Philippines Addiction Therapeutics Market Analysis

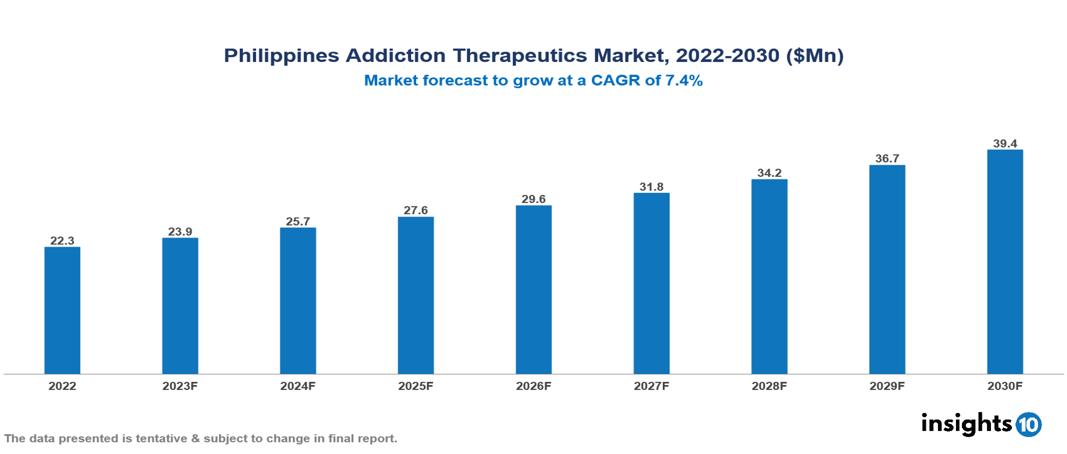

Philippines addiction therapeutics market was valued at $22 Mn in 2022 and is estimated to reach $39 Mn in 2030, exhibiting a CAGR of 7.4% during the forecast period. The market for addiction therapies has expanded significantly as a result of increased awareness of mental health issues, particularly drug addiction and misuse. The top pharmaceutical firms in the market for addiction therapeutics include United Laboratories, Pfizer, GlaxoSmithKline, AstraZeneca, Merck, Boehringer Ingelheim, Sanofi, Bayer, Abbott, Pharmaceutical and Healthcare Association of Philippines (PHAP).

Buy Now

Philippines Addiction Therapeutics Market Executive Summary

Philippines addiction therapeutics market was valued at $22 Mn in 2022 and is estimated to reach $39 Mn in 2030, exhibiting a CAGR of 7.4% during the forecast period.

Addiction therapies include a range of empirically validated pharmaceutical and psychological interventions aimed at helping individuals stop using drugs and alcohol and address the underlying causes of their addiction. It is common practice to combine medication, counselling, and behavioural treatment. Some common therapeutic techniques used in addiction treatment are dialectical behaviour therapy, family therapy, motivational interviewing, contingency management, cognitive behavioural therapy, and group therapy. Methadone and buprenorphine are two commonly used drugs prescribed as part of continuing treatment for opioid use disorder addiction. Acamprosate, disulfiram, and naltrexone are a few more drugs that are approved for the treatment of substance use disorders; however, they might not be started until after detox is over.

With its significant effects on families, communities, and the country as a whole, drug addiction is a complex and urgent issue in the Philippines. A large percentage of people in the nation take drugs, with about 39% admitting to using narcotics 2–5 times a week. A significant portion of the population in the country consumes drugs, with around 39% acknowledging regular narcotics use 2–5 times weekly. Additionally, over 25% reported monthly usage, and 21% admitted to weekly use. Many socioeconomic variables, including poverty, a lack of opportunities, and mental health issues, are linked to addiction vulnerability. Because of the potential for these situations to worsen drug addiction susceptibility, it is important to take a holistic approach to addressing the underlying causes and offering support networks to impacted individuals and communities in the Philippines.

Pharmaceuticals are actively collaborating with governments and non-governmental organizations (NGOs) in order to improve medication-assisted treatment (MAT) accessibility and expand services for addiction treatment. In order to help train healthcare professionals in MAT approaches and support pilot projects, Merck Sharp & Dohme (MSD) Philippines is collaborating with the Department of Health and the University of the Philippines Manila.

Market Dynamics

Market Growth Drivers

Increasing Awareness and Recognition: The need for addiction therapies is being driven by an increase in the number of people seeking treatment and rehabilitation services as a result of growing awareness of addiction as a medical disease that may be treated. The rapid increase in awareness and acknowledgment of substance abuse and its treatment have significantly pushed the rapid growth of the addiction therapeutics market.

Evolving Healthcare Infrastructure: First and foremost, the creation of specialty treatment facilities for drug abuse disorders greatly improves treatment accessibility for impacted persons in various locations. Furthermore, the expenditure on training medical professionals who specialize in addiction treatment, including doctors, therapists, and support personnel, improves the calibre of services rendered. In addition to increasing accessibility, this concentrated effort to upgrade the healthcare system also raises the general standard and efficacy of addiction treatment interventions, which supports the general growth and viability of the addiction therapeutics market in the Philippines.

Government Support and Policy Initiatives: The expansion of the industry is facilitated by government-led initiatives that emphasize drug prevention, treatment, and rehabilitation programs. Market expansion is facilitated by policies that aim to provide healthcare services for addiction treatment that are both accessible and affordable.

Market Restraints

Stigma and Awareness: The stigma associated with mental health and addiction in society might prevent people from seeking treatment, which could impede the market's expansion. Furthermore, the market's ability to grow may be constrained by the general lack of knowledge about various therapies and the significance of getting aid.

High Cost of Treatment: For those seeking therapy or recovery, high out-of-pocket expenses for addiction treatment may provide financial hurdles. These financial barriers might deter consumers from using these services, which would prevent the market from growing.

Regulatory Constraints: Robust regulatory protocols or lengthy approval processes for new therapies or drugs could impede the expansion of the market. The introduction of new drugs may be slowed down by intricate regulatory pathways. Because of the expenses and difficulties involved in complying with regulations, new enterprises may find it difficult to enter the market, and innovation may be hindered.

Healthcare Policies and Regulatory Landscape

The Food and Drug Administration (FDA), a division of the Department of Health (DOH), is the regulatory body in the Philippines responsible for regulating pharmaceuticals, including medications used to treat addiction. Pharmaceutical products are subject to evaluation, regulation, and supervision by the FDA about their safety, efficacy, quality, and labelling. Before any pharmaceutical product can be marketed and delivered in the Philippines, its producers and distributors must receive approval or registration from the FDA. In order to maintain public health safety, the FDA makes sure that these medications adhere to strict guidelines and criteria.

Addiction therapy regulations and healthcare policies in the Philippines are centred on the standards set out by the Dangerous Drugs Board (DDB). The processes for gaining admission to drug treatment and rehabilitation programs are outlined in these laws, namely Board Regulation No. 7 of 2019, which calls for individuals or their immediate relatives within the fourth degree of consanguinity to file a verified application to the DDB.

Competitive Landscape

Key Players

- United Laboratories

- Pfizer

- GlaxoSmithKline

- AstraZeneca

- Merck

- Boehringer Ingelheim

- Sanofi

- Bayer

- Abbott

- Pharmaceutical and Healthcare Association of Philippines (PHAP)

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Philippines Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.