Saudi Arabia Biobanks Market Analysis

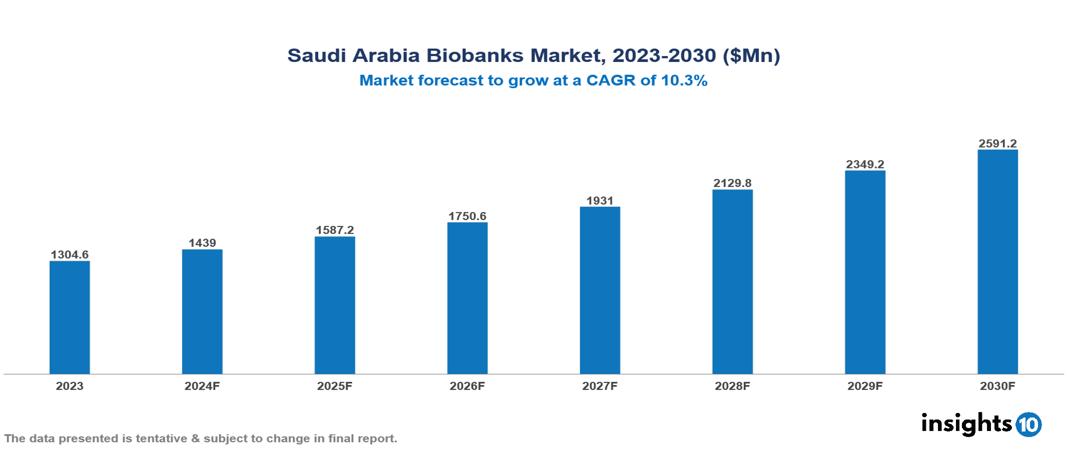

The Saudi Arabia Biobanks Market was valued at $1,304.60 Mn in 2023 and is predicted to grow at a CAGR of 10.30% from 2023 to 2030, to $2,591.20 Mn by 2030. The key drivers of this industry include advancements in research, chronic disease prevalence, and government support. The industry is primarily dominated by players such as Thermo Fisher Scientific, Merck KGaA, QIAGEN, and Tecan Group among others.

Buy Now

Saudi Arabia Biobanks Market Executive Summary

The Saudi Arabia Biobanks Market was valued at $1,304.60 Mn in 2023 and is predicted to grow at a CAGR of 10.30% from 2023 to 2030, to $2,591.20 Mn by 2030.

A biobank is a carefully curated collection of primarily human biological samples and associated data, systematically organized for research purposes. These facilities are pivotal in medical research, aiding diverse studies such as genomics and personalized medicine. Each biobank collects samples and data tailored to its specific research goals. For example, some focus on diseases like cancer, while others gather samples and data from specific demographics or geographic regions.

In a 2022 study, healthcare providers in Saudi Arabia demonstrated a moderate knowledge level of 3.5 (±1.8) out of 7 regarding biobanks. Awareness of the Human Genome Project (HGP) and the term biobank was noted among approximately one-third of the participants, with 35% familiar with HGP and 34% with the term biobank. The market is driven by significant factors like advancements in research, chronic disease prevalence, and government support. However, ethical and regulatory challenges, limited public awareness, and financial sustainability restrict the growth and potential of the market.

Prominent players in this field include Thermo Fisher Scientific, Merck KGaA, QIAGEN, and Tecan Group among others.

Market Dynamics

Market Growth Drivers

Advancements in Research: Saudi Arabia's investment in enhancing research infrastructure and healthcare is driving the establishment of modern biobanks. This initiative aims to satisfy rising demands for biological specimens essential for personalized medicine and advanced medical research.

Chronic Disease Prevalence: The increasing prevalence of chronic diseases like diabetes in Saudi Arabia, estimated at 14.8% among males and 11.7% among females, is a significant market driver for the biobank industry. This trend underscores the need for comprehensive biobanks to support research into disease prevention, treatment, and management strategies tailored to the Saudi population.

Government Support: Government initiatives like The Saudi Biobank, led by the King Abdullah International Medical Research Center (KAIMRC), drive the biobank market in Saudi Arabia. This national project aims to enroll 200,000 participants from the Saudi population, significantly expanding the availability of biological samples and data for research purposes, thereby advancing healthcare and biomedical research capabilities in the country.

Market Restraints

Ethical and Regulatory Challenges: Strict regulations and ethical considerations surrounding consent, data privacy, and sample usage can complicate biobank operations and limit participation. These factors represent a market restraint for the biobank industry in Saudi Arabia, as they can hinder efficient functioning and reduce the number of willing participants.

Limited Public Awareness: Limited public understanding and awareness of biobanks and their significance can result in low participation rates and reduced donor engagement. This represents a market restraint for the biobank sector in Saudi Arabia, as it can impede the recruitment of sufficient biological samples and data needed for effective research.

Financial Sustainability: Maintaining the long-term financial viability of biobanks is challenging, especially for smaller or newly established ones that may have difficulty securing consistent funding. This serves as a market restraint for the biobank industry in Saudi Arabia, as financial instability can hinder the sustainable operation and growth of these biobanks.

Regulatory Landscape and Reimbursement Scenario

The Saudi Food and Drug Authority (SFDA) regulates biomedical research and ensures the safety and quality of biobank operations. The SFDA oversees various aspects of biomedical research, including clinical trials, post-market evaluations, and clinical evaluation studies, to ensure the safety and efficacy of medical devices and pharmaceuticals. The governance of the Saudi Biobank aligns with the International Ethical Guidelines for Biomedical Research Involving Human Subjects - Islamic View, published by the Islamic Organization for Medical Sciences, as well as the Saudi Arabian Law of Ethics of Research on Living Creatures from the National Committee of Medical and Bioethics.

Competitive Landscape

Key Players

Here are some of the major key players in the Saudi Arabia Biobanks Market:

- Thermo Fisher Scientific

- Merck KGaA

- QIAGEN

- Tecan Group

- Becton, Dickinson and Company

- STEMCELL Technologies Inc.

- Avantor

- BioLife Solutions

- NoorDx

- King Fahd Medical City Biobank

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Biobanks Market Segmentation

By Product and Service

- Equipment

- Consumables

- Services

By Sample Type

- Blood Products

- Human Tissues

- Nucleic Acids

- Others

By Application

- Regenerative Medicine

- Life Science Research

- Clinical Research

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.