North America Cancer Pain Management Market Analysis

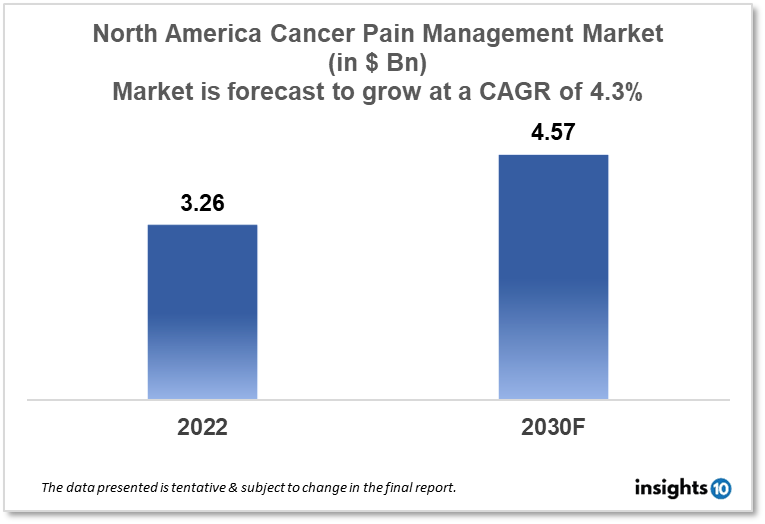

The North America Cancer Pain Management market is projected to grow from $3.26 Bn in 2022 to $4.57 Bn by 2030, registering a CAGR of 4.3% during the forecast period of 2022-2030. The main factors driving the growth would be the launch of advanced novel pain management drugs, increasing cancer incidence, and the growing need for non-invasive and minimally invasive pain management treatment. The market is segmented by drug type and by disease. Some of the major players include Collegium Pharmaceutical, Pfizer, Abbott, Sorrento Therapeutics, WEX Pharmaceuticals, and Tetra Bio-Pharma.

Buy Now

North America Cancer Pain Management Market Executive Summary

The North America Cancer Pain Management market is projected to grow from $3.26 Bn in 2022 to $4.57 Bn by 2030, registering a CAGR of 4.3% during the forecast period of 2022 - 2030. North America, which consists of the US and Canada, has one of the largest GDPs in the entire world. The GDP of North America is expected to reach $20.5 trillion in 2020, according to the World Bank. In North America, the cost of healthcare is often high even if it varies from country to country. The US spends 17.2% more on healthcare than any other country in North America as a proportion of GDP, according to the WHO. In Canada and Mexico, respectively, healthcare spending as a proportion of GDP was 10.3% and 6.2%.

Cancer-related treatments including chemotherapy and surgery as well as the disease itself may contribute to cancer discomfort. The form, location, and degree of pain experienced have an impact on the medications chosen and how they are used. Numerous different drugs are used to treat cancer pain. For instance, potent opioids are used to treat severe pain, whereas non-opioid medications like acetaminophen and NSAIDs are favored to treat mild to moderate cancer pain. The US is the largest market in North America for cancer pain management, accounting for a significant portion of the global market for cancer pain management.

Market Dynamics

Market Growth Drivers

The North America cancer pain management market is expected to be driven by factors such as the launch of advanced novel pain management drugs, increasing cancer incidence, and the growing need for non-invasive and minimally invasive pain management treatment. Moreover, the North American government has been funding programs like the National Cancer Institute's Pain Management Steering Committee that attempt to improve cancer patients' access to pain management therapies.

Market Restraints

Some pain relievers include side effects such as nausea, dizziness, urinary incontinence, sleep issues, and constipation, which can limit their use and have an impact on the growth of the cancer pain relief market. Furthermore, it is anticipated that rigorous laws and restrictions will limit market expansion. For instance, in order to deal with the opioid epidemic, Canadian regulators have imposed strict restrictions on the prescription of prescription opioids, which may limit the availability of these drugs for some cancer patients. In the US, FDA also maintains strict guidelines for new drug approval, which may cause delays in the development of new cancer pain management therapies.

Competitive Landscape

Key Players

- Collegium Pharmaceutical

- Pfizer

- Abbott

- Sorrento Therapeutics

- WEX Pharmaceuticals

- Tetra Bio-Pharma

Notable Recent Deals

March 2022: Collegium Pharmaceutical acquired BioDelivery Sciences International (BDSI) to establish a premier, diverse specialty pharmaceutical company committed to improving the lives of patients with serious medical problems. It was planned for the acquisition to be a cash tender offer to buy all of the outstanding shares of BDSI for $5.60 each.

July 2020: The acquisition of Lumiera Health Innovation has been announced jointly by Tetra and Mondias. Tetra and Mondias jointly announced the acquisition of Lumiera Health Innovation. With this acquisition, Tetra is able to focus on what it does best: developing novel, medically effective cannabinoid-based medicines for ophthalmic diseases, chronic pain (both cancer-related and not-related to cancer), and advanced cancer pain.

Healthcare Policies and Regulatory Landscape

The United States and Canada's laws and policies play a major role in determining the regulatory environment for the North American cancer pain treatment market. The U.S. Food and Drug Administration (FDA), which is in charge of approving medications for the treatment of cancer pain and supervising their usage and distribution, is the main regulatory organization in the country. The FDA also establishes requirements for the efficacy and safety of certain medications. Health Canada, which has a comparable function to the FDA in the approval, monitoring, and regulation of medications used for cancer pain treatment, has an impact on the regulatory environment in Canada. A number of specialized associations and organizations exist in both nations, including the American Pain Society and the Canadian Pain Society, which help to shape the regulatory environment by offering recommendations on the best ways to treat cancer pain. Additionally, the policies and regulations governing healthcare funding and payment, the accessibility of alternative treatments, and the cost-effectiveness of various medications all have an impact on the reimbursement picture for cancer pain management in North America.

Reimbursement Scenario

Different countries and regions have different reimbursement policies for the North American cancer pain management market. The cost of cancer pain management treatments, such as prescription medications, medical equipment, and palliative care services, is covered by Medicare and Medicaid in the United States. These therapies are also covered by private insurance policies; however, the level of coverage varies by plan and policy. Canada's publicly financed healthcare system pays for the cost of cancer pain management therapies; however, the extent of coverage varies by province and by individual insurance plans. Furthermore, a lot of patients choose to pay out-of-pocket for complementary or alternative therapies like acupuncture or massage therapy.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cancer Pain Management Market Segmentation

By Drug Type (Revenue, USD Billion):

Non-steroidal anti-inflammatory medicines relieve pain at the site of injury by blocking the cyclooxygenase enzyme, which prevents prostaglandin formation. NSAIDs are a class of medications that includes medications with analgesic, antipyretic, and, at higher doses, anti-inflammatory properties.

- Opioids

- Morphine

- Fentanyl

- Others

- Non-Opioids

- Acetaminophen

- Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)

- Nerve Blockers

By Disease Indication (Revenue, USD Billion):

Based on disease Indication the market is segmented into:

- Lung Cancer

- Colorectal cancer

- Breast cancer

- Prostate cancer

- Blood cancer

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.