Philippines Alcohol Addiction Therapeutics Market Analysis

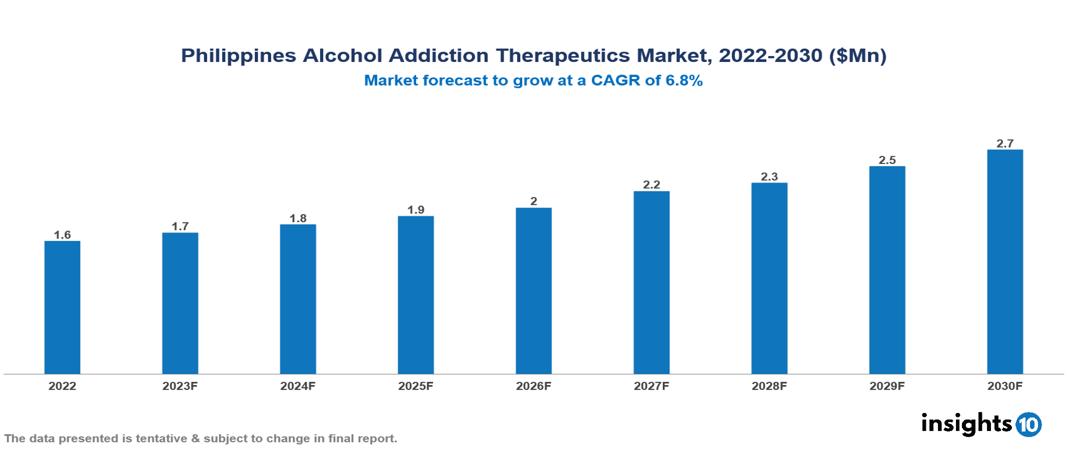

The Philippines Alcohol Addiction Therapeutics Market is valued at around $2 Mn in 2022 and is projected to reach $3 Mn by 2030, exhibiting a CAGR of 6.8% during the forecast period. The drivers of the Philippines Alcohol Addiction Therapeutics Market include urbanization-related stress, higher disposable income for healthcare, government mental health initiatives and policies, and an evolving healthcare landscape with expanded coverage and improved accessibility through telemedicine and digital health solutions. The key players involved in the research, development, and distribution of Alcohol Addiction Therapeutics in the Philippines are Lundbeck, Roche, Eli Lilly, AstraZeneca, GlaxoSmithKline (GSK), BioCorRx, Generika, Unilab, Medco, PhilPharma etc among others.

Buy Now

Philippines Alcohol Addiction Therapeutics Market Executive Summary

The Philippines Alcohol Addiction Therapeutics Market is valued at around $2 Mn in 2022 and is projected to reach $3 Mn by 2030, exhibiting a CAGR of 6.8% during the forecast period.

Alcohol addiction, also known as alcohol use disorder (AUD), is a chronic illness characterized by the inability to control or discontinue alcohol usage despite negative consequences to health, relationships, and everyday functioning. It comprises compulsive and harmful drinking behaviour, which is frequently accompanied by a physical and psychological dependence on alcohol. Persistent and severe alcohol drinking can cause liver damage, leading to illnesses such as fatty liver, alcoholic hepatitis, and cirrhosis. It can also affect the cardiovascular system, increasing the risk of hypertension and heart disease. It can be treated with behavioural therapy, counselling, membership in support organizations such as Alcoholics Anonymous (AA), and the use of drugs such as naltrexone and acamprosate to control urges. In more severe situations, detoxification and rehabilitation programs may be recommended.

40% of Filipino adults are reported to consume alcohol, with 33% engaging in excessive drinking. Additionally, almost 9% of people over the age of 15 suffer from an alcohol consumption problem. Heavy episodic drinkers include 25% of males and 8.3% of females aged 15–85+. The drivers of the Philippines Alcohol Addiction Therapeutics Market include urbanization-related stress, higher disposable income for healthcare, government mental health initiatives and policies, and an evolving healthcare landscape with expanded coverage and improved accessibility through telemedicine and digital health solutions.

International companies such as AstraZeneca, Eli Lilly, and GlaxoSmithKline (GSK) produce drugs used in the treatment of alcohol dependency in the Philippines, including acamprosate, naltrexone, and disulfiram. Local firms do not have significant market share, although they are active in the development of cost-effective, cheaper generic alternatives.

Market Dynamics

Market Drivers

Socioeconomic Factors: Rapid urbanization and changing lifestyles can lead to stress and social isolation, which increases the risk of alcohol dependency. Higher disposable income may result in more spending on healthcare, particularly addiction treatment. Employers are more aware of workplace wellness initiatives, which pushes them to provide assistance to employees who are battling with alcohol misuse.

Government Initiatives and Policies: The Philippine government's focus on improving mental healthcare and developing initiatives such as the National Mental Health Program helps to drive market growth. Addiction treatment services benefit from increased financing and resource allocation, strengthening the market. The Sin Tax Law, which raises taxes on alcohol, may indirectly enhance funding for treatment services.

Changing Healthcare Landscape: Expanding healthcare coverage via efforts such as PhilHealth makes addiction treatment more affordable. Increased investment in rehabilitation facilities and addiction treatment professionals enhances service availability and quality. The use of telemedicine and digital health solutions improves access to therapy and support, particularly in distant places.

Market Restraints

Geographic barriers: Treatment facilities are frequently concentrated in metropolitan regions, limiting access for rural communities. Individuals are discouraged from getting treatment due to the social stigma associated with addiction. There is a paucity of educated addiction specialists and counsellors, especially in rural regions. Public healthcare institutions may lack the funding and resources to provide comprehensive treatment for alcoholism.

Affordability and Financial constraints: Private rehabilitation facilities may be costly, and even public healthcare treatments may incur charges that those battling with addiction cannot pay. Insurance coverage for addiction treatment is frequently insufficient, forcing patients to face the financial burden on their own. Individuals facing poverty or economic difficulties may find it challenging to prioritize addiction treatment over other fundamental necessities.

Cultural and societal factors: Alcohol use is firmly rooted in Filipino society, making it difficult to recognize and treat addiction. The public's knowledge of addiction as a curable medical problem is frequently restricted, which contributes to stigma and prejudice. Traditional healing traditions or religious beliefs may occasionally collide with evidence-based therapeutic methods.

Healthcare Policies and Regulatory Landscape

The Philippines' healthcare policy and drug regulatory authorities play critical roles in guaranteeing the safety, effectiveness, and accessibility of pharmaceutical goods in the country. The Philippine Food and Drug Administration (FDA) regulates the pharmaceutical business, promotes its growth, and manages the supply of medicinal goods. However, the regulatory structure has faced problems and limits, including organizational and budgetary restrictions, which have influenced the regulatory authority's efficacy. The FDA is divided into three centers: the Center for Drug Regulation and Research, the Center for Food Regulation and Research, and the Center for Device Regulation, Radiation Health, and Research. These centers oversee certain areas of FDA regulation and research. These centers are responsible for specific areas of regulation and research within the FDA.

Competitive Landscape

Key Players

- Lundbeck

- Roche

- Eli Lilly

- AstraZeneca

- GlaxoSmithKline (GSK)

- BioCorRx

- Generika

- Unilab

- Medco

- PhilPharma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.