Philippines Actinic Keratosis Therapeutic Market Analysis

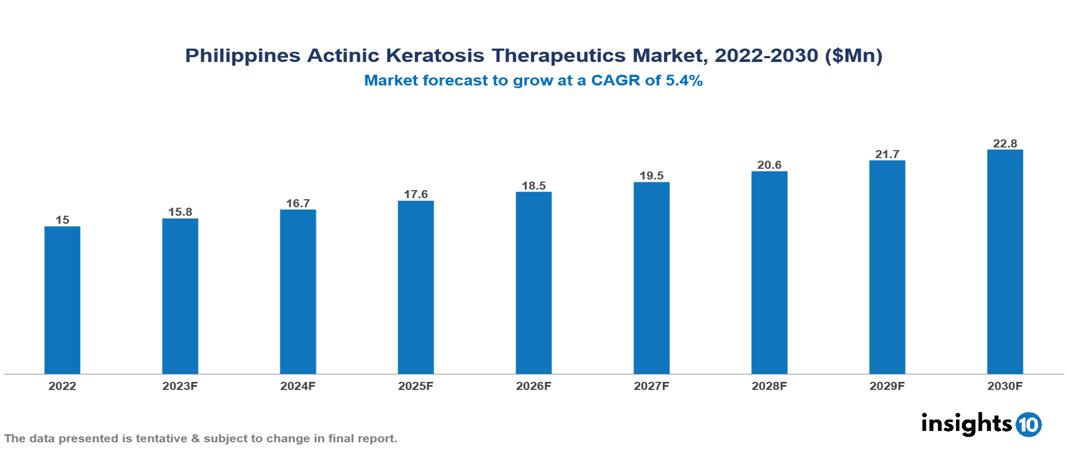

According to estimates, the Philippines Actinic Keratosis Therapeutic Market is expected to reach around $23 Mn by 2030, up from $15 Mn in 2022, growing at a compound annual growth rate of 5.4% over the forecast period. The Philippines Actinic Keratosis Therapeutic Market is set to expand with enhanced treatment options, telemedicine advancements, government initiatives in remote healthcare, and a growing prevalence due to changing lifestyles and aging population, all contributing to heightened market demand. DUSA Pharmaceuticals, Novartis, Perrigo, LEO Pharma, Bausch Health, Taro Pharmaceutical etc are the key players in the Philippines Actinic Keratosis Therapeutic Market

Buy Now

Philippines Actinic Keratosis Therapeutic Market Executive Summary

Estimates indicate that the Philippines Actinic Keratosis Therapeutic Market will reach roughly $23 Mn by 2030, up from $15 Mn in 2022, growing at a CAGR of 5.4% during the anticipated period.

Actinic keratoses (AK), also known as solar keratoses, are scaling or keratotic macules, papules, or plaques that develop as a result of atypical keratinocytes proliferating intraepidermal in response to extended UV radiation exposure. It is the most prevalent precancer that develops on skin harmed by prolonged exposure to ultraviolet (UV) radiation from the sun and/or indoor tanning. The disorder is also known as solar keratosis. Long-term exposure to ultraviolet (UV) radiation causes AK. AK can be effectively treated with a variety of approaches, such as topical medications (e.g., topical fluorouracil, imiquimod, topical tirbanibulin, diclofenac), destructive therapies (e.g., cryosurgery, surgery, dermabrasion, photodynamic therapy [PDT]), and field ablation treatments (e.g., chemical peels, laser resurfacing). Numerous factors, such as the quantity and distribution of lesions as well as the nature of the lesions, affect the choice of therapy

The prevalence of AK in the Philippines is heightened due to the tropical climate and outdoor lifestyle, exposing a large portion of the population to high UV radiation, coupled with the predominance of moderately pigmented skin types (Fitzpatrick types IV and V) and an increased likelihood of AK with age due to cumulative sun exposure. The Philippines Actinic Keratosis Therapeutic Market is set to expand with enhanced treatment options, telemedicine advancements, government initiatives in remote healthcare, and a growing prevalence due to changing lifestyles and an aging population, all contributing to heightened market demand.

