Saudi Arabia ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Analysis

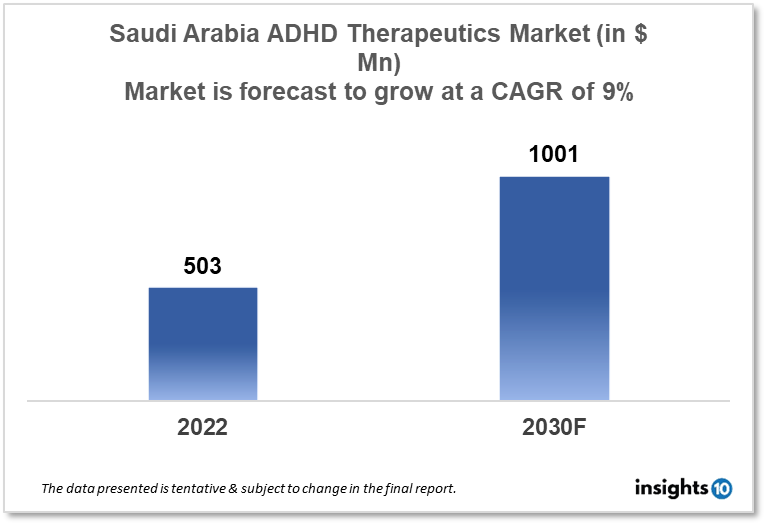

Saudi Arabia's Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market is expected to witness growth from $503 Mn in 2022 to $1,001 Mn in 2030 with a CAGR of 9% for the year 2022-2030. New product launches, approval of new medicines, and increased research and development activities in ADHD therapeutics in Saudi Arabia will drive the growth of the market during the forecast period. The Saudi Arabia ADHD therapeutics market is segmented by drug, drug type, demographics, and by distribution channel. Some of the key competitors in the market are Softec Pharma, Al-Dawa, and Eli Lily.

Buy Now

Saudi Arabia Attention Deficit Hyperactivity Disorder (ADHD) Therapeutics Market Executive Analysis

The Saudi Arabia Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market size is at around $503 Mn in 2022 and is projected to reach $1,001 Mn in 2030, exhibiting a CAGR of 9% during the forecast period. Healthcare spending in the Gulf Cooperation Council (GCC) is largely financed by Saudi Arabia, and the Saudi government continues to place a high emphasis on the industry. It will devote $36.8 Bn in 2022, or 14.4% of its budget, to healthcare and social development. The Saudi Arabian government intends to spend more than $65 Bn as part of Vision 2030 to build the nation's healthcare system. Additionally, it targets the privatization of 2,300 basic health centers and 290 hospitals, increasing private sector participation from 40% to 65%. The Saudi Ministry of Health (MOH) intends to establish "health clusters" serving about one Mn people in order to improve access to the healthcare system and to encourage preventive and integrated care.

Attention deficit hyperactivity disorder (ADHD) is a complex developmental disorder defined by primarily inattentive, disorganized, and/or hyperactive symptoms that interfere with a person's functioning. An estimated 7.2% of children worldwide are thought to have ADHD. Strong heritability suggests that ADHD can persist into maturity, with similar symptomatology and disabilities in adults. The prevalence of ADHD among students in Riyadh was 10.9%, and a history of ADHD in childhood and a medium-to-low grade-point average (GPA) were associated factors. Childhood ADHD is a disorder that is frequently identified in Saudi Arabia.

Drugs used to treat Attention Deficit Hyperactivity Disorder (ADHD) can generally be split into two categories: stimulant and non-stimulant drugs. The first-line therapy for ADHD in older children and teenagers, as well as adults with ADHD, or in Saudi Arabia, adults with ADHD who have been receiving treatment since childhood, is generally thought to be medication from the stimulant class. At the moment, Saudi Arabia only has access to Concerta, Ritalin (short-acting), and Strattera as ADHD medicines.

Market Dynamics

Market Growth Drivers

The Saudi Arabia ADHD therapeutics market is likely to be driven by international product launches, the approval of new medications, and greater research and development efforts. The ADHD market in Saudi Arabia is anticipated to grow as the government and the general public become more conscious of mental health issues. The government in Saudi Arabia has been forced to take action to address this condition due to the growing number of individuals who suffer from a variety of mental health disorders, including attention deficit hyperactivity disorder.

Market Restraints

The cost of ADHD medications can be high, which may restrict entry for those who cannot afford them. This could have a major impact on the growth of the Saudi Arabia ADHD therapeutics market. The approval of novel ADHD medications, like fenethyllene, is being seriously questioned in Saudi Arabia due to the risks of abuse and adverse effects. This sense of panic is preventing Saudi Arabia from introducing novel medications for the treatment of ADHD.

Competitive Landscape

Key Players

- MEPHCO (SAU)

- Jamjoom Pharma (SAU)

- Jazan Pharmaceutical (SAU)

- Softec Pharma (SAU)

- Al-Dawa (SAU)

- Eli Lily

- Pfizer

- Johnson & Johnson

- Lupin

- Shire

- Mallinckrodt

Healthcare Policies and Regulatory Landscape

The main Drug Regulatory Authority in Saudi Arabia is the Saudi Food and Drug Authority (SFDA). The SFDA's drug section is in charge of managing and issuing licenses for the production, distribution, import, export, promotion, and advertising of pharmaceuticals. Additionally, the SFDA is in charge of granting marketing authorizations, monitoring the quality and safety of the sold pharmaceuticals, and evaluating the safety, efficacy, and quality of medicinal goods. Before marketing to customers in Saudi Arabia, businesses must have their products approved by the SFDA. Companies apply to the authority for this regulation procedure, known as the SFDA registration, in order to go through a scientific evaluation and compliance verification. An SFDA registration certificate will be given to product files that demonstrate compliance with relevant laws, allowing the businesses to begin marketing efforts and clear shipments into Saudi Arabia. The SFDA is regarded as the MENA region's strictest regulatory body. It established its own set of laws and was the first to embrace international standards. As a result, it serves as a benchmark for nations in the GCC and MENA areas. In 2021, the SFDA completed its ongoing regulatory development and joined the International Council for Harmonization (ICH) of Technical Requirements for Pharmaceuticals for Human Use as a full regulatory partner.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Segmentation

By Drug Type (Revenue, USD Billion):

- Stimulants

- Amphetamine

- Methylphenidate

- Dextroamphetamine

- Dexmethylphenidate

- Lisdexamfetamine

- Others

- Non-Stimulants

- Atomoxetine

- Bupropion

- Guanfacine

- Clonidine

By Age Group (Revenue, USD Billion):

- Pediatric And Adolescent

- Adult

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Speciality Clinics

- Retail Pharmacies

- e-Commerce

By Psychotherapy (Revenue, USD Billion):

- Behaviour Therapy

- Cognitive Behavioral Therapy

- Interpersonal Psychotherapy

- Family Therapy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.