Saudi Arabia Blood Disorder Therapeutics Market

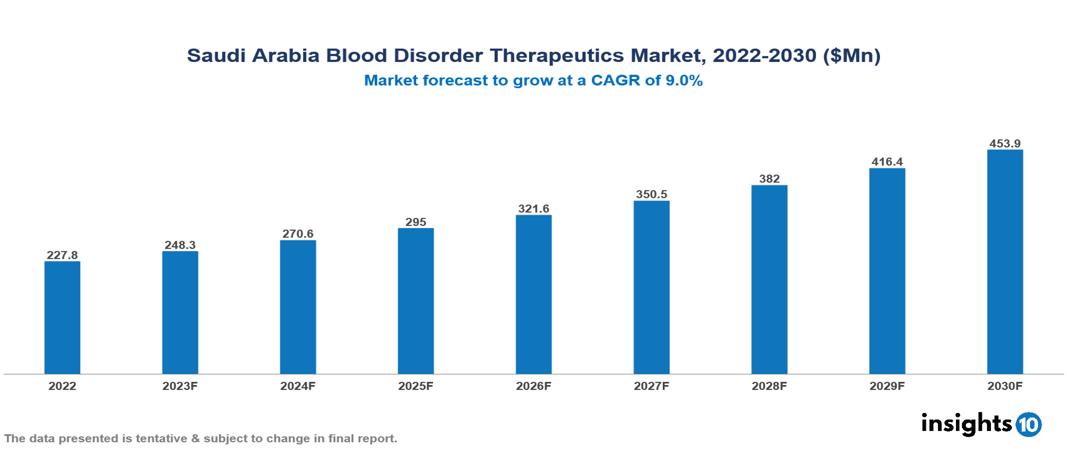

Saudi Arabia Blood Disorder Therapeutics Market valued at $228 Mn in 2022, projected to reach $454 Mn by 2030 with a 9% CAGR. Several factors are converging to cause market expansion, such as a young and expanding population, government initiatives supporting improved healthcare accessibility, advocacy groups raising awareness about advanced therapies, and digital healthcare integration. The Saudi Arabia Blood Disorder Therapeutics Market encompasses various players across different segments, including Pfizer, Roche, Takeda Pharmaceuticals, Novartis, Sanofi, Novo Nordisk, Bayer, Jamjoom Pharma, Tabuk Pharma, Tamer Pharma etc, among various others.

Buy Now

Saudi Arabia Blood Disorder Therapeutics Market Executive Summary

Saudi Arabia Blood Disorder Therapeutics Market valued at $228 Mn in 2022, projected to reach $454 Mn by 2030 with a 9% CAGR.

Blood diseases are illnesses that impact the platelets, plasma, white blood cells, red blood cells, and white blood cells. Numerous reasons, including genetics, infections, autoimmune responses, and certain drugs, can result in these illnesses. Hemophilia, a hereditary condition affecting blood clotting, leukemia, a malignancy of the blood-forming tissues, anemia, which is defined by a decrease in red blood cells or hemoglobin, and thrombocytopenia, which is characterized by a low platelet count, are common blood diseases. They might not be malignant or cancerous. The precise kind and degree of a blood issue determine the available treatment choices. Changes in diet or avoidance of certain drugs can be beneficial for some blood diseases. Others could require interventions like blood transfusions, chemotherapy, replacement treatment, radiation therapy, iron supplements, or stem cell transplantation. Treating genetic blood abnormalities like hemophilia and some other kinds of anemia may be possible with newer methods like precision treatment and gene therapy.

The two most frequent blood diseases in Saudi Arabia are thalassemia and sickle cell disease, with thalassemia being more common in the eastern area and sickle cell disease more common in the western and southern portions of the nation. In Saudi Arabia, adults with sickle cell disease make up more than 45,100 per 1,000,000. Furthermore, more than 2400 out of 1,000,000 Saudi children and adolescents have sickle cell disease.

Several factors are converging to cause market expansion, such as a young and expanding population, government initiatives supporting improved healthcare accessibility, advocacy groups raising awareness about advanced therapies, and digital healthcare integration.

Major firms with a strong presence in the KSA and a broad worldwide reach include Pfizer, Roche, Novartis, Sanofi, and Takeda. With a concentration on generics, local giants like Jhulphar, Tabuk Pharmaceuticals, and Tamer Pharmaceuticals have a significant market presence. Their local manufacture may provide them an advantage in particular markets.

