Saudi Arabia Cardiac Arrhythmia Therapeutics Market Analysis

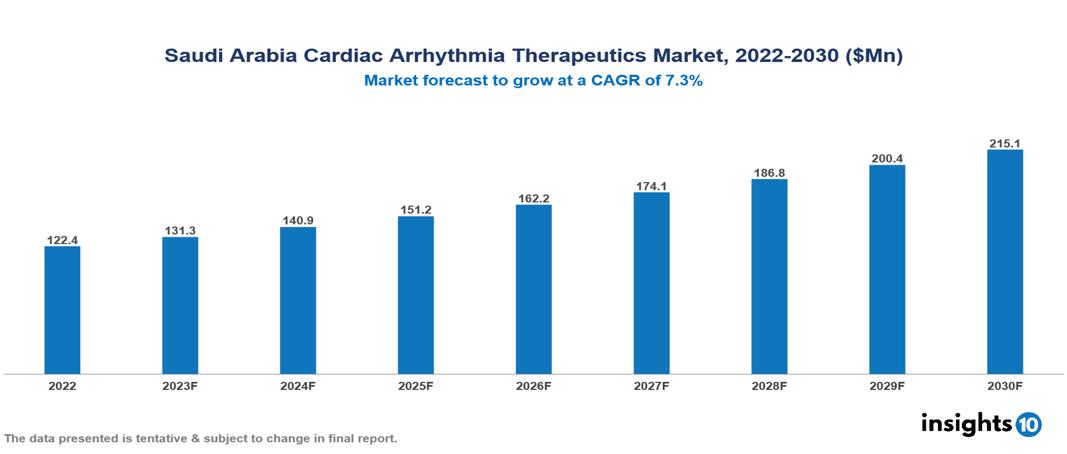

Saudi Arabia Cardiac Arrhythmia Therapeutics Market valued at $122 Mn in 2022, projected to reach $215 Mn by 2030 with a 7.3% CAGR. The key drivers of this industry include the increasing prevalence of cardiac diseases, technological advancements, and supportive government initiatives. The industry is primarily dominated by players such as Abbott, Medtronic, Novartis, Pfizer, Johnson & Johnson, and Boston Scientific among others.

Buy Now

Saudi Arabia Cardiac Arrhythmia Therapeutics Market Analysis: Executive Summary

Saudi Arabia Cardiac Arrhythmia Therapeutics Market valued at $122 Mn in 2022, projected to reach $215 Mn by 2030 with a 7.3% CAGR.

Cardiac arrhythmia is characterized by an irregular heartbeat, manifesting as either rapid, slow, or irregular heart patterns. This condition can disrupt the heart's normal function, impacting its ability to efficiently pump blood. Common causes of cardiac arrhythmias encompass underlying heart conditions like coronary artery disease, heart valve disorders, high blood pressure, diabetes, smoking, alcohol consumption, and stress. Symptoms may include palpitations, chest discomfort, dizziness, fainting, and fatigue, often diagnosed through ECG or EKG tests. Treatment options range from anti-arrhythmic drugs, beta-blockers, and calcium channel blockers, which aim to regulate heart rhythm and rate. Additionally, implantable devices like pacemakers or defibrillators are employed. Renowned companies such as Medtronic, Boston Scientific, Abbott Laboratories, and Johnson & Johnson play pivotal roles in manufacturing treatments for cardiac arrhythmias, contributing to the advancement of innovative medical devices and pharmaceuticals in this field.

The estimated prevalence of atrial fibrillation is around 5% and accounts for about 30% of deaths in Saudi Arabia. The market is being propelled by important factors such as the rising burden of cardiovascular diseases, technological advancements in the therapeutics industry, and increasing government spending. However, conditions such as lack of human resources, limited accessibility, and affordability challenges limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increase in prevalence of CVDs: CVDs stand as the primary cause of mortality in Saudi Arabia, accounting for around 30% of all deaths. The estimated prevalence of cardiac arrhythmias is around 5%. It frequently emerges as a complication of CVDs, adding to the overall healthcare burden. The risk factors such as sedentary lifestyles, poor dietary choices, and tobacco consumption are becoming more prevalent in Saudi Arabia, contributing to an elevated susceptibility to CVDs and cardiac arrhythmias. The aging demographic in Saudi Arabia is also contributing to a higher incidence of age-related conditions like atrial fibrillation, a prevalent type of cardiac arrhythmia.

