Poland Cardiovascular Diseases Therapeutics Market Analysis

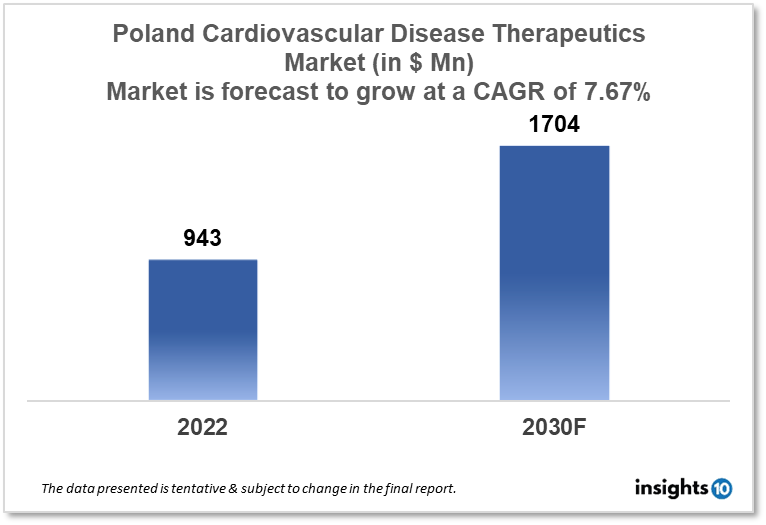

Poland's cardiovascular disease therapeutics market is projected to grow from $943 Mn in 2022 to $1,704 Mn in 2030 with a CAGR of 7.67% for the year 2022-30. The growing prevalence of cardiovascular disease and the improving healthcare infrastructure of Poland are responsible for the expansion of the market. The Poland cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and end user. Grupa Neuca, Farmina Krakow, and Pfizer are the major players in the Poland cardiovascular disease therapeutics market.

Buy Now

Poland Cardiovascular Disease Therapeutics Market Executive Analysis

Poland's cardiovascular disease therapeutics market is projected to grow from $943 Mn in 2022 to $1,704 Mn in 2030 with a CAGR of 7.67% for the year 2022-30. According to Poland's health minister, the nation is methodically moving toward allocating 7% of its GDP to healthcare. Poland has increased the plans being carried out by an additional $10 Bn. The United Right government places a high emphasis on health. The government included a table with the message outlining the rise in healthcare costs over the past few years. From $17.5 Bn in 2015 to $36 Bn in 2023, they indicate an increase in spending. The amount spent on healthcare will increase to 7% of GDP by 2027, according to a parliament amendment to the act on healthcare funded with public funds that was approved in August 2021.

Cardiovascular disease is the leading cause of death in Poland for both males and women over the age of 70. According to recent statistics, the mortality rate for men in Poland is 109% higher than the average for other EU nations, while the mortality rate for women is 87% higher. Additionally, Poland's typical life expectancy is 3–7 years lower than that of the other 15 European Union nations.

It has been conclusively shown that high levels of low-density lipoproteins in the blood contribute to atherosclerotic coronary disease (ASCVD). For every mmol (1 mg/dL) drop in low-density lipoprotein levels, statin therapy lowers the risk of cardiovascular events by about 25%, and long-term LDL-C reduction (over 40 years) may even be linked to a 50%–55% drop in cardiovascular mortality. Statin therapy has the highest absolute benefits in those who are most at risk, such as those who have already had an ASCVD event.

Market Dynamics

Market Growth Drivers

With a high prevalence rate, cardiovascular diseases are one of the main causes of mortality in Poland. As a result, there is a rising need for coronary disease treatments in the nation. Poland's population is ageing, with a sizable proportion of the populace being over 60. Age-related increases in the danger of cardiovascular disease have increased the demand for cardiovascular disease therapeutics. Poland has made significant investments in its healthcare infrastructure, which has increased the cost of healthcare. Patients’ increased access to more sophisticated and costly treatments, has contributed to the Poland cardiovascular disease therapeutics market expansion.

Market Restraints

Some of the more contemporary and front-line treatments for cardiovascular diseases can be very expensive, which may curb some patients' access to them. This may be a substantial roadblock to market growth. In Poland, the government has a significant amount of influence over how medical expenditures are reimbursed. Certain cardiovascular disease therapies may only be somewhat covered by insurance, which may restrict patients' access to them. Pharma companies seeking to market state-of-the-art therapies for cardiovascular diseases may find the regulatory setting in Poland to be problematic. This may reduce the supply of new goods, which may slow the expansion of the Poland cardiovascular disease therapeutics market.

Competitive Landscape

Key Players

- Aurora Polska (POL)

- BioVirtus (POL)

- Polfa (POL)

- Grupa Neuca (POL)

- Farmina Krakow (POL)

- Pfizer

- AstraZeneca

- Merck

- Sanofi

- Novartis

- Daiichi Sankyo

- Takeda Pharmaceutical

Healthcare Policies and Regulatory Landscape

The National Health Fund (NFZ), a government association in charge of supervising the nation's healthcare system, has a noteworthy amount of control over how Poland compensates for medical expenses. For entitled patients, the NFZ covers the expenditure of medical services and treatments, including those for cardiovascular conditions. Treatments for cardiovascular disease are typically covered by the NFZ, though the amount reimbursed can fluctuate based on the treatment and the patient's disorder. The Reimbursement List, which is kept up to current on a regular basis by the NFZ, is a list of treatments that are eligible for reimbursement. Cardiovascular disease treatments must be suggested by a medical professional, accomplish certain requirements, such as being acknowledged by the Polish Agency for Health Technology Assessment and Tariff System (AOTMiT), and have an established therapeutic benefit, in order to be capable of reimbursement. The NFZ offers coverage for preventative measures like screening tests and lifestyle interventions targeted at lowering the risk of cardiovascular disease in addition to compensation for treatments.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.