Nigeria Anti Aging Therapeutics Market Analysis

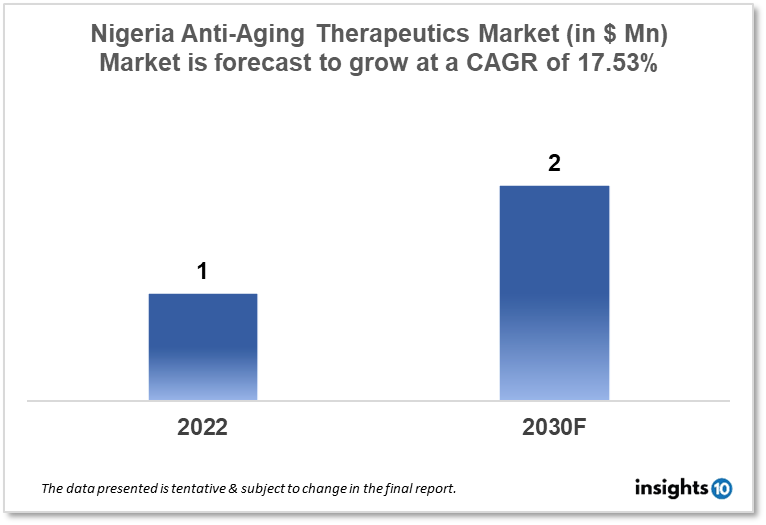

Nigeria anti-aging therapeutics market is expected to witness growth from $1 Mn in 2022 to $2 Mn in 2030 with a CAGR of 17.53% for the forecasted year 2022-2030 due to the increase in age-related chronic disorders and the rise in awareness about anti-aging therapeutics in Nigeria. The Nigeria anti-aging therapeutics market is segmented by product, treatment, target group, type of aging, type of molecules, mechanism of action, ingredient, and by distribution channel. Some of the major players in the market are May and Baker, Agary Pharmaceutical, and Athersys.

Buy Now

Nigeria Anti-Aging Therapeutics Market Executive Summary

The Nigeria anti-aging therapeutics market size is at around $1 Mn in 2022 and is projected to reach $2 Mn in 2030, exhibiting a CAGR of 17.53% during the forecast period. In the proposed 2023 budget, the health sector received over $2 Bn for the first time in the country's history of health financing. Out of the $45 Bn total budget for the 2023 fiscal year, $2.5 Bn was allocated to the health industry. The service-wide vote includes $0.18 Bn for the health industry. Included in this are $0.15 Bn for GAVI/vaccination; $16 Mn for counterpart financing, which includes a global fund and a health refund to GAVI; and $9.6 Mn for military retirees covered by the National Health Insurance Scheme (NHIS). From the $1.80 Bn allocated to the health sector in 2022 and the $1.19 Bn allocated in 2021, the 2023 budget represents a significant rise.

Technology related to stem cells is constantly improving. One Lancet article described a Nigerian lady who received an insulin-producing stem cell transplant from her mother and was almost cured of diabetes. A study team published findings from a follow-up investigation of eight Alzheimer's patients who got stem cells that had been genetically altered. The brain's nerve growth factor was discovered to be increased by the stem cells, and tests of cognition and memory revealed that six out of eight subjects responded very favorably. One patient passed away soon after the study's conclusion, and an autopsy revealed that local tissue regeneration was taking place in the area of the patient's brain where the stem cells had been injected.

The designated organ seems to be the only place where stem cells seem to go. Additionally, they appear to be helpful in either saving cells that are in the resting state or in aiding in the generation of entirely new cells. It is interesting to observe that human growth hormone also promotes nerve growth factor, a crucial cytokine in the modulation, remodeling, and plasticity of brain tissue. Perhaps this is the reason why human growth hormone therapy has been shown to be effective in some Alzheimer's disease situations.

Market Dynamics

Market Growth Drivers Analysis

As the population of Nigeria ages, it becomes more vulnerable to age-related illnesses like cancer, gout, and Alzheimer's. This will result in a rise in the desire for anti-aging treatments. The Nigerian populace is becoming more conscious of the advantages of anti-aging treatments. There will be greater demand for these goods as more people become aware of these advantages. There is a rise in disposable money as Nigeria's economy continues to expand. People can now spend more on healthcare, including anti-aging treatments, as a result of this, therefore, driving Nigeria anti-aging therapeutics market.

Market Restraints

Although anti-aging therapeutics are becoming more widely known in Nigeria, many people still do not completely comprehend the advantages of these products. More education and awareness campaigns are required to inform the public about the possible advantages of these products. Not everyone can afford anti-aging therapies because they can be expensive. This restricts the market to those who can purchase the goods, potentially slowing the Nigeria anti-aging therapeutics market's expansion. Strong regulatory frameworks are required in Nigeria to guarantee the security and effectiveness of anti-aging therapeutics. The absence of regulations may deter some customers from using these goods and impede market expansion.

Competitive Landscape

Key Players

- Fidson Healthcare (NGA)

- Mopson Pharmaceutical (NGA)

- Vitabiotic (NGA)

- May And Baker (NGA)

- Agary Pharmaceutical (NGA)

- Athersys

- BHB Therapeutics

- Biosplice

- Cyclo Therapeutics

- Denali Therapeutics

- Elysium Health

- Genome Protection

- GenSight Biologics

Notable Deals

Sept 2022- The Memorandum of Understanding (MoU) on the implementation of stem cell medicine was signed in Abuja, Nigeria, by the Federal Government through the National Biotechnology Development Agency (NABDA), RAHAB RVD Global Industries, and Mesencell Biotech.

The application and use of stem cells will help Nigeria reduce medical tourism because many Bns of dollars will be conserved. Nigerians frequently travel overseas for stem cell therapy because the country lacks the necessary technology, but owing to this MoU and the start of the deployment, the nation will save a significant amount of foreign currency.

Healthcare Policies and Regulatory Landscape

In Nigeria, all drugs, including anti-aging medicines, are governed by the National Agency for Food and Drug Administration and Control (NAFDAC). The Federal Ministry of Health's NAFDAC is the government organization in charge of overseeing and regulating the production, distribution, use, and advertising of all drugs and medical goods in Nigeria. Before any goods are made available on the market, the agency makes sure they are all reliable, efficient, and of high quality. Along with NAFDAC, other government organizations in Nigeria that regulate drugs and medical goods include the National Institute for Pharmaceutical Research and Development (NIPRD) and the National Drug Law Enforcement Agency (NDLEA).

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Anti-Aging Therapeutics Market Segmentation

By Product (Revenue, USD Billion):

- Anti-Wrinkle

- Hair Color

- Ultraviolet (UV) Absorption

- Anti-Stretch Mark

- Others

By Treatment (Revenue, USD Billion):

- Hair Restoration

- Anti-Pigmentation

- Adult Acne Therapy

- Breast Augmentation

- Liposuction

- Chemical Peel

- Others

By Target Group (Revenue, USD Billion):

- Male

- Female

By Type of Aging (Revenue, USD Billion):

- Cellular Aging

- Immune Aging

- Metabolic Aging

- Others

By Type of Molecules (Revenue, USD Billion):

- Biologics

- Small Molecules

By Mechanism of Action (Revenue, USD Billion):

- Senolytic

- Cell Regeneration

- mTOR inhibitor/Modulator

- AMP-kinase/AMP Activator

- Mitochondria Inhibitor/Modulator

- Others

By Ingredient (Revenue, USD Billion):

- Retinoid

- Hyaluronic Acid

- Alpha Hydroxy Acid

- Others

By Distribution Channel (Revenue, USD Billion):

- Pharmacies

- Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.