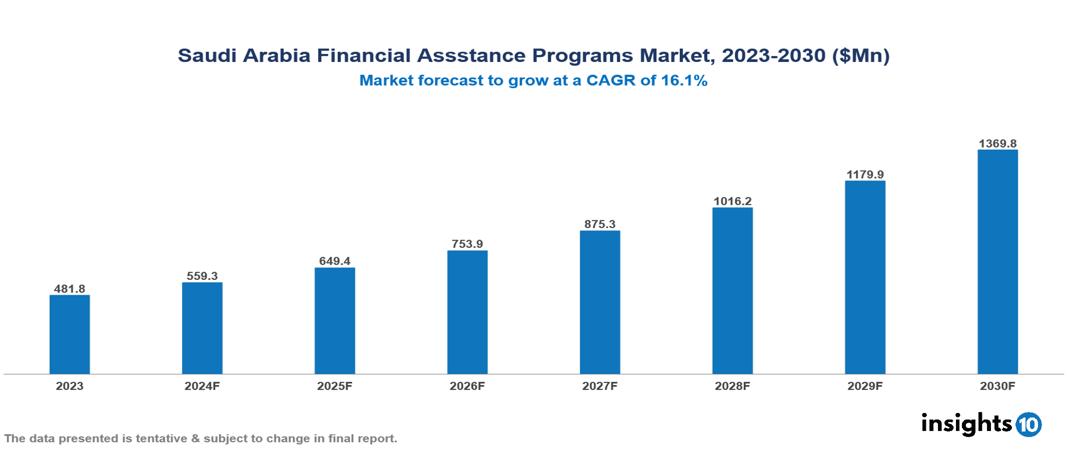

The Saudi Arabia Financial Assistance Programs Market was valued at $481.8 Mn in 2023 and is projected to grow at a CAGR of 16.1% from 2023 to 2023, to $1,369.8 Mn by 2030. The market is driven by various sector such as rising drug cost, complex insurance landscape, regulatory environment, market competition, patient adherence concern etc. The prominent pharmaceutical companies providing financial assistance to patient are such as Takeda Pharmaceuticals, Teva Pharmaceuticals, GSK, Novartis among others.

Buy Now

Saudi Arabia Financial Assistance Programs Market Executive Summary

The Saudi Arabia Financial Assistance Programs Market is at around $481.8 Mn in 2023 and is projected to reach $1,369.8 Mn in 2030, exhibiting a CAGR of 16.1% during the forecast period 2023-2030.

Pharmaceutical companies in Saudi Arabia and globally are offering financial assistance programs to help patients access and afford their medications. This is especially important for patients with chronic or rare diseases who may have high out-of-pocket costs for their treatments. These patient assistance programs can provide financial support in the form of copay assistance, free or discounted medications, and other resources to help make treatments more affordable and accessible. Providing financial assistance is crucial for pharmaceutical companies to ensure patients can access the medications they need, improve treatment adherence, and ultimately achieve better health outcomes.

Around 22,000 Saudis die every year from the four main Non-Communicable Diseases (NCD’s) which is equal to 35% of all the deaths in KSA. The major NCD’s are Cardiovascular disorders, cancer, cardiovascular diseases, diabetes and hypertension. The estimated prevalence of Diabetics in Saudi Arabia is 14.8% for males and 11.7% for females, according to a national survey, Hypertension (HTN): The estimated prevalence of HTN is 17.7% for males and 12.5% for females, cardiovascular diseases (CVD), is a major cause of mortality in Saudi Arabia, with a prevalence rate of 1% and a utilization rate of 71%, Cancer: Cancer is another significant chronic disease, with a prevalence rate of 0.3% and a utilization rate of 83%. Therefore, the market is predominately driven by factors such as increasing prevalence of chronic conditions, rising cost of pharmaceuticals and limited insurance where factors such as limited awareness, stringent regulatory environment and budgetary concerns restrict the market.

Pharmaceutical companies providing financial assistance to patient are such as Hikma Pharmaceuticals, Tabuk Pharmaceuticals, Takeda Pharmaceuticals, Teva Pharmaceuticals, Merck, GSK, Pfizer, Johnson & Johnson, Novartis among others.

Market Dynamics

Market Drivers

Cost of pharmaceuticals is rising: Novel and specialty medications are getting more and more expensive, especially for complex or rare disorders. Even for people with insurance, this tendency results in increased out-of-pocket expenses. As a result, more patients require financial support in order to obtain their prescription drugs.

Complicated insurance landscape: The insurance industry is complicated because many people have high-deductible health plans, which mean they must pay a large amount up front before their insurance starts to pay for things. More of the financial load is placed on patients via rising co-pays and coinsurance rates. An expanded patient population may gain from financial aid initiatives as a result of these insurance patterns.

Chronic disease prevalence: Around 22,000 Saudis die every year from the four main Non-Communicable Diseases (NCD’s) which is equal to 35% of all the deaths in KSA. The increasing number of patients with chronic conditions necessitates long-term, often expensive treatments. This creates a sustained need for financial assistance over extended periods. Chronic disease management is a priority in healthcare, driving support for assistance programs.

Market Restraints

Regulatory constraints: Anti-kickback statutes limit how pharmaceutical companies can structure their assistance programs. These regulations aim to prevent improper influence on prescribing decisions but can make program design complex. Compliance requirements increase operational costs and complexity for program administrators.

Limited Awareness: Many eligible individuals are not aware of the available financial assistance programs or the criteria for eligibility. Access to financial assistance programs can vary depending on location, with rural areas and remote regions facing greater challenges in accessing these services

Budgetary pressures: Pharmaceutical companies must carefully manage the cost of assistance programs while ensuring profitability. Economic challenges or shifts in company priorities can lead to reduced funding, which may result in more restricted or selective support offerings. This financial strain could impact the availability and scope of patient assistance initiatives.

Regulatory Landscape and Reimbursement Scenario

The Saudi Food and Drug Authority (SFDA) is Saudi Arabia's National Regulatory Authority overseeing the regulation of medical products like pharmaceuticals and medical devices. It has attained the highest maturity level (ML4) from the World Health Organization, indicating advanced performance in medicine and vaccine regulation.

The SFDA ensures quality, safety, and efficacy through stringent authorization and safety monitoring processes. It sets pricing regulations for pharmaceutical products to balance affordability for the public and profitability for industry. The SFDA upholds rigorous requirements for market entry of medical devices, drugs, and cosmetics to safeguard public health.

Foreign manufacturers seeking approvals in Saudi Arabia's large healthcare market must navigate the SFDA's complex and continuously evolving regulations. Overall, the SFDA's robust regulatory framework is critical for controlling access to and quality of medical products through pricing policies, quality control measures, and facilitating availability of safe, effective solutions.

Competitive Landscape

Key Players

Here are some of the major key players in the Saudi Arabia Financial Assistance Programs Market:

- Hikma Pharmaceuticals

- Teva Pharmaceuticals

- Takeda Pharmaceuticals

- Tabuk Pharmaceuticals

- Bayer

- Sanofi

- Novartis

- Roche

- Pfizer

- GSK

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Financial Assistance Programs Market Segmentation

By Application

- Population Health Management

- Outpatient Health Management

- In-patient Health Management

- Others

By Therapeutics Area

- Health & Wellness

- Chronic Disease Management

- Other therapeutic area

By End Users

- Payers

- Providers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.