Saudi Arabia Diabetes Therapeutics Market Analysis

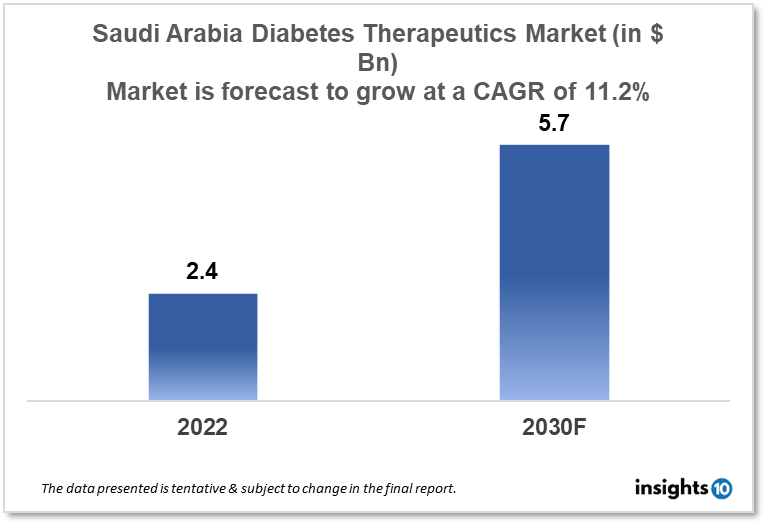

Saudi Arabia's diabetes therapeutics market is expected to witness growth from $2.4 Bn in 2022 to $5.7 Bn in 2030 with a CAGR of 11.2% for the forecasted year 2022-2030. The increase in the awareness of diabetes in Saudi Arabia and recent technological advancements in the treatment of diabetes has resulted in the expansion of the market. The Saudi Arabia diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. Damman Pharma, Saudi Pharmaceutical, and Eli Lilly are the major players in the Saudi Arabia diabetes therapeutics market.

Buy Now

Saudi Arabia Diabetes Therapeutics Market Executive Analysis

Saudi Arabia's diabetes therapeutics market is expected to witness growth from $2.4 Bn in 2022 to $5.7 Bn in 2030 with a CAGR of 11.2% for the forecasted year 2022-30. With projections of $301 Bn in income and a surplus of $4.26 Bn, or 0.4% of GDP, Saudi Arabia has announced a $296 Bn budget for 2023. Funding for social and health development totals $50.4 Bn. While most sectors are expected to see a 1.6 % decrease in spending over 2022, the military sector is expected to see an increase of 5.8 % due to a mandate to strengthen the Kingdom's military capabilities, military hospitals and medical services, and military universities, among other things.

According to the World Health Organization (WHO), Saudi Arabia has the second-highest rate of diabetes in the Middle East and is ranked seventh globally. Around 7 Mn people are thought to have diabetes, while another 3 Mn are thought to have pre-diabetes. SGLT2 inhibitors are a significant pharmacological class for T2DM that have recently been used. They work by reducing blood glucose levels by partially preventing glucose reabsorption from the kidney back into the bloodstream, which improves diabetic control. Additionally, SGLT2 inhibitors enhance cardiovascular and renal outcomes. Studies have shown that SGLT2 inhibitors, especially empagliflozin, are well tolerated and show dose-dependent efficacy. Although empagliflozin is frequently used as a monotherapy or as a supplement to other treatments, it is also linked to some adverse events (AEs), including urinary tract infections, diabetic ketoacidosis, and hypoglycemia.

Market Dynamics

Market Growth Drivers

In Saudi Arabia, people are becoming more aware of diabetes and its problems, which is predicted to increase the demand for diabetic therapies. Government agencies and healthcare professionals are attempting to sensitize the public about the value of diabetes control and early identification. With a focus on enhancing access to healthcare services and managing chronic diseases like diabetes, the Saudi Arabian government has been boosting healthcare spending in recent years. The Saudi Arabia diabetes therapeutics market is anticipated to grow as a result of this rise in healthcare spending. Technology for managing diabetes has advanced significantly, and products like insulin pumps and continuous glucose monitors are now more widely available in Saudi Arabia. It is anticipated that these developments would increase the demand for diabetes medicines that can collaborate with these technologies.

Market Restraints

The cost of treating diabetes can be high, especially for more recent treatments like SGLT2 inhibitors and GLP-1 receptor agonists. The high price may restrict access to these treatments and impede commercial expansion. Although Saudi Arabia is becoming more aware of diabetes, certain medical professionals might not be completely conversant with the most recent diabetes treatments or how to use them. This ignorance may restrict the use of more modern diabetes treatments and restrain market expansion. The Saudi Arabian pharmaceutical regulatory environment can be complicated, which could delay the approval and uptake of new diabetes therapies. As a result, there may be fewer newer therapies available, which could slow Saudi Arabia's diabetes therapeutics market expansion.

Competitive Landscape

Key Players

- Avicenna HIS (SAU)

- Badir (SAU)

- Tabuk Pharmaceuticals (SAU)

- Jamjoom Pharma (SAU)

- Damman Pharma (SAU)

- Saudi Pharmaceutical (SAU)

- Eli Lilly

- Glaxosmithkline

- Johnson Johnson

- Merck

- Novartis

- Novo Nordisk

- Sanofi

Healthcare Policies and Regulatory Landscape

The Saudi Food and Drug Authority (SFDA) must provide manufacturers with marketing authorization before their medical and in vitro diagnostic (IVD) products can be sold in the Kingdom of Saudi Arabia (KSA). Prior to entering the market, all classes of medical equipment must receive pre-market approval. All human-registered medications made in Saudi Arabia or imported into the country are tracked by the Saudi Food and Drug Authority (SFDA) and the Drug Track and Trace System (RDS). A standardized identification system called RDS is used to follow medications from the manufacturer to the patient. It applies to all pharmaceutical items on the Saudi market, including over-the-counter (OTC) medications, and adopts GS1 standards. The Saudi Food and Drug Authority (SFDA), according to GS1, is developing comparable standards for medical equipment.

The Ministry of Health (MOH) is the main government organization in charge of providing healthcare services to the people of the Kingdom that are preventive, curative, and rehabilitative. The Ministry has a network of medical facilities all across the Kingdom that offer primary healthcare (PHC) services. Additionally, it makes use of a referral system to deliver curative treatment to every member of society, from primary care physicians in health clinics to sophisticated technology specialists and curative services delivered by a wide range of general and speciality hospitals. Additionally, the MOH oversees and keeps track of all actions relating to healthcare that are carried out by the private sector. As a result, the MOH can be seen of as the country's national health service (NHS).

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Damman Pharma, Saudi Pharmaceutical, and Eli Lilly are the major players in the Saudi Arabia diabetes therapeutics market.

The Saudi Arabia diabetes therapeutics market is expected to grow from $2.4 Bn in 2022 to $5.7 Bn in 2030 with a CAGR of 11.2% for the forecasted year 2022-2030.

The Saudi Arabia diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.