Poland Nutritional Supplements Market Analysis

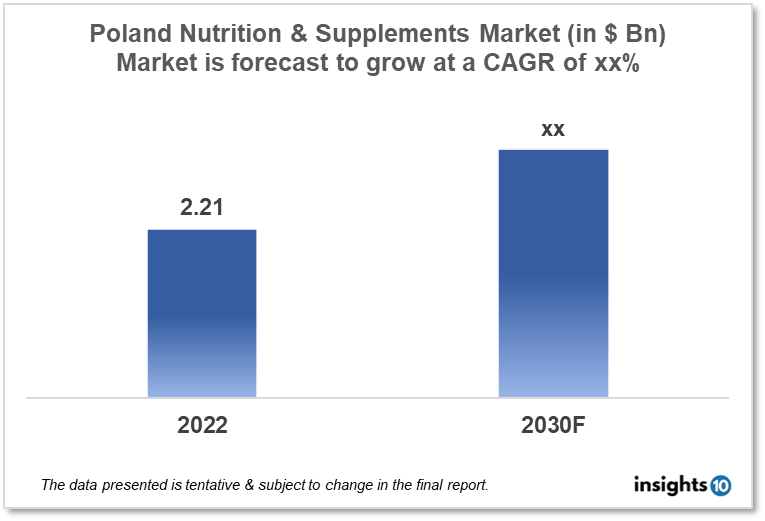

By 2030, it is anticipated that the Poland Nutrition and Supplements market will reach a value of $xx Bn from $2.21 Bn in 2022, growing at a CAGR of xx% during 2022-2030. The nutrition and supplements market in Poland is primarily dominated by local players such as Walmark, Aflofarm Farmacja Polska, and Olimp Laboratories. The market for nutrition and supplements in Poland is primarily driven by an inclination towards better health infrastructure, government regulations and increasing consumer awareness of health and lifestyle. The Poland nutrition and supplements market in Poland is segmented by Type, Product, application, and Distribution Channel.

Buy Now

Poland Nutrition and Supplements Market Analysis Summary

By 2030, it is anticipated that the Poland Nutrition and Supplements market will reach a value of $xx Bn from $2.21 Bn in 2022, growing at a CAGR of xx% during 2022-2030.

Poland's ageing population has resulted in an increase in demand for supplements that can help support healthy ageing. Calcium, vitamin D, and omega-3 supplements are popular among elderly people in Poland.

To ensure the safety and quality of products sold on the market, the Polish government regulates the nutrition and supplement industry. Improving diet, nutrition, and physical activity has also been identified as the new National Health Programme's first operational goal for 2021-25. In 2019, total health spending in Poland accounted for 6.5 % of GDP, which is significantly lower than the EU average of 9.9 %.

Market Dynamics

Market Growth Drivers Analysis

Price controls implemented in 2012 to reduce government spending on pharmaceuticals have resulted in significant price differences between prices payable in Poland and prices payable elsewhere in Europe. The sports nutrition market in Poland is also expanding, with many people turning to supplements to help them perform and recover from sports. Athletes and fitness enthusiasts are big fans of protein powders, amino acids, and creatine. People in Poland can now buy nutrition and supplement products online thanks to the growth of e-commerce. This has resulted in increased supplier competition and a broader range of products available to consumers. This has contributed to increased consumer trust in the industry. These factors have the potential to drive the Poland nutrition and supplement market.

Market Restraints

Malnutrition is one of the most pressing issues confronting Poland today. Over 23,000 children in Warsaw are malnourished. Malnutrition occurs when the body's essential nutrients are not supplied by the diet. In Poland, 1% of men, more than 3% of women, and 13% of children suffer from this type of malnutrition. In Poland, poverty is the leading cause of malnutrition and hunger. Approximately 7% of the Polish population lives in poverty. As a result, many of the poor have unhealthy diets, resulting in vitamin D, folate, vitamin C, calcium, and iodine deficiencies. Infants, adolescent girls, and women are especially vulnerable. Iron deficiency is also a problem in Poland, affecting approximately one-quarter of children and pregnant women. These factors may deter new entrants into the Poland nutrition and supplement market.

Competitive Landscape

Key Players

- Olimp Laboratories (POL)

- Aflofarm Farmacja Polska (POL)

- Walmark (POL)

- Adamed Group (POL)

- Pharma Nord (POL)

- BioTech USA (POL)

- GNC

- GlaxoSmithKline

Recent Notable Update

December 2019: In October, Jost Chemical opened a new manufacturing plant in Kosian, Poland, as the first step in its global expansion strategy. The plant will manufacture high-purity speciality mineral salts for the pharmaceutical, biopharmaceutical, nutrition, and clinical nutrition industries. In 2020, production will begin. The new plant will supplement Jost's existing production facility in St. Louis, MO, and will help the company respond to its expanding global market. The factory's opening will create more than 40 jobs over the next five years, with plans for future expansions.

Healthcare Policies and Reimbursement Scenarios

The Polish Ministry of Health, the Chief Sanitary Inspectorate, and the National Food and Nutrition Institute are in charge of nutrition and supplement regulations in Poland. Food supplements must comply with the Polish Food Safety Act, which specifies the labelling, composition, and safety requirements for food supplements. The Chief Sanitary Inspectorate regulates the sale of food supplements.

Under certain conditions, the National Health Fund (NFZ) in Poland may reimburse some nutrition and supplements. Nutrition and supplement reimbursement is governed by the Polish Ministry of Health and the NFZ. The NFZ may reimburse nutrition and supplements if they are prescribed by a doctor and used to treat a specific medical condition. The NFZ must recognise the medical condition, and the use of nutrition and supplements must be supported by scientific evidence. Some types of nutrition and supplements are reimbursed by the NFZ, including specialised formulas for infants and young children, enteral nutrition for patients with impaired digestion or absorption, and certain supplements used to treat specific medical conditions.

1. Executive Summary

1.1 Product Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Government Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel and Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Poland Nutritional Supplements Market Segmentation

The Nutritional Supplements Market is segmented as mentioned below:

By Product (Revenue, USD Billion):

- Sports Nutrition

- Sports Food

- Sports Drinks

- Sports Supplements

- Fat Burners

- Green Tea

- Fiber

- Protein

- Green Coffee

- Others (Turmeric, Ginseng, Cranberry, Garcinia Cambogia)?

- Dietary Supplements

- Vitamins

- Minerals

- Enzymes

- Amino Acids

- Conjugated Linoleic Acids

- Functional Foods

- Probiotics

- Omega-3

- Others

By Consumer Group (Revenue, USD Billion):

- Infant

- Children

- Adults

- Pregnant

- Geriatric

By Formulation (Revenue, USD Billion):

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

By Delivery Channel (Revenue, USD Billion):

- Chemists/Pharmacists

- Direct-to-Consumer Sales

- E-commerce

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The Polish Ministry of Health, the Chief Sanitary Inspectorate, and the National Food and Nutrition Institute are in charge of nutrition and supplement regulations in Poland.

Nutrition and supplement reimbursement is governed by the Polish Ministry of Health and the NFZ.

The nutrition and supplements market in Poland is primarily dominated by local players such as Walmark, Aflofarm Farmacja Polska, and Olimp Laboratories.