Nigeria HIV Therapeutics Market Analysis

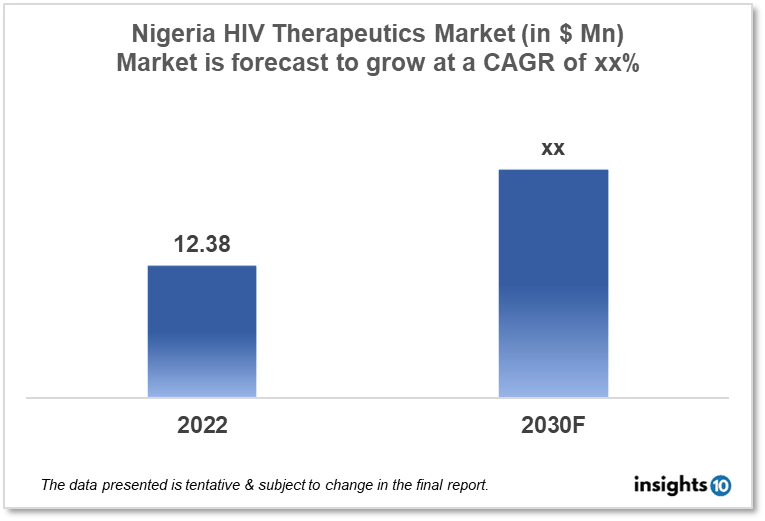

Nigeria's HIV therapeutics market is expected to reach $12.38 Mn by 2030, up from $xx Mn in 2022, with a CAGR of xx% from 2022-30. Local Players such as Emzor Pharmaceutical, Fidson Healthcare Plc, and May & Baker Nigeria Plc dominate the HIV therapeutics market in Nigeria. The government policies, funding, and initiatives by international organizations to manage HIV infections in the country propel the market. The HIV therapeutics market in Nigeria is divided into four segments: type, product, geography, end user, and distribution channel.

Buy Now

Nigeria HIV Therapeutics Market Analysis Summary

Nigeria's HIV therapeutics market is expected to reach $12.38 Mn by 2030, up from $xx Mn in 2022, with a CAGR of xx% from 2022-30.

Nigeria had a 1.3% adult HIV/AIDS prevalence rate in 2021, which placed it in 33rd place globally. According to the latest WHO data published in 2020 HIV/AIDS Deaths in Nigeria reached 44,124 or 2.98 % of total deaths. The age-adjusted Death Rate is 26.81 per 100,000 of the population ranks Nigeria 36th in the world. Nigeria ranks fifth among the Top 10 Countries with the most HIV Cases in the World, with 1,700,000 HIV cases.

Despite the fact that Nigeria's National Health Insurance Scheme (NHIS), which was launched in 1999, aims for universal coverage, penetration remains persistently low. The NHIS currently enrols less than 5% of the population, and an estimated 120 Mn Nigerians do not have health insurance coverage. Nigeria spent 3.4 % of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers

The United States Agency for International Development, USAID, has expressed commitment to ensuring that pregnant women and people Living with HIV/AIDS in Nigeria are provided with adequate medical services. In collaboration with the Federal Ministry of Health (MoH), the Nigerian Sovereign Investment Authority (NSIA) has signed a series of agreements to modernize and expand healthcare services through private-sector participation. These factors may entice new entrants into the HIV therapeutics market in Nigeria.

Market Restraint

There are no treatment centers specialized in HIV/AIDS. There are currently no public or non-governmental organizations that provide appropriate assistance. Nigeria's healthcare infrastructure is still underdeveloped, with few modern medical facilities. The healthcare indicators in the country are among the worst in Africa. According to WHO figures, medical professionals are in short supply, with only about 35,000 doctors available despite a need for 237,000, owing in part to the massive migration of healthcare workers overseas. As a result, the Nigerian Medical Association estimates that medical tourism costs the country at least $1.5 Bn per year (NMA). These factors may deter new entrants into the HIV therapeutics market in Nigeria.

Competitive Landscape

Key Players

- May & Baker Nigeria Plc (NGA)

- Fidson Healthcare Plc (NGA)

- Emzor Pharmaceutical (NGA)

- Orange Drugs Limited (NGA)

- Miraflash Pharmaceuticals (NGA)

- ViiV Healthcare

- Bristol Myers Squibb

- Merck & Co.

- Gilead Sciences

Recent Notable Update

January 2023: The US government spent more than $7.8 Bn on the President's Emergency Plan for AIDS Relief (PEPFAR) to assist Nigeria in its fight against HIV/AIDS. The investment enabled more than 1.9 Mn Nigerians to gain access to antiretroviral treatment (ART).

Healthcare Regulations and Reimbursement Policies

The National Agency for Food and Drug Administration and Control (NAFDAC) in Nigeria is in charge of the registration, licensing, and regulation of all medicines and health products in the country. Before HIV therapeutics and other health products are approved for use in Nigeria, NAFDAC ensures that they meet safety, efficacy, and quality standards. NAFDAC has implemented a number of regulations to ensure the safety and quality of HIV therapeutics in Nigeria.

HIV therapeutics are reimbursed in Nigeria through various public and private health insurance schemes. The National Health Insurance Scheme (NHIS), a government-run health insurance program, manages the reimbursement of HIV therapeutics in the public health system. The National Health Insurance Scheme (NHIS) covers a wide range of health services, including HIV therapeutics, and aims to improve access to healthcare for all Nigerians, particularly the economically disadvantaged. Health insurance companies are regulated by the National Insurance Commission (NAICOM), which oversees their operations and ensures that they comply with industry regulations.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

HIV Therapeutics Segmentation

By Types (Revenue, USD Billion):

- Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- Coreceptor Antagonists

- Entry and Fusion Inhibitors

- Integrase Inhibitors

- Protease Inhibitors (PIs)

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.