Saudi Arabia Alcohol Addiction Therapeutics Market Analysis

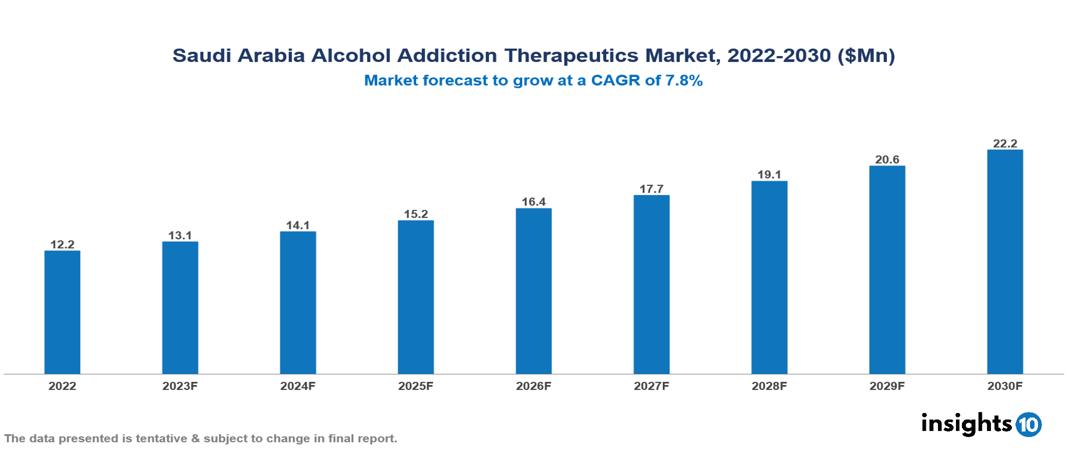

The Saudi Arabia Alcohol Addiction Therapeutics Market is valued at around $12 Mn in 2022 and is projected to reach $22 Mn by 2030, exhibiting a CAGR of 7.8% during the forecast period. The Therapeutics Sector is facing an expanding market opportunity due to the changing demographic landscape, with younger people who are more exposed to global trends and have more disposable income, as well as increased awareness of alcoholism as a treatable disorder and limited treatment options in Saudi Arabia. The key players involved in the research, development, and distribution of Alcohol Addiction Therapeutics in Saudi Arabia are GlaxoSmithKline, Lundbeck, TEVA, Roche, Eli Lilly, AstraZeneca, Cipla, Naseej, Taamer, Sun Pharmaceuticals, etc among others

Buy Now

Saudi Arabia Alcohol Addiction Therapeutics Market Executive Summary

The Saudi Arabia Alcohol Addiction Therapeutics Market is valued at around $12 Mn in 2022 and is projected to reach $22 Mn by 2030, exhibiting a CAGR of 7.8% during the forecast period.

Alcohol Use Disorder (AUD) is a complicated and multidimensional condition marked by the dysregulation of several executive function-related brain circuits, which results in excessive alcohol consumption despite detrimental effects on one's health and social life as well as feelings of withdrawal when alcohol access is restricted. Anybody, regardless of age, gender, or background, can develop AUD. An individual's general quality of life, relationships, and health can all be greatly impacted by AUD. In order to address dysfunctional behaviours and reduced functioning, treatment options include both psychological and pharmaceutical therapies that attempt to reduce alcohol use and/or promote abstinence. Behavioral therapies, including cognitive-behavioural therapy (CBT), motivational interviewing, and contingency management, are examples of psychological interventions for AUD. AUD can be treated pharmacologically with drugs including naltrexone, acamprosate, disulfiram, and nalmefene.