Technological advancements: The advancement of minimally invasive ablation techniques for addressing specific arrhythmias results in quicker recovery periods and reduced complications, ultimately promoting better patient outcomes and preferences and driving market expansion. Progress in telehealth and remote cardiac monitoring technologies has the potential to enhance accessibility to the diagnosis and treatment of arrhythmias, particularly in remote regions.

Supportive government initiatives: The Vision 2030 initiative of the Saudi government places a significant emphasis on enhancing healthcare accessibility and quality. This commitment involves allocating resources towards the development of new technologies, infrastructure, and healthcare training, ultimately contributing to advancements in the diagnosis and treatment of cardiac arrhythmias. Projections indicate a rise in government healthcare spending in Saudi Arabia in the foreseeable future, ensuring increased resources for the diagnosis, treatment, and adoption of innovative therapies for cardiac arrhythmias.

Market Restraints

Limited accessibility: The presence of sophisticated diagnostic tools such as electrophysiology labs and Holter monitors shows considerable disparity throughout the country. This inequality in accessibility poses a constraint on obtaining precise diagnoses and obstructs timely interventions for arrhythmias.

Lack of human resources: Specialists in cardiac arrhythmia are primarily located in major urban areas, resulting in limited access to specialized care and diagnosis in vast rural regions. This situation can result in delayed diagnoses and treatment, ultimately affecting patient outcomes. The shortage of well-trained nurses and technicians proficient in handling cardiac arrhythmia devices and medications acts as a barrier to providing optimal patient care and ensuring treatment adherence.

Affordability challenges: Advanced treatments for cardiac arrhythmia, both devices and medications, come with substantial costs, imposing a significant financial strain on patients. This can result in delays or treatment non-compliance. Understanding and navigating the reimbursement policies within the Saudi healthcare system for cardiac arrhythmia treatments can be complex. The lack of transparency and clear guidelines in this regard can introduce administrative obstacles for both patients and healthcare providers, ultimately impeding timely access to essential care. Furthermore, not all insurance plans in Saudi Arabia comprehensively cover treatments for cardiac arrhythmia, leaving patients susceptible to elevated out-of-pocket expenses.

Healthcare Policies and Regulatory Landscape

In Saudi Arabia, the regulatory authority for therapeutics is the Saudi Food and Drug Authority (SFDA). The SFDA plays a pivotal role in ensuring the safety, efficacy, and quality of pharmaceuticals, medical devices, and other healthcare products. It is responsible for granting marketing authorizations and overseeing the entire lifecycle of therapeutic products in the country. The SFDA follows international standards and guidelines to evaluate applications for licensure, ensuring that products meet rigorous standards before they are allowed into the Saudi Arabian market.

The process of obtaining licensure for therapeutics in Saudi Arabia involves submitting a comprehensive application to the SFDA, including detailed information on the product's safety, efficacy, and quality. Once a product is deemed compliant, the SFDA grants marketing authorization, allowing the therapeutic to be distributed and sold in the Saudi market.

For new entrants, navigating the regulatory landscape can be challenging due to the stringent requirements and thorough evaluations. However, adherence to international standards and collaboration with the SFDA can facilitate a smoother entry into the Saudi Arabian market for new therapeutic products.

Competitive Landscape

Key Players

- Abbott

- Boston Scientific Corporation

- Medtronic

- Siemens Healthineers

- Johnson & Johnson

- Pfizer

- Merck & Co

- AstraZeneca

- Novartis

- Sanofi

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Cardiac Arrhythmia Therapeutics Market Segmentation

By Test Equipment

- Electrocardiogram (ECG)

- Holter monitor

- Others

By Site of Origin

- Atrial Fibrillation

- Sinus Bradycardia

- Atrial Tachycardia

- Atrial Flutter

- Premature Atrial Contractions (PACS)

- Others

By Type

- Supraventricular Tachycardias

- Ventricular Arrhythmias

- Bradyarrhythmia’s

By Drug Type

- Antiarrhythmic drugs

- Calcium channel blockers

- Beta-blockers

- Anticoagulants

- Others

By Mode of Administration

- Injectable

- Oral

- Others

By Distribution channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.