Poland Healthcare Insurance Market Analysis

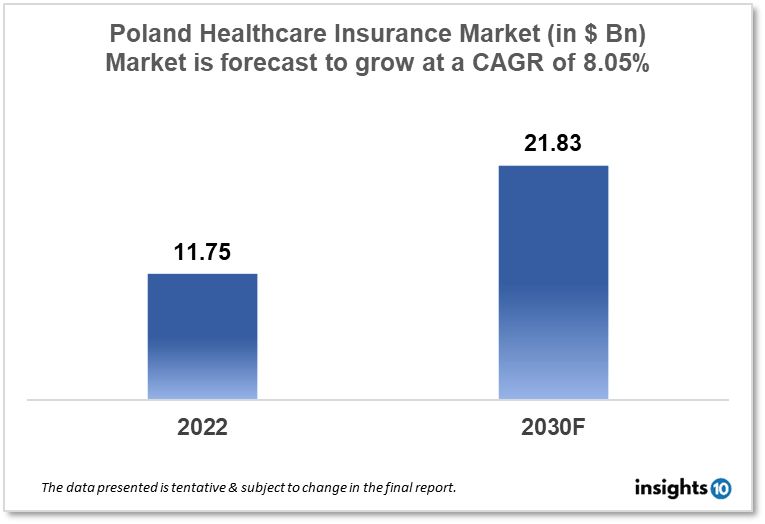

The Poland healthcare insurance market is projected to grow from $11.75 Bn in 2022 to $21.83 Bn by 2030, registering a CAGR of 8.05% during the forecast period of 2022 - 2030. The main factors driving the growth would be the digital health marketplace, rising healthcare costs, government policies and Technological advancements. The market is segmented by component, provider, coverage, by health insurance plans and end-user. Some of the major players include Luxmed, PZU Zdrowie, Inter Polska, Medicover and Allianz.

Buy Now

Poland Healthcare Insurance Market Executive Summary

The Poland healthcare insurance market is projected to grow from $11.75 Bn in 2022 to $21.83 Bn by 2030, registering a CAGR of 8.05% during the forecast period of 2022 - 2030. In 2019, Poland spent 6.45% of its national GDP, or $1,014 per person, on health care. Throughout the past ten years, Poland has regularly spent less on health than the average EU nation, both in terms of per-capita spending and as a proportion of GDP.

In 2021, the Polish insurance market generated $8.57 Bn in premiums for life insurance and $10.93 Bn for non-life insurance. The public health insurance system in Poland is funded by general taxes and offers free and subsidised services like primary care, hospital treatment and emergency services. Furthermore, the Polish government offers free medical care to the elderly, kids, expectant mothers, and individuals with disabilities. Holders of the European Health Insurance Card (EHIC) or other reciprocal health insurance programmes between the nations reimburse the cost of healthcare in Poland. Other foreign nationals residing in Poland are expected to purchase private health insurance or pay for their own medical costs. Private health insurance is quite well-liked in Poland, even among Polish citizens, as it is a typical employee benefit. One of the main factors influencing the decision of many Poles to obtain insurance from private health insurance firms in Poland is the extended wait times for receiving public healthcare.

Market Dynamics

Market Growth Drivers

The Poland healthcare Insurance market is expected to be driven by factors such as:

- Digital health marketplace- Although it is still in its early stages in Poland, insurance is becoming increasingly digital. The development of a digital health marketplace could result in enormous growth for the health and life insurance sectors. Health and life insurers would have the chance to benefit from the developing market by broadening their present product offerings, expanding the number of their policyholders, enhancing their customer support, and mitigating the consequences of low-interest rates. Due to its capacity to better focus interventions and cut down on the amount of pointless physical visits, this insurance digitisation could play a significant role in increasing the financial sustainability of healthcare systems

- Rising healthcare costs- As healthcare expenses are increasing in Poland, more people are required to have health insurance in order to afford medical care. Also, this will lead to the expansion of the market for health insurance

- Government policies- The Polish government is attempting to strengthen the healthcare system and increase access to medical treatment. This involves promoting the purchase of health insurance. This will contribute to the market for health insurance expanding

- Technological advancements- The demand for healthcare insurance is being driven by technological advancements in healthcare. Due to the high cost of new medical technologies and treatments, consumers must have healthcare insurance in order to afford them

Market Restraints

The following factors are expected to limit the growth of the healthcare insurance market in Poland:

- Uneven distribution of healthcare resources- Patients in rural areas have less access to healthcare than urban patients, despite the fact that access to healthcare is generally good. Notwithstanding the oversupply in the hospital sector, the geographical location of hospitals, which is more influenced by historical considerations than by the demands of the current population, may also restrict access to them. Since hospitals house, the majority of medical equipment, access to diagnostics is also disjointed. This restricts the market growth

- Limited coverage- Many healthcare insurance policies in Poland offer limited coverage, which is not enough to meet the needs of the public. Moreover, most digital insurers and intermediary platforms tend to focus on the age group under 55 years. The population aged over 60 years in Poland is not considered within the zone of interest for insurance companies because such people generate significant costs from a portfolio-wide perspective which is to hamper growth

- Low affordability- Despite rising incomes, many Polish still find it difficult to spend on health insurance costs. As a result, it is challenging for insurance companies to sell policies, and this restricts the healthcare insurance market growth in the country

Competitive Landscape

Key Players

- Luxmed (POL)- The LUX MED Group, a member of the global Bupa Group, which functions as an insurer and a provider of medical services globally, is the market leader in private health services in Poland. For more than 2,500,000 patients, they offer comprehensive treatment, including outpatient, diagnostic, rehabilitative, hospital, and long-term care

- PZU Zdrowie (POL)- One of Poland's TOP 3 private healthcare providers is PZU Zdrowie. For both individual and business clients, it provides healthcare services through insurance, subscriptions, and fee-for-service models

- Inter Polska (POL)- It is a Polish-based business. Inter Polska provides complete medical plan solutions for family members and employees, ensuring easy access to healthcare

- Medicover- In Poland, Medicover specialises in providing diagnostic and medical services. It has lately entered India and is primarily targeting markets in Central and Eastern Europe. The business is divided into the Diagnostic Services and Healthcare Services divisions

- Allianz- One of the top global providers of integrated financial services is the Allianz Group. Almost every continent, including Poland, is where Allianz conducts business as an international insurer

Healthcare Policies and Regulatory Landscape

Social health insurance (SHI) is the foundation of Poland's healthcare system. It is mainly centralised, with purchasing being handled by the National Health Fund and governance being overseen by the National Health Fund (NFZ).

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Insurance Market Segmentation

By Provider (Revenue, USD Billion):

It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

- Public

- Private

By Coverage Type (Revenue, USD Billion):

In terms of sales and market share, it is anticipated to rule the market over the projection period. This is explained by a number of benefits provided by life insurance, including guaranteed death payout and permanent coverage. Additionally, investing in these kinds of plans enables working professionals to save taxes

- Life Insurance

- Term Insurance

By Health Insurance Plans (Revenue, USD Billion):

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

By Demographics (Revenue, USD Billion):

- Minors

- Adults

- Seniors

There is a high prevalence of lifestyle disease in the adult population that can increase health risks in the future. The population is more prone to cardiac and other diseases that require hospitalization. Healthcare insurance plans for seniors are more of a necessity, especially in the case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

By End-user (Revenue, USD Billion):

- Individuals

- ?Corporates

A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.