Philippines Brain Cancer Therapeutics Market

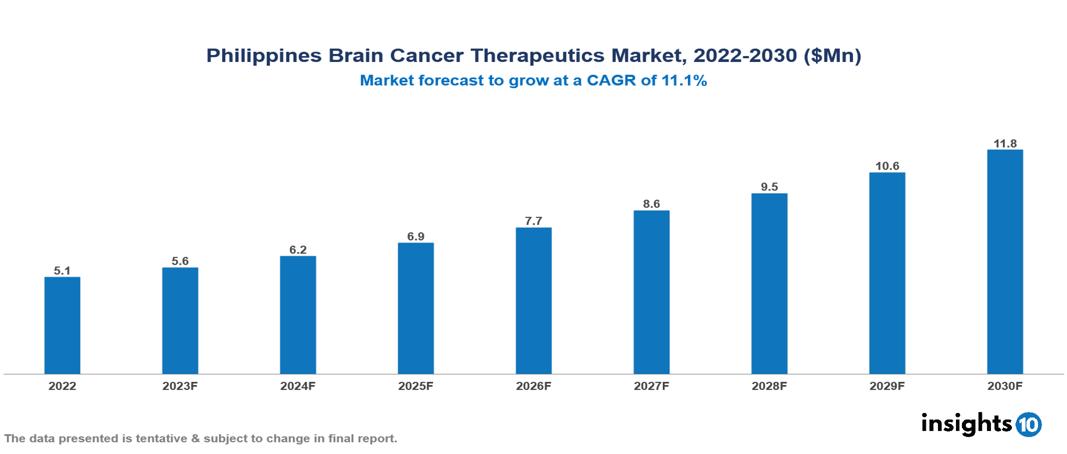

Philippines Brain Cancer Therapeutics Market valued at $5 Mn in 2022, projected to reach $12 Mn by 2030 with a 11.1% CAGR. Anticipated increases in the occurrence of brain cancer, particularly glioblastoma multiforme, are expected to substantially boost the need for treatments targeting brain cancer, thereby impacting the market's overall landscape. Currently, prominent pharmaceutical entities in the market include Merck & Co, Amgen, Roche, Pfizer, Teva Pharmaceutical, Karyopharm Therapeutics, Novartis, AstraZeneca, Bristol Myers Squibb, and Eli Lilly.

Buy Now

Philippines Brain Cancer Therapeutics Market Executive Summary

Philippines Brain Cancer Therapeutics Market valued at $5 Mn in 2022, projected to reach $12 Mn by 2030 with a 11.1% CAGR.

The abnormal growth of brain cells serves as an indicator of brain cancer, wherein these cells display characteristics that can be either malignant (cancerous) or benign (non-cancerous). Although the precise cause of brain cancer remains unclear, recognized risk factors encompass exposure to ionizing radiation and a family history of brain tumors. Common symptoms associated with a brain tumor consist of headaches, gradual sensory decline, balance issues, speech impediments, and hearing difficulties. The presentation of these symptoms varies depending on factors like the tumor’s size, location, and growth rate. Treatment strategies for brain cancer are determined by the tumor’s type, location, and size, with frequently employed methods including radiosurgery, chemotherapy, radiotherapy, surgery, and the utilization of carmustine implants.

Cancer constitutes a significant health challenge in the Philippines, ranking among the leading causes of mortality in a population exceeding 110 Mn. Brain cancer, characterized by the abnormal growth of cells in the brain, presents as either malignant (cancerous) or benign (non-cancerous). Globally, brain tumors stand as the second most prevalent malignancy among children aged 0-14 years, with an incidence ranging from 1.12 to 5.14 cases per 100,000 individuals. In the Philippines, prevalent types of brain tumors include Astrocytoma (25.8%), Medulloblastoma (23.9%), Meningioma (45.1%), and Glioblastoma multiforme (7.5%). Addressing the specific challenges posed by these tumor types is essential for effective healthcare planning and resource allocation in the Philippines.

Avastin (bevacizumab), Temodar (temozolomide), Afinitor (everolimus), and other medications are approved for the treatment of brain tumors in the Philippines. Notably, City of Hope announced a significant milestone in October 2022 when the first patient was given a revolutionary drug that may be able to stop cancer. Furthermore, preliminary findings from a prospective pivotal trial evaluating Berubicin for the management of recurrent Glioblastoma Multiforme (GBM) were released by CNS Pharmaceuticals. The creation of next-generation cancer therapy medications is aided by the advancement of businesses such as Elpis Biopharmaceuticals and Regency Pharmaceuticals, demonstrating the changing landscape of brain tumor treatments.

Market Dynamics

Market Growth Drivers

Advancements in Treatment Options: The development of innovative medicines for brain-related disorders and technological advances in the healthcare industry are improving the effectiveness of treatments, which in turn is driving market expansion. The introduction of novel and efficacious treatments frequently results in a surge in the demand for these therapies. As the market expands, it attracts further investment, fostering a cycle of innovation, demand, and growth within the healthcare industry.

Increasing Incidence Rates: An increase in brain cancer incidence fuels the need for medications used in therapy. Effective pharmacological therapies may be required if brain cancer incidence rises due to factors like population expansion, aging demographics, and lifestyle changes.

Increasing Healthcare Awareness: Growing awareness about the importance of early detection, regular screenings, and access to advanced treatments for brain cancer can drive patient demand for effective pharmaceutical solutions. Increased public awareness often leads to a proactive approach to healthcare, influencing market growth.

Market Restraints

Regulatory Hurdles: The strict regulations and approval processes could create challenges for the creation and release of new medications for treating brain cancer, which may result in delays in their availability.

Limited Efficacy of Current Treatments: The efficacy of current treatments for brain cancer may be limited, underscoring the need for revolutionary innovations to significantly improve patient outcomes. This limitation has the potential to impact the market outlook for currently accessible drugs.

High Cost of Treatment: The substantial costs associated with advanced treatments such as targeted drugs and immunotherapies pose a financial challenge for both patients and the healthcare system. Financial hardship may be exacerbated by access to these expensive treatments being hampered by complex payment processes or inadequate insurance coverage. As a result, gaps in treatment availability due to socioeconomic reasons could appear, raising ethical questions about the equitable distribution of healthcare.

Healthcare Policies and Regulatory Landscape

In the Philippines, the regulatory landscape and healthcare policies governing treatment drugs are overseen by key entities, including the Food and Drug Administration (FDA), which ensures the safety and quality of pharmaceuticals through registration and post-market monitoring. The Department of Health (DOH) is crucial in establishing standards and rules for healthcare while working with the FDA. Purchasing and choosing necessary medications is influenced by the DOH's Philippine National Drug Formulary (PNDF). Furthermore, the Health Technology Assessment Council (HTAC) assesses the efficacy and cost-effectiveness of health technology, including medications, while the Philippine Health Insurance Corporation (PhilHealth) controls coverage and payment guidelines.

Competitive Landscape

Key Players

- Merck & Co

- Amgen

- Roche

- Pfizer

- Teva Pharmaceutical

- Karyopharm Therapeutics

- Novartis

- AstraZeneca

- Bristol Myers Squibb

- Eli Lilly

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Philippines Brain Cancer Therapeutics Market Segmentation

By Type

- Gliomas

- Meningiomas

- Pituitary Adenomas

- Vestibular Schwannomas

- Neuroectodermal Tumours

By Treatment

- Chemotherapy

- Immunotherapy

- Targeted Drug Therapy

- Radiation Therapy

- Others

By End-Users

- Hospitals

- Oncology Specialty Clinics

- Oncology Treatment Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.