Saudi Arabia Addiction Therapeutics Market Analysis

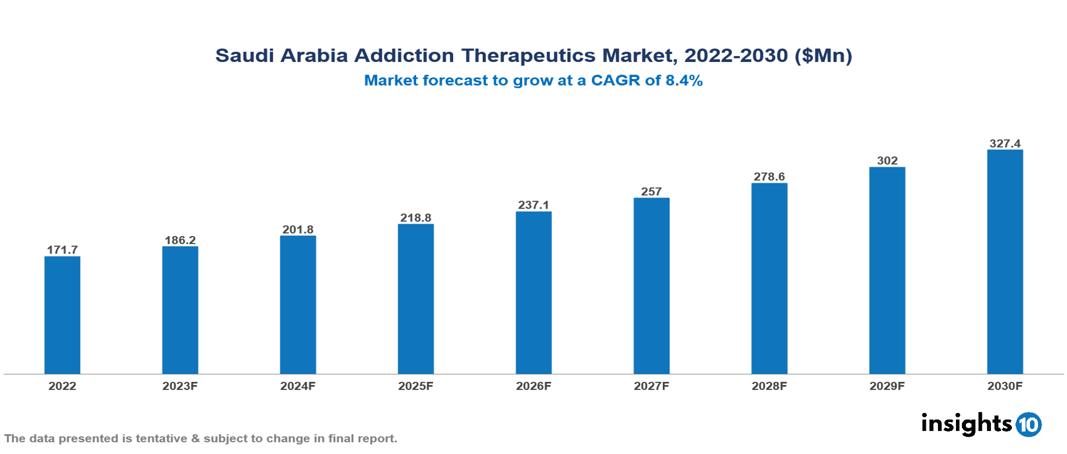

Saudi Arabia addiction therapeutics market was valued at $172 Mn in 2022 and is estimated to reach $327 Mn in 2030, exhibiting a CAGR of 8.4% during the forecast period. The market is growing as the government is committed to addressing substance abuse problems by increasing mental health awareness and accessibility and improving access to addiction treatment facilities. The key players in addiction therapeutics market are Eradah (Al Amal) Mental Health Complex, Taif Mental Health Hospital, KAAUH developmental Hospital, Pfizer, Novartis, GSK, Johns Hopkins Aramco Healthcare Dhahran, Dr. Sulaiman Al-Habib Medical Group, AbbVie and Saudi German Hospitals Group

Buy Now

Saudi Arabia Addiction Therapeutics Market Executive Summary

Saudi Arabia addiction therapeutics market was valued at $172 Mn in 2022 and is estimated to reach $327 Mn in 2030, exhibiting a CAGR of 8.4% during the forecast period.

Addiction treatment is a broad field that includes a variety of treatments for people struggling with substance use disorders or behavioural addictions. It aims to address the root causes and consequences of addiction, help people achieve lasting recovery, and improve their overall well-being. Medications and supportive care alleviate the physical and psychological discomfort associated with withdrawal from addictive substances. Addiction is treated in a variety of ways, including motivational interviewing and cognitive-behavioural therapy. In situations such as opioid use disorder, medications help to prevent relapse, manage withdrawal symptoms, and reduce cravings.

7–8% of Saudis have been using drugs; 70% of all people who use drugs are 12–22 years old. The most frequently used abuse substances among Saudis are Amphetamines, Heroin, Alcohol, and Cannabis. A majority of the population is addicted to the use of multiple substances. Over the past decade, the use of cannabis and amphetamines has increased, while the use of heroin and volatile substances has decreased.

The prevalence of hepatitis C (HCV), hepatitis B (HBV), and HIV among around 10,000 Saudis who inject drugs was 7.7%, 3.5%, and 77.8%, respectively. As substance use is stigmatized and disclosure is associated with fear, the estimate of substance use disorders may be underestimated. Major cities have seen the establishment of additional clinics, and a substantial budget of $1 Bn annually has been set aside for the treatment and rehabilitation of drug users.

Leading Saudi Arabian research institutes, such as King Abdullah University of Science and Technology (KAUST) and Umm Al-Qura University, are actively engaged in groundbreaking investigations that aim to investigate novel techniques for the treatment of addiction. KAUST is a leader in the field of research on the possible therapeutic uses of psilocybin, the hallucinogenic ingredient in "magic mushrooms," with a particular emphasis on how well it works to treat methamphetamine and other substance addictions. Also, Umm Al-Qura University is carrying out clinical trials to assess the efficacy of treating alcohol dependence in patients by combining behavioural therapy with the opioid antagonist naltrexone.

Market Dynamics

Market Growth Drivers

Increasing Mental Health Awareness and Accessibility: There has been a significant increase in mental health awareness among the population. This increased awareness has led to greater acceptance of mental health issues and more individuals seeking help and services. Additionally, increased access to mental health services, including addiction treatment, is also contributing to increased demand for addiction treatment services.

Changing Societal Attitudes: People are more likely to seek treatment when stigma is lessened and addiction is seen as a medical issue that can be treated rather than a moral failing. Addiction treatment drug demand is rising as a result of this shift in perception.

Market Restraints

Stigma and Cultural Attitudes: Cultural understanding of addiction and social stigma surrounding mental health issues and addictions can dissuade people from seeking treatment for substance abuse disorders. There is a reluctance and humiliation in acknowledging and addressing mental health and substance use disorders, which results in under-reporting and a reduced willingness to seek help.

Regulatory and Policy Challenges: There are complicated regulatory frameworks, bureaucratic hurdles, and inconsistent policies can impede the progress and expansion of addiction therapeutic services. It can be challenging for organizations and addiction therapeutic providers to comply with numerous regulations and processes. This could hinder with the development and growth of the addiction therapeutic market.

Workforce Shortages and Training: There may be a lack of mental health professionals, such as psychiatrists, psychologists, therapists, and addiction counsellors, which may restraint the opportunity and access to addiction treatment. Also, it could be challenging to ensure that the workforce is appropriately skilled in the evidence-based practices for addiction therapeutics. These factors could influence the market for addiction therapeutics in its growth and development.

Healthcare Policies and Regulatory Landscape

National Mental Health Strategy (2020-2024): Saudi Arabia launched the National Mental Health Policy in 2006, which consists of counselling and communication services in general medical facilities, as well as specialist programs for drug and alcohol dependent patients, children, adolescents and the elderly. This program was designed to cover the requirements of all age groups.

Ministry of Health: MoH acts as the primary governing body which is responsible for health policy, regulations and the country's overall health system. It oversees and inspects different forms of policy implementation for addiction treatment services, substance abuse disorders and mental health services.

Saudi Food and Drug Authority: Main objective of SFDA is to establish safety, quality and effectiveness of medicines and to grant marketing authorization for medicines. They carry out quality control of OTC drugs to ensure safety and give drug information from reliable sources to public and health care providers who need it. It monitors the registration, licensing, import, and distribution of pharmaceutical products, including medications used in addiction treatment. To enter the addiction treatment market in Saudi Arabia you need approval and license from SFDA.

Competitive Landscape

Key Players

- Eradah (Al Amal) Mental Health Complex

- Taif Mental Health Hospital

- KAAUH developmental Hospital

- Pfizer

- Novartis

- GSK

- Johns Hopkins Aramco Healthcare Dhahran

- Dr. Sulaiman Al-Habib Medical Group

- AbbVie

- Saudi German Hospitals Group

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Saudi Arabia Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.