Philippines ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Analysis

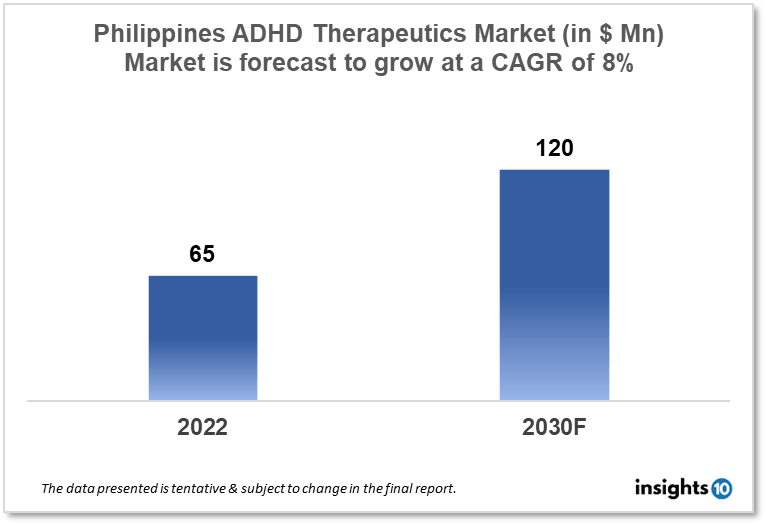

Philippines Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market is projected to witness growth from $65 Mn in 2022 to $120 Mn in 2030 with a CAGR of 8% for the year 2022-30. The increase in ADHD awareness in the Philippines as a result of various government initiatives to spearhead information about ADHD is the major growth driver of the market. The Philippines ADHD therapeutics market is segmented by drug, drug type, demographics, and by distribution channel. Farmacia Medica, Phil Pharmawealth, and Eli Lily are some of the key players in the market.

Buy Now

Philippines Attention Deficit Hyperactivity Disorder (ADHD) Therapeutics Market Executive Analysis

The Philippines Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market size is at around $65 Mn in 2022 and is projected to reach $120 Mn in 2030, exhibiting a CAGR of 8% during the forecast period. The Philippines national budget for 2023 is $96 Bn or 22.2% of GDP. The majority of this, or 66.4%, is allocated to national government organizations. (NGAs). Social Services will account for $38 Bn, or 39.2%, of the planned National Budget of which $5.63 Bn will go to healthcare services. Hospital treatments will cost $0.22 Bn. Health insurance services account for $0.24 Bn. Services for public health receive $0.093 Bn.

One of the most prevalent childhood mental illnesses, Attention Deficit Hyperactivity Disorder (ADHD) is thought to impact 3 to 5 % of Filipinos between the ages of 0 and 14 years. People who have ADHD are afflicted with a condition that is defined by inappropriately high levels of impulsivity, hyperactivity, or inability to focus. Symptoms are frequently severe enough to impair social and scholastic performance. The origin of ADHD is still a mystery. The bulk of researchers, however, propose a neurological basis. Chemicals that communicate with the brain malfunction in children with ADHD. ADHD may be accompanied by a decrease in activity in the regions of the brain that regulate attention and degree of activity. Further research has shown that ADHD is inherited, which is why it often runs in families. Male and female relatives of children with ADHD are more prone to have the condition than the general population.

Stimulants and non-stimulants are the two primary types of medications used to treat ADHD in the Philippines. Antidepressants are also utilized occasionally. The most popular form of therapy for kids and teenagers is stimulants. This kind of medication is typically the first one a doctor will attempt. Stimulants have a lengthy history of use and are thoroughly studied. They support the brain's ability to regulate behavior, focus, and impulses. Several stimulants are Amphetamine (Adzenys XR-ODT), Amphetamine/dextroamphetamine (Adderall, Adderall XR), Dexmethylphenidate (Focalin, Focalin XR), Dextroamphetamine (Dexedrine), Lisdexamfetamine (Vyvanse), Methylphenidate (Concerta, Daytrana, Metadate, Methylin, Ritalin, Quillivant XR). The testing of non-stimulants is less extensive. They function differently than stimulants, but they can aid in impulse control and focus. Atomoxetine (Strattera), Clonidine ER (Kapvay), Guanfacine ER (Intuniv), and Viloxazine (Qelbree) are some of the non-stimulants used in the treatment of ADHD in the Philippines.

Market Dynamics

Market Growth Drivers

More patients with ADHD are likely to be diagnosed and seek treatment as awareness of the disorder rises in the Philippines. This is anticipated to increase demand for ADHD treatments and drugs. The main factors influencing the growth of the Philippines ADHD therapeutics market are the measures taken by the government to raise awareness of the condition, its treatment, and funding for the drugs for a cure. (ADHD). For example, The National Council on Disability Affairs (NCDA) leads National Attention Deficit Hyperactivity Disorder (ADHD) celebration on October 16-22 – “Declaring Every Third Week of October and Every Year Thereafter as the “National Attention Deficit Hyperactivity Disorder” directing ADHD Society Philippines to spearhead the celebration in partnership with various government and non-government organizations and Persons with Disability Affairs Offices of the local government units.

Market Restraints

Despite increased awareness of the disorder, there is still a sizable quantity of stigma in the Philippines. This may limit the development of the market by making it challenging for people with ADHD to get diagnosed and receive treatment. To treat the symptoms of ADHD, some people may opt to use non-prescription options like dietary supplements. This might reduce the desire for prescribed ADHD treatments and medications, which might reduce the Philippines ADHD therapeutics market expansion.

Competitive Landscape

Key Players

- Altomed Pharmaceutical (PHL)

- Zuellig Pharma (PHL)

- Jvzea Pharmaceuticals (PHL)

- Vizcarra Pharmaceutical (PHL)

- Farmacia Medica (PHL)

- Phil Pharmawealth (PHL)

- Eli Lily

- Pfizer

- Johnson & Johnson

- Lupin

Healthcare Policies and Regulatory Landscape

The Philippines' Food and Medication Administration (FDA) oversees medication regulation. In the Philippines, the FDA is in charge of ensuring the safety, efficacy, and quality of pharmaceuticals, medical devices, and food items. The FDA is an organization that reports to the Department of Health (DOH) and is in charge of policing and observing the production, distribution, and selling of pharmaceuticals and other goods intended for human consumption. The FDA also monitors drugs and other products after they have been introduced to the market to make sure they continue to satisfy safety and efficacy requirements. The FDA is responsible for overseeing the approval of food items, cosmetics, and medical devices in addition to drugs. Manufacturers, importers, and distributors of these goods must obtain licenses from the FDA, which also carries out inspections to verify that rules are being followed.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Segmentation

By Drug Type (Revenue, USD Billion):

- Stimulants

- Amphetamine

- Methylphenidate

- Dextroamphetamine

- Dexmethylphenidate

- Lisdexamfetamine

- Others

- Non-Stimulants

- Atomoxetine

- Bupropion

- Guanfacine

- Clonidine

By Age Group (Revenue, USD Billion):

- Pediatric And Adolescent

- Adult

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Speciality Clinics

- Retail Pharmacies

- e-Commerce

By Psychotherapy (Revenue, USD Billion):

- Behavior Therapy

- Cognitive Behavioral Therapy

- Interpersonal Psychotherapy

- Family Therapy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.