Philippines Financial Assistance Programs Market Analysis

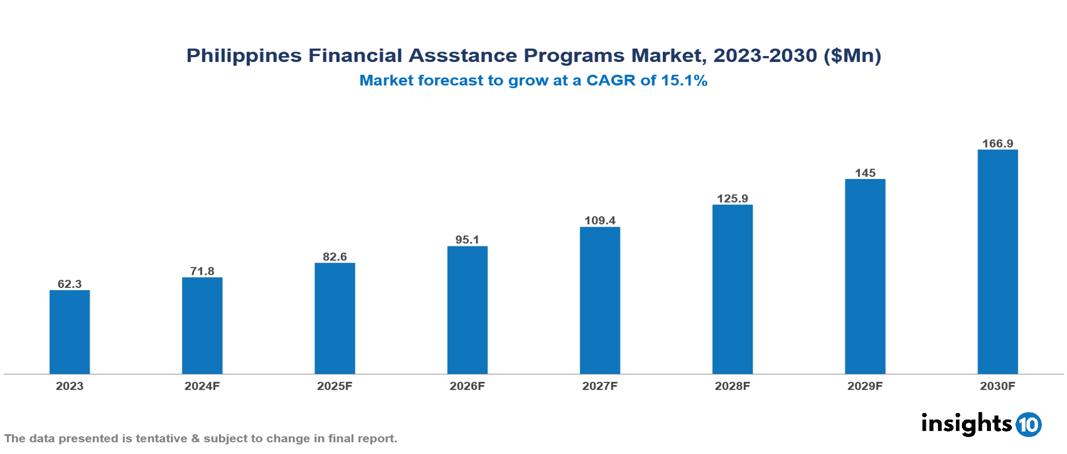

The Philippines Financial Assistance Programs Market was valued at $62.3 Mn in 2023 and is projected to grow at a CAGR of 15.1% from 2023 to 2023, to $166.9 Mn by 2030. The market is driven by various sector such as rising drug cost, complex insurance landscape, regulatory environment, market competition, patient adherence concern etc. The prominent pharmaceutical companies providing financial assistance to patient are such as Sanofi, Pfizer, GSK, among others.

Buy Now

Philippines Financial Assistance Programs Market Executive Summary

The Philippines Financial Assistance Programs Market is at around $62.3 Mn in 2023 and is projected to reach $166.9 Mn in 2030, exhibiting a CAGR of 15.1% during the forecast period 2023-2030.

The aim of drug manufacturers' patient financial support is to minimize or remove out-of-pocket cost sharing as an obstacle when patients choose medications, thereby keeping them on brand-name drugs for longer. Co-pay assistance, free drugs trails, bridge programs, sliding scale programme, Coupons, Bulk purchasing programs etc are some of the widely used financial assistance programme under patient assistance programs. Patients' out-of-pocket drug cost sharing is determined by their health plans or pharmacy benefit manager's (PBM's) formulary--a list of preferred and nonpreferred prescription drugs. Preferred status is based on a drug's effectiveness, price, and the level of rebate the payer receives from the manufacturer for giving the drug preference over its competitors. Generics and preferred brand drugs are generally assigned lower patient cost sharing than nonpreferred brand drugs. As drug prices have increased, so has patient cost sharing, causing some patients to stretch, forgo, or discontinue medication that is too expensive. Drug manufacturers often seek to mitigate these effects by providing or funding various forms of patient financial support.

There is an increasing prevalence of chronic diseases in Philippines, such as cardiovascular diseases, hypertension, diabetics, COPD, asthma and renal failure. Among all diabetics is most prevalent with prevalence rate around 7.5%. According to Internation Diabetics Federation as of 2021, In the Philippines, it was estimated that about 4.3 Mn Filipinos had been diagnosed with diabetes, and 2.8 Mn remained undiagnosed. Therefore, the market is predominately driven by factors such as rising drug cost, rising prevalence of chronic diseases, complex insurance landscape whereas sustainability concerns, limited awareness and budgetary concerns restrict the market

Pharmaceutical companies providing financial assistance to patient are such as Merck, GSK, Pfizer, Johnson & Johnson, Novartis among others.

Market Dynamics

Market Drivers

Rising cost of pharmaceutical products: The rising expense of pharmaceutical products: Specialty and innovative drugs, especially those for rare or complex conditions, are becoming more costly. This trend results in higher out-of-pocket costs for patients, including those with insurance. Consequently, more patients require financial aid to obtain their prescribed medications.

Complex insurance landscape: With the growing number of high-deductible health plans, patients often face substantial upfront costs before their insurance coverage applies. Rising co-pays and coinsurance rates increase the financial burden on patients. These insurance trends lead to a greater need for financial assistance programs.

Chronic disease prevalence: There is an increasing prevalence of chronic diseases in Philippines, such as cardiovascular diseases, hypertension, diabetics, COPD, asthma and renal failure. Among all diabetics is most prevalent with prevalence rate around 7.5%. According to Internation Diabetics Federation, In the Philippines, it was estimated that about 4.3 Mn Filipinos had been diagnosed with diabetes, and 2.8 Mn remained undiagnosed. This rise in prevalence rate of chronic diseases is driving the market of financial assistance in Indonesia.

Market Restraints

Sustainability concerns: The long-term feasibility of patient assistance programs may be in doubt, especially during economic downturns or shifting healthcare policies. Pharmaceutical companies and healthcare providers might be concerned about fostering dependence on these programs or setting unrealistic expectations. There is also worry about the impact on drug pricing, with fears that these programs could be used to justify higher medication prices.

Regulatory concerns: Financial assistance programs must navigate complex healthcare laws and regulations. Compliance with anti-kickback statutes, privacy laws, and other regulations can be difficult and might restrict the level of assistance provided. The potential risk of breaching these regulations could lead some organizations to be overly cautious in designing their programs.

Limited awareness: Many eligible patients are unaware of existing patient assistance programs, leading to missed opportunities for those who could benefit. Effective outreach and education are essential but can be expensive and challenging, especially when trying to reach vulnerable or isolated individuals.

Regulatory Landscape and Reimbursement Scenario

The regulatory body responsible for the pharmaceutical industry in the Philippines is the Food and Drug Administration (FDA). The FDA is responsible for ensuring the safety and efficacy of drugs and medical devices in the country. The FDA has implemented several regulations to facilitate the registration of new drugs, including the Abridged and Verification Review Pathways for New Drug Applications. This allows for a more efficient and streamlined process for drug registration, which can help reduce the time and cost associated with the process.

The reimbursement system in the Philippines is managed by the Department of Health (DOH) and the Philippine Health Insurance Corporation (PhilHealth). The DOH is responsible for setting the prices of medicines and medical services, while PhilHealth is responsible for providing health insurance coverage to eligible individuals. The reimbursement process involves several steps, including the submission of claims by healthcare providers and the review and approval of those claims by PhilHealth.

Competitive Landscape

Key Players

Here are some of the major key players in the Philippines Financial Assistance Programs Market:

- GSK

- Novartis

- Roche

- Pfizer

- Bayer

- Sanofi

- Merck

- Johnson & Johnson

- AbbVie

- AstraZeneca

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Philippines Financial Assistance Programs Market Segmentation

By Application

- Population Health Management

- Outpatient Health Management

- In-patient Health Management

- Others

By Therapeutics Area

- Health & Wellness

- Chronic Disease Management

- Other therapeutic area

By End Users

- Payers

- Providers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.