Poland Depression Therapeutics Market Analysis

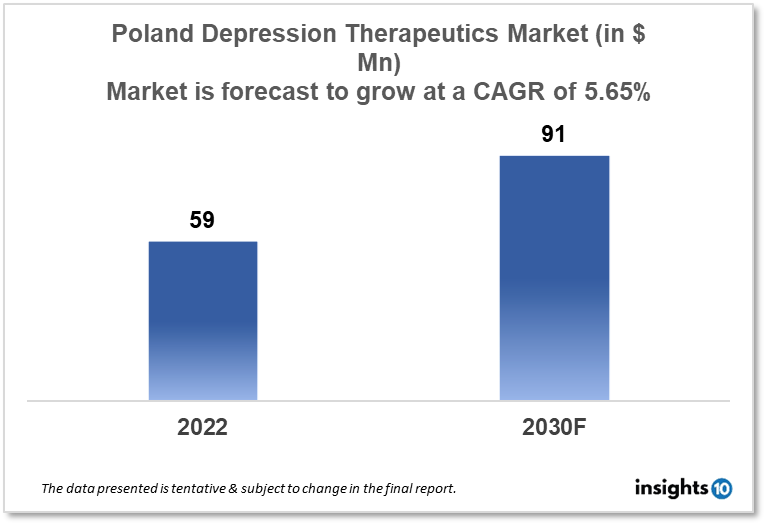

Poland's depression therapeutics market is expected to grow from $59 Mn in 2022 to $91 Mn in 2030 with a CAGR of 5.65% for the forecasted year 2022-30. The increase in healthcare spending in Poland along with the rising prevalence of depression are the major drivers for the growth of the market. The Poland depression therapeutics market is segmented by drug type, therapies, indication, and end users. Alfasigma, NEUCA, and Johnson & Johnson are the major players in the Poland depression therapeutics market.

Buy Now

Poland Depression Therapeutics Market Executive Analysis

Poland's depression therapeutics market is expected to grow from $59 Mn in 2022 to $91 Mn in 2030 with a CAGR of 5.65% for the forecasted year 2022-30. Poland has one of the lowest present health expenditures in the European Union (EU). An outline of financial law for 2023 has been approved by the Council of Ministers. It projects that Poland's national budget will earn an additional $141 Bn throughout the following year. That is an increase of approximately 100% from the 2015 figures. The budget for 2023 anticipates a rise in healthcare spending to nearly 6 % of GDP. Approximately $18 Bn was spent on health protection in 2015. According to our projections, it will rise to almost $38 Bn in 2023.

Nearly 73% of Polish participants in the research investigation in February 2023 reported having at least one depressive symptom. The medication ketamine has been used extensively in anesthesiology for many years. It is a type of general anesthesia used for quick surgical and diagnostic procedures that don't involve relaxing the skeletal muscles. It inhibits the neurotransmitter glutamate, which prevents synapses from transmitting excitatory information as the nervous system relaxes. Since 2014, it has also been used off-label and at smaller doses to treat depression that has not responded to conventional pharmacotherapy and psychotherapy. Ketamine is a dissociate, which means that it suppresses or decreases the messages that the brain sends to the mind.

The majority of patients with depression who also experience sorrow, anxiety, sleeplessness, loss of appetite, lack of ambition, or apathy should consider ketamine and ketamine therapy. It works well when there is drug resistance or when pharmacotherapy has not produced the intended results or the results were short-lived. When two or more antidepressant medications from various drug classes have been utilized for therapy and have lasted for a respectable period of time, the condition is said to be drug-resistant depression. Current evidence suggests that ketamine and ketamine are beneficial in preventing relapse, even if research on illness remission following therapy with these drugs is still in progress.

Market Dynamics

Market Growth Drivers

In Poland, depression affects an estimated 2 Mn people, making it a common mental health disease. The market for depression treatments is expanding as a result of new antidepressant medications and other depression treatments being developed, as well as improvements in delivery systems and diagnostic equipment. With a focus on enhancing access to healthcare services, Poland has recently increased its healthcare spending. Making therapies more accessible and expanding the availability of care, is propelling the growth of the Poland depression therapeutics market.

Market Restraints

Some individuals may find it difficult to finance treatment due to the high cost of depression treatment methods. Some anti-depression medications might have unwanted side effects that patients may find difficult to cope with. As a result, patients may be less likely to comply with treatment, which could restrict the Poland depression therapeutics market growth.

Competitive Landscape

Key Players

- Active Pharma (POL)

- Adamed Pharma (POL)

- Aflofarm Farmacja (POL)

- Alfasigma (POL)

- NEUCA (POL)

- Johnson & Johnson

- Otsuka Pharmaceutical

- Allergan

- Novartis

- Eli Lilly

- Takeda Pharmaceutical

- Abbott

- Pfizer

- GlaxoSmithKline

Healthcare Policies and Regulatory Landscape

The national health fund of Poland is called the Narodowy Fundusz Zdrowia (NFZ). It was created by an Act of the Sejm on August 27, 2004. NFZ is funded by mandatory health insurance contributions and pays for medical services and medication costs for those who are insured. Patients can view their treatment history and expenditures for the previous 10 years using a ZIP system that is used by the facility. Additionally, it handles grievances against healthcare practitioners, approves the supply of medical devices, and provides European Health Insurance Cards. Patients must be covered by the NFZ and have a current prescription from a qualified doctor in order to be eligible for coverage. Furthermore, the prescription needs to be for a depression treatment that is on the NFZ's list of covered medications. The Polish Ministry of Health regularly updates the reimbursement list, which covers a variety of depression treatments such as antidepressant drugs and psychotherapy sessions. The list details the requirements for payment, including the maximum amount that may be reimbursed for each therapy session and the maximum length of treatment.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Alfasigma, NEUCA, and Johnson & Johnson are the major players in the Poland depression therapeutics market.

The Poland depression therapeutics market is expected to grow from $59 Mn in 2022 to $91 Mn in 2030 with a CAGR of 5.65% for the forecasted year 2022-2030.

The Poland depression therapeutics market is segmented by drug type, therapies, indication, and by end users.