Romania Depression Therapeutics Market Analysis

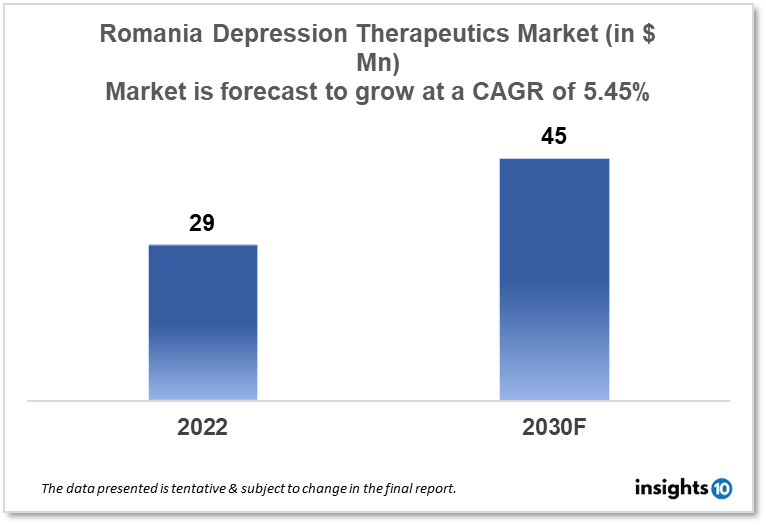

Romania's depression therapeutics market is expected to grow from $29 Mn in 2022 to $45 Mn in 2030 with a CAGR of 5.45% for the forecasted year 2022-30. The introduction of new and ground-breaking medicines for the treatment of depression and increased healthcare funding in Romania has resulted in the expansion of the market. The Romania depression therapeutics market is segmented by drug type, therapies, indication, and end users. Oftafarma, Zentiva, and Bristol-Myers Squibb are the major players in the Romania depression therapeutics market.

Buy Now

Romania Depression Therapeutics Market Executive Analysis

Romania's depression therapeutics market is expected to grow from $29 Mn in 2022 to $45 Mn in 2030 with a CAGR of 5.45% for the forecasted year 2022-30. The government of Romania announced on Thursday that it is putting forth a draft budget for 2023 based on estimates of a deficit of roughly 4.4% of gross domestic product (GDP) and a 2.8% increase in the economy. After Poland, Romania had the second-largest pharmaceutical market in terms of revenue in 2021 with $4.36 Bn. Pharmaceutical distribution has continued to be the most valuable business segment over the past ten years, followed by pharmacies and production. Pharmaceutical distribution accounted for 68% of the pharmaceutical industry's total income in Romania, which is estimated to have reached $15 Bn in 2022.

According to estimates, 1018 new instances of depression are reported annually per 100,000 people in Romania, making up about 1% of the population. There were 166,594 individuals registered with different types of mental disorders in 2003, including 28,895 children. 8.6% of them were institutionalized.

There are presently significant limitations to the therapeutic management of depression, and this low efficacy is reflected in the high rates of non-response even after numerous antidepressant trials in Romania. Nearly two-thirds of patients with severe depression who tried an antidepressant for 4-6 weeks did not experience remission, and more than 30% of these patients are thought to be treatment-resistant. Although significant resources have been devoted to the study of neurobiologically oriented Major Depressive Disorder (MDD) treatments, the FDA has only authorized a small number of products that do not fit the monoamine hypothesis' conceptual framework. Brexanolone for postpartum depression and ketamine for MDD that is resistant to therapy are two exceptions to this rule. However, a variety of pathogenetic pathways have been researched, from glutamatergic, opioidergic, or sestrin modulators to abnormalities in orexinergic or -aminobutyric acid (GABA) neurotransmission. New triple monoaminergic inhibitors and new atypical antipsychotics are two examples of the new generation of monoaminergic agents that have been investigated. In an effort to find novel ways to reduce lingering symptoms or increase the likelihood that treatment-resistant MDD patients will respond or experience remission, old medications have been repurposed as antidepressants or adjuvants to current antidepressant therapy.

Market Dynamics

Market Growth Drivers

One of the major trends in psychopharmacology and depression has been an exponential rise in the number of medications accessible in Romania for the treatment of mental disorders. Anti-depressant drugs take the lead in this diverse environment because depression continues to be one of the most serious public health issues in Romania, with a lifetime incidence of 20–35% and significant costs to both the person and the community. With an emphasis on enhancing access to healthcare services, Romania has recently increased its healthcare spending. As a result of increased treatment options and better access to care, the Romania depression therapeutics market is expanding.

Market Restraints

Despite the real benefits, side effects like vertigo and activation are possible with all serotonin selective reuptake inhibitors (SSRIs). On the other hand, these effects tend to stabilize over time. (sedation, sexual side effects). Additionally, some patients are dubious about the real impact of SSRIs due to their ambivalent effects, at least in terms of mood parameters [e.g., sedation (paroxetine, fluvoxamine) vs. activation (fluoxetine, sertraline)] thus limiting the growth of the Romania depression therapeutics market. Despite the advancements made by the pharmaceutical industry in recent decades, there is presently no antidepressant that can be regarded as being tailored to the majority of patients who need antidepressant medication. While some patients may become non-compliant, for others, the benefits may outweigh the dangers (which could expose them to drug abuse, with consequences like tolerance and psychological addiction). These problems could severely hamper the development of the Romania depression therapeutics market.

Competitive Landscape

Key Players

- Biotehnos (ROU)

- Rontis (ROU)

- Fiterman Pharma (ROU)

- Oftafarma (ROU)

- Zentiva (ROU)

- Bristol-Myers Squibb

- GSK

- Bayer

- Lupin

- Perrigo

- Johnson & Johnson

- Sun Pharmaceutical

- Amneal Pharmaceuticals

Notable Events

March 2022- The Depression Scorecard was introduced to stakeholders by the Janssen Pharmaceutical Companies of Johnson & Johnson. It is a report that suggests a number of suggested actions to enhance the administration and care of patients with depression in Romania. Johnson & Johnson Pharmaceutical Companies sponsored and spearheaded the drafting of the document. The article builds on a 2018 European Union study by nine stakeholder groups, which identified ten areas that require urgent attention if "A Sustainable Approach to Depression: Moving from Words to Action" is to be achieved.

Healthcare Policies and Regulatory Landscape

The residents of Romania have access to a public healthcare system that offers them fundamental medical treatment. The Romanian government offers some coverage for mental health services through its public healthcare system, including compensation plans for treating depression. However, there are often extended waiting lists for appointments with mental health professionals and inadequate access to mental health services. In Romania, there are also private health insurance options, but they are less prevalent due to their expensive premiums and negligible coverage of mental health services. Counselling and psychotherapy are covered by some private brokers, though the coverage may be limited and come with high copays and deductibles.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Oftafarma, Zentiva, and Bristol-Myers Squibb are the major players in the Romania depression therapeutics market.

The Romania depression therapeutics market is expected to grow from $29 Mn in 2022 to $45 Mn in 2030 with a CAGR of 5.45% for the forecasted year 2022-2030.

The Romania depression therapeutics market is segmented by drug type, therapies, indication, and by end users.