Saudi Arabia Constipation Therapeutics Market Analysis

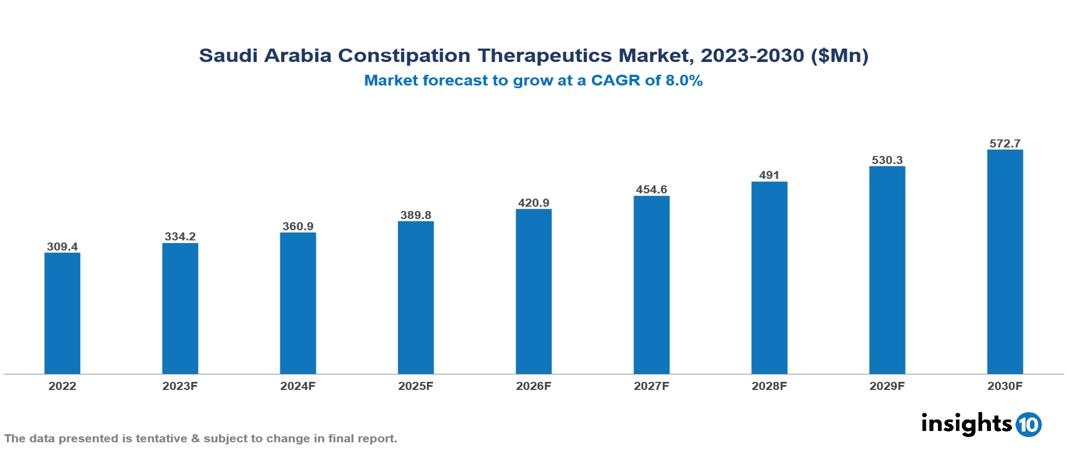

Saudi Arabia Constipation Therapeutics Market was valued at $309 Mn in 2022 and is estimated to reach $573 Mn in 2030, exhibiting a CAGR of 8% during the forecast period. The constipation therapeutics market is growing driven by the global rise in constipation prevalence associated with aging, sedentary lifestyles, and poor dietary habits, and further fuelled by an expanding elderly population more prone to chronic conditions. Key players in this industry include Abbott, Almirall, Boehringer Ingelheim, GlaxoSmithKline, Johnson & Johnson, Medtronic, Norgine Pharmaceuticals, Pfizer, Sanofi, and Takeda Pharmaceutical.

Buy Now

Saudi Arabia Constipation Therapeutics Market Executive Summary

Saudi Arabia's Constipation Therapeutics Market was valued at $309 Mn in 2022 and is estimated to reach $573 Mn in 2030, exhibiting a CAGR of 8% during the forecast period.

Constipation is a digestive condition characterized by infrequent bowel movements, difficulty passing stool, or the passage of hard and dry stool. It occurs when the movement of stool through the colon (large intestine) is slow, allowing more water to be absorbed from the stool, leading to its hardening. Common symptoms of constipation include straining during bowel movements, a sense of incomplete evacuation, abdominal discomfort, and infrequent or irregular bowel habits. Various factors can contribute to constipation, including a low-fiber diet, inadequate fluid intake, lack of physical activity, certain medications, and underlying medical conditions. Lifestyle changes, dietary adjustments, increased physical activity, and, if necessary, medications are often employed to manage and relieve constipation.

Constipation rates in Saudi Arabia demonstrate regional differences, as the central region records a prevalence of 4.4%, in contrast to the Makkah region where the prevalence is significantly higher at 22%. In Riyadh, constipation affects 83.3% of the population, while in Qassim, the percentage stands at 16.7%. This information emphasizes the widespread occurrence of constipation in Saudi Arabia, emphasizing variations influenced by geographic locations and demographics. The prevalence is influenced by factors such as age, gender, and lifestyle choices, including dietary habits related to fiber and water intake.

Finch Therapeutics is at the forefront of innovation in constipation therapeutics with their development of FCR006, a medication designed to modulate bile acid signaling in the intestine. This novel approach showcases the company's commitment to exploring innovative methods for treating constipation beyond traditional remedies. The research efforts at Finch Therapeutics also highlight a broader industry trend, where there is a growing interest in developing drugs that target specific receptors or interact with the gut microbiota, signifying a shift towards more personalized and targeted approaches to address gastrointestinal disorders.

Market Dynamics

Market Growth Drivers

Growing Awareness: Growing awareness of gut health and digestive issues is a key driver for the constipation therapeutics market. Increased public awareness is fostering a higher demand for effective constipation treatments, shaping consumer behavior and driving market growth.

Dietary changes: The increasing consumption of processed foods and reduced fiber intake contribute to constipation, highlighting the pivotal role of dietary fiber in gut health. As awareness grows, there is a potential rise in demand for fiber-based laxatives or dietary solutions, reflecting a trend towards health-conscious choices and acting as a driver for constipation therapeutics.

Aging Population: As of 2023, Saudi Arabia's elderly population (60 and above) stands at 5.4% (2.8 Mn), projected to reach 18% by 2050. This demographic shift increases constipation risk due to reduced physical activity, dietary changes, and medication effects. The growing elderly population and their susceptibility to constipation create a significant market opportunity for constipation therapeutics in the country.

Market Restraints

Safety and Efficacy Concerns: Concerns regarding safety and effectiveness pose a significant obstacle to the constipation therapeutics market. Both prescription and over-the-counter laxatives have the potential to induce adverse effects such as bloating, electrolyte imbalances, and dependency. Overcoming these challenges in the development of new medications is crucial to ensure prolonged safety. Moreover, dissatisfaction with the ineffectiveness of current treatments for a broad range of patients impedes widespread adoption in the market.

Cost and Affordability: The elevated expenses of innovative drugs and potential financial challenges linked to certain non-prescription laxatives serve as a constraint in the constipation therapeutics market, restricting access for patients, particularly those with limited insurance coverage.

Preference for Over-the-counter (OTC) Remedies: A common tendency among individuals is to self-medicate using over-the-counter solutions for constipation, disregarding prescription therapeutics. This consumer trend may hinder the market's expansion, presenting difficulties for healthcare professionals in advocating and recommending specialized constipation treatments.

Healthcare Policies and Regulatory Landscape

In Saudi Arabia, key healthcare laws and regulatory agencies supervise the administration of prescription drugs. The primary regulatory entity is the Saudi Food and Drug Authority (SFDA), responsible for ensuring the safety and quality of pharmaceuticals. The Drug Sector of the Ministry of Health (MOH) oversees pharmaceutical affairs, such as drug registration and pricing, and works in tandem with the SFDA to develop healthcare policies. The National Committee for Drug Control (NCDC) places a high priority on safe and responsible drug use when coordinating drug control initiatives. While the Saudi Central Board for Accreditation of Healthcare Institutions (CBAHI) indirectly affects drug administration through the accreditation of healthcare institutions, the National Pharmacovigilance Centre (NPC) is devoted to monitoring pharmaceutical safety.

Competitive Landscape

Key Players

- Abbott

- Almirall

- Boehringer Ingelheim

- GlaxoSmithKline

- Johnson & Johnson

- Medtronic

- Norgine Pharmaceuticals

- Pfizer

- Sanofi

- Takeda Pharmaceutical

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Constipation Therapeutics Market Segmentation

By Therapeutic

- Laxatives

- Chloride Channel Activators

- Peripherally Acting Mu-Opioid Receptor Antagonists

- GC-C Agonists

- 5-HT4 Receptor Agonists

By Disease

- Chronic Idiopathic Constipation

- Irritable Bowel Syndrome with Constipation

- Opioid-Induced Constipation

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.