In Saudi Arabia, currently, alcohol is one of the drugs that individuals use the most often, and peer pressure and psychosocial stress are the main factors that lead to alcohol addiction and misuse. Although prevalence rates of alcohol addiction were lower in Saudi Arabia in the past, they appear to have increased during the last five years. The therapeutics sector is facing an expanding market opportunity due to the changing demographic landscape, with younger people who are more exposed to global trends and have more disposable income, as well as increased awareness of alcoholism as a treatable disorder and limited treatment options in Saudi Arabia.

International companies such as GSK, Roche, Lundbeck, and AbbVie, which market medications like naltrexone and acamprosate, contribute significantly to medication sales. Though there are some local players in the Saudi Arabia Alcohol Addiction Therapeutics Market, their contributions play a less significant role.

Market Dynamics

Market Drivers

Changing Demographic Landscape: Saudi Arabia's young population, which is more exposed to global trends and has more disposable cash, represents a potential alcohol consumer base. This demographic transition will increase the prevalence of alcohol consumption in the country, necessitating the availability of accessible and culturally acceptable treatment facilities.

Rising Awareness and Recognition: Alcoholism, a once-stigmatized disorder, is now widely accepted as curable. Public outreach programs and educational activities are breaking down the silence, prompting more individuals and families to seek assistance. This increased awareness drives up the need for better treatment solutions.

Limited Treatment Options: There are currently few specific drugs available in Saudi Arabia for the treatment of alcohol abuse. This creates a potential void for pharmaceutical businesses that provide effective and culturally relevant remedies. There are no big local firms that manufacture these medications or operate in the behavioural treatment sector. This fosters market growth. However, negotiating sensitive cultural norms and ethical concerns necessitates precise marketing and distribution tactics.

Market Restraints

Limited Infrastructure: The healthcare infrastructure dedicated to addiction treatment in Saudi Arabia remains in its early stages of development. The availability of specialized addiction clinics, qualified therapists, and support groups is still limited, particularly outside major cities. This lack of access creates geographical disparities in treatment availability, further hindering market growth.

Regulatory hurdles: Navigating the regulatory system for pharmaceutical and healthcare goods in Saudi Arabia can be challenging. Stringent restrictions and long approval processes for drugs and treatment programs might impede market entrance and reduce the variety of accessible alternatives. Furthermore, cultural sensitivity to specific drugs or treatment procedures may need adaptation or alternate solutions.

Knowledge Gaps: A lack of knowledge and proper information, especially for low-income groups, concerning alcohol addiction can lead to misconceptions and stigma. This impedes early intervention and may lead individuals to use inefficient or hazardous coping techniques. Public education campaigns and culturally relevant awareness programs are critical for closing the knowledge gap and supporting evidence-based treatments.

Healthcare Policies and Regulatory Landscape

The Ministry of Health drives Saudi Arabia's healthcare policy, which seeks universal access and excellent care. This includes investing in infrastructure, increasing insurance coverage, and encouraging preventative actions. The Saudi Food and Drug Authority (SFDA) is critical to guaranteeing this vision's success. As the single drug regulatory agency, the SFDA painstakingly evaluates the safety, effectiveness, and quality of all medicines and medical devices before they are released to the market. This protects public health and increases faith in the healthcare system. Furthermore, the SFDA aggressively controls pharmaceutical manufacture, distribution, and advertising, combating counterfeit pharmaceuticals and upholding ethical market practices. SFDA contributes considerably to Saudi Arabia's healthcare aims by establishing a rigorous framework and worldwide cooperation, laying the groundwork for a healthy and protected population.

Competitive Landscape

Key Players

- GlaxoSmithKline

- Lundbeck

- TEVA

- Roche

- Eli Lilly

- AstraZeneca

- Cipla

- Naseej

- Taamer

- Sun Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Alcohol Addiction Therapeutics Market Segmentation

By Therapy Type

- Pharmacological Therapy

- Behavioural Therapy

- Digital Health Interventions

- Others

By Disease Stage

- Mild Alcohol Dependence

- Moderate Alcohol Dependence

- Severe Alcohol Dependence

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Residential Treatment Centres

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.