Key players in the Philippine Actinic Keratosis Therapeutic Market include DUSA Pharmaceuticals, Novartis, Perrigo, LEO Pharma, Bausch Health, Taro Pharmaceutical, and others.

Market Dynamics

Market Growth Drivers

The Philippines Actinic Keratosis Therapeutic Market is intended to grow in size through factors including increasing treatment options and market offerings. Patient attraction may arise from the introduction of novel topical medicines, photodynamic treatments, and minimally invasive procedures. Access to specialists may be enhanced by developments in telemedicine and online consultation availability. Expanding the market reach might be possible with more accessible generic or reasonably priced versions of current treatments. The market is expanding due to the existence of major companies, the release of novel treatments, and advantageous reimbursement practices.

The rising prevalence of AK due to increasing sun exposure due to changing lifestyles and outdoor activities could boost AK cases. An aging population is more susceptible to AK due to cumulative sun damage. Improved awareness and diagnosis capabilities might lead to higher reported cases. This, in turn, increases market demand. Greater awareness and diagnostic proficiency may result in more instances being recorded. Consequently, there is a rise in market demand.

Market Restraints

AK treatments have a market in the Philippines, but expansion is hampered by a number of issues, including low awareness and education. There is insufficient public awareness of AK, its dangers, and available treatments, particularly in rural regions. restricted access to medical specialists who can diagnose and treat AK, such as dermatologists. With an uneven allocation of medical facilities and experts, and rural areas having restricted access to dermatologists, the demand for medicines on the market may be hampered by inadequate diagnostic instruments and equipment in some healthcare settings, which can impede correct diagnosis and prompt treatment.

The high expense of sophisticated AK therapies, such as cryotherapy and photodynamic therapy, discourages patients, especially those with low incomes or insurance coverage. Patients must foot the bill for AK therapies due to inadequate insurance coverage.

Healthcare Policies and Regulatory Landscape

The healthcare system in the Philippines is based on a hybrid public-private model that mostly relies on out-of-pocket payments while providing Universal Health Care (UHC) through PhilHealth insurance. UHC coverage is growing, but it still has problems with underfunding, accessibility issues in remote locations, and disjointed treatment routes. The main goals of recent initiatives are to enhance health information systems, support preventative health, and promote primary care. Nonetheless, problems like the uneven distribution of resources and poor pay for healthcare workers continue to exist, resulting in a complicated environment with both continuous difficulties and opportunities. The Department of Health oversees the Food and Drug Administration (FDA) of the Philippines, which serves as the primary regulating authority for therapeutics. It was originally known as the Bureau of Food and Drugs. By guaranteeing the safety, effectiveness, and efficacy of medications, medical equipment, cosmetics, and home goods, they protect the general public's health. Pre-market assessment and licensing, post-market monitoring, and rule enforcement are some of their duties. Concerns over possible budget constraints and business influence, however, underscore the necessity of maintaining the agency's capability and transparency.

Competitive Landscape

Key Players

- Sun Pharmaceuticals

- Novartis

- Bausch Health

- GlaxoSmithKline

- Almirall

- Johnson and Johnson Services

- Merck

- Carl Zeiss

- Alimera Sciences

- Annexin Pharmaceuticals

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Philippines Actinic Keratosis Market Segmentation

By Treatment Type

- Topical Treatment

- Procedural Modality

- Photodynamic Therapy

- Others

By Drug Class

- Nucleoside Metabolic Inhibitor

- Immune Response Modifiers

- NSAIDs

- Photo enhancer

- Other Drug Classes

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Providers

By Disease Type

- Clinical AK

- Subclinical AK

By End User

- Hospitals

- Private Dermatology Clinics

- Laser Therapy Centres

- Cancer Treatment Centres

- Spas and Rejuvenation Centres

- Homecare

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.