Market Dynamics

Market Growth Drivers

Rising Demand for Healthcare: Numerous reasons contribute to the rising demand for healthcare services, especially in the treatment of blood disorders. This increase in demand is partly caused by a young and growing population, as these groups frequently require more healthcare services. Specialized therapies are also more readily available as a result of enhanced healthcare accessibility, which is bolstered by greater government funding and programs like Vision 2030. Demand for pharmaceuticals is also significantly increased by campaigns and patient advocacy groups that raise awareness of blood diseases.

Government Support and Changing Treatment Landscape: The need for therapies for blood disorders is further impacted by the substantial changes taking place in the healthcare industry. A favorable environment for market expansion is being created by government-sponsored programs for managing chronic diseases and providing subsidies for particular pharmaceuticals. The emphasis on cutting-edge medicines, such as CAR-T cell and gene therapy, offers novel and very successful therapeutic alternatives. The incorporation of digital healthcare technologies, such as telemedicine and online platforms, is improving patient involvement and market reach by improving access to specialists and educational resources.

Disease Patterns: The need for therapy for blood disorders is further influenced by certain trends in illness. Genetic illnesses including sickle cell anemia and beta-thalassemia continue to be major drivers of the market for specialty medications. The market for relevant therapies is also growing as a result of the growing emphasis on controlling non-communicable illnesses such as autoimmune disorders and leukemia. Increased awareness and improvements in early detection and diagnostics result in earlier diagnosis and treatment commencement, which drives market expansion.

Market Restraints

Limited Healthcare Infrastructure: In certain locations of Saudi Arabia, the lack of sufficient healthcare professionals is impeding the growth of the healthcare market. Inequitable allocation of healthcare facilities and resources, especially in isolated or underdeveloped areas, may hinder the availability of specialist therapies for blood disorders. Inadequate infrastructure can cause problems with prompt diagnosis, treatment delivery, and patient care in general.

Global Giants' Dominance in the Market: Local or smaller firms may find it difficult to compete in the Saudi Arabia Blood Disease Therapeutics Market due to the presence and dominance of multinational pharmaceutical giants. Due to their established market shares, vast resources, and robust distribution networks, a new player entering the market will face a lot of initial competition.

Lack of Knowledge: Another major barrier is the general public's and healthcare professionals' little knowledge about blood diseases. A delayed diagnosis and start of therapy may result from a lack of knowledge about the signs, dangers, and available remedies. This problem is exacerbated by a lack of awareness campaigns and educational programs, which affects the market for treatments for blood disorders. For the industry to realize its full potential, raising public and healthcare provider knowledge is essential.

Notable Recent Updates

- January 2024, The SFDA has approved the marketing of CASGEVY (exagamglogene autotemcel [exa-cel]), a CRISPR/Cas9 gene-edited therapy developed by US-based Vertex Pharmaceuticals, for the treatment of sickle cell disease and transfusion-dependent beta-thalassemia.

- February 2023, The Saudi Vision 2030 Health Sector Transformation Program intends to invest more than $65 Bn in the construction of healthcare infrastructure in collaboration with Kite, a Gilead Company, helping to shape Saudi Arabia's developing healthcare environment by introducing potentially life-saving cell therapy medicines.

Healthcare Policies and Regulatory Landscape

The Ministry of Health is in charge of Saudi Arabia's healthcare policies, which aim to provide high-quality treatment to everyone. This entails making infrastructural investments, raising insurance coverage levels, and encouraging preventative actions. To make sure that this objective is realized, the Saudi Food and Drug Authority (SFDA) is essential. Before any medication or medical equipment is released into the market, the SFDA, which is the only agency responsible for regulating drugs, carefully evaluates it for safety, effectiveness, and quality. This promotes confidence in the healthcare system and protects the general public's health. In addition, the SFDA aggressively controls the manufacture, marketing, and distribution of pharmaceuticals to prevent the sale of fake goods and uphold moral business conduct. Using its stringent framework and global partnerships, SFDA makes a substantial contribution to Saudi Arabia's healthcare objectives, establishing a strong basis for a population that is both safe and well.

Competitive Landscape

Key Players:

- Pfizer

- Roche

- Takeda Pharmaceuticals

- Novartis

- Sanofi

- Novo Nordisk

- Bayer

- Jamjoom Pharma

- Tabuk Pharma

- Tamer Pharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Blood Disorder Therapeutics Market Segmentation

By Disorder:

- Anemia

- Hemophilia

- Leukemia

- Myeloma

- Lymphoma

- Rare blood disorders

By Product Type

- Plasma-derived therapeutics

- Recombinant therapeutics

- Gene therapy

- Other therapies

By End User

- Hospitals

- Specialty clinics

- Ambulatory care

- Home healthcare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.