Romania Neurology Clinical Trials Market Analysis

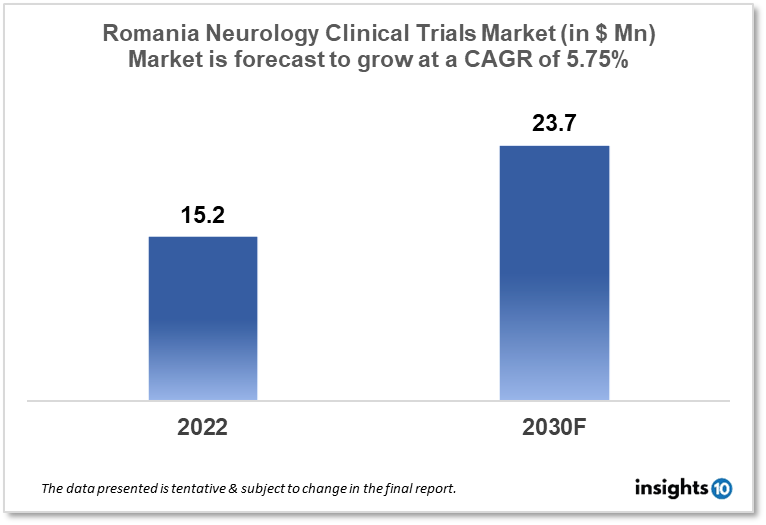

The Romania Neurology Clinical Trials market is projected to grow from $15.2 Mn in 2022 to $23.7 Mn by 2030, registering a CAGR of 5.75% during the forecast period of 2022 - 2030. The market will be driven by collaborations with international research institutions and improved funding for clinical research. The market is segmented by phase, by study design & by indication. Some of the major players include Biogen Inc., Pfizer Inc. & Novartis AG.

Buy Now

Romania Neurology Clinical Trials Market Executive Summary

The Romania Neurology Clinical Trials market is projected to grow from $15.2 Mn in 2022 to $23.7 Mn by 2030, registering a CAGR of 5.75% during the forecast period of 2022 - 2030. Romania is the twelfth-largest nation in Europe and the seventh-most populated member state of the European Union, with a rising population of 19,4 million people. With its clinical research activities on the upswing, it now hosts over 500 clinical studies. According to clinicaltrials.gov statistics, oncology has the highest number of current clinical studies (205), followed by neurology (38), gastrointestinal (36) and cardiology (32). (35). The majority of active studies (55%) are in Phase 3. Foreign Sponsors are in charge of 91% of all active studies. According to the most recent WHO statistics, Alzheimer's and Dementia Deaths in Romania reached 2,839, or 1.22% of total deaths, in 2020, while Epilepsy Deaths reached 314, or 0.13% of total deaths.

In Romania, various neurology clinical trials are now underway, covering a wide variety of disorders and therapies. There are trials looking into the use of novel medications to treat multiple sclerosis, Parkinson's disease, and Alzheimer's disease, as well as research looking into new surgical procedures to treat epilepsy and other neurological illnesses. In Romania, there are several high-quality investigational sites, as well as numerous teaching hospitals and university clinics. In Romania, there are 17 medical institutions and 39 university clinics with diagnostic capacities equivalent to the highest international standards. In terms of Romania's innovation hubs, the city of Iasi, which is also the city with the most universities, is highly prominent. The Clinical Trials Information System was recently deployed in Romania (CTIS). The Clinical Trials Information System (CTIS) facilitates the exchange of data among clinical trial sponsors, European Union (EU) Member States, European Economic Area (EEA) nations, and the European Commission. CTIS launched a searchable public website on January 31, 2022. It sets a 60-day timeframe for a response following filing.

Market Dynamics

Market Growth Drivers

Beginning in 2022, the Ministry of Research, Innovation, and Digitization, in collaboration with the POLITEHNICA University of Bucharest, began organising annual "Romania of the Future" forums, that included exhibitions of research and innovation outcomes, as well as committee sessions and conversations on research and entrepreneurship.

Romania has a big patient population, which makes recruiting subjects for clinical trials simpler. Romania has cheaper labour and operational expenses than other European nations, which translates into reduced clinical trial expenditures. Romania has a highly competent medical workforce, with many physicians and nurses who have conducted clinical studies in the past. The Romanian regulatory framework is efficient and supportive of clinical trials, with shortened approvals and study completion procedures. Romania has a well-developed healthcare system, with modern medical facilities and easy access to medical supplies and equipment.

Market Restraints

When it comes to the expansion of neurology clinical trials, Romania encounters a number of problems and constraints. One significant impediment is a lack of funds and resources for clinical research. Several hospitals and research organisations in Romania have low financial resources, making large-scale clinical trials challenging. This may also lead to a scarcity of skilled employees and insufficient infrastructure, impeding the expansion of clinical trials. Another challenge is the small number of patients available for clinical studies. Romania has a population of around 19 million people, which is tiny in comparison to other nations. Moreover, people suffering from neurological illnesses may be unwilling to take part in clinical trials owing to doubts regarding the safety and effectiveness of experimental therapies. Regulatory and regulatory hurdles might potentially impede the progress of neurology clinical trials in Romania. The procedure of gaining regulatory clearance for clinical trials may be time-consuming and difficult, delaying or discouraging researchers from carrying out studies in the nation.

Competitive Landscape

Key Players

- Biogen Inc.

- Pfizer Inc.

- Novartis AG

- Sanofi S.A.

- Merck & Co., Inc.

- Roche Holding AG

- Eli Lilly and Company

- GlaxoSmithKline PLC

Notable Deals

January 2020, Pfizer's investigational medication PF-05251749 for neurological diseases has been acquired by Biogen.

Healthcare Policies and Regulatory Landscape

In Romania, clinical trials in neurology are governed by the National Agency for Medicines and Medical Devices (ANMDM), which is in charge of ensuring that all clinical studies adhere to international norms and laws. The ANMDM controls clinical trial approval, analyses the progress of current studies, and guarantees that all trial information is reliable and trustworthy.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Neurology Clinical Trials Market Segmentation

By Phase (Revenue, USD Billion):

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design Outlook (Revenue, USD Billion):

- Epilepsy

- Parkinson's Disease (PD)

- Huntington's Disease

- Stroke

- Traumatic Brain Injury (TBI)

- Amyotrophic Lateral Sclerosis (ALS)

- Muscle regeneration

- Others

By Indication Outlook (Revenue, USD Billion):

- Interventional

- Observational

- Expanded Access

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.