Nigeria ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Analysis

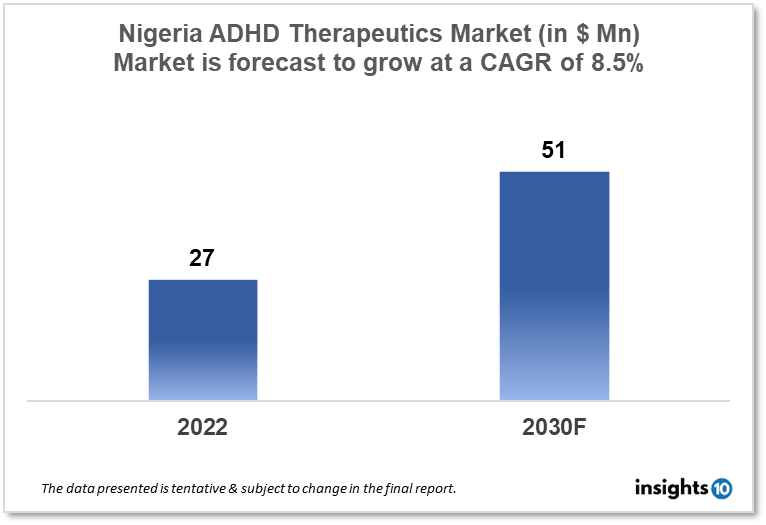

Nigeria's Attention Deficit Hyperactivity Disorder (ADHD) therapeutics market is projected to grow from $27 Mn in 2022 to $51 Mn in 2030 with a CAGR of 8.5% for the year 2022-2030. The major factors responsible for the expansion of the market in Nigeria include increasing awareness about ADHD and consequently the demand for its therapeutic options. The Nigeria ADHD therapeutics market is segmented by drug, drug type, demographics, and by distribution channel. Phamatex, LaBeta drugs, and Eli Lilly are the key players in the market.

Buy Now

Nigeria Attention Deficit Hyperactivity Disorder (ADHD) Therapeutics Market Executive Analysis

Nigeria's attention deficit hyperactivity disorder therapeutics market is projected to grow from $27 Mn in 2022 to $51 Mn in 2030 with a CAGR of 8.5% for the year 2022-30. In the proposed 2023 budget, the health sector received over a trillion Naira for the first time in the country's history of health financing. The service-wide vote includes $0.18 Bn for the health industry. Included in this are $0.15 Bn for GAVI/vaccination; $0.016 Bn for counterpart financing, which includes a global fund and a health refund to GAVI; and $0.0096 Bn for military retirees covered by the National Health Insurance Scheme. (NHIS). From the $1.80 Bn allocated to the health sector in 2022 and the $1.19 Bn allocated in 2021, the 2023 budget represents a significant rise. The recurrent health budget grew by 25.54 %, while capital expenditures increased by 94.83 % from the 2022 budget. The health capital expenditure rose from $0.049 Bn in 2015 to $0.88 Bn in 2023, while the health recurrent budget increased from $0.52 Bn to $1.27 Bn.

Inattention, excessive movement, and impulsivity are characteristics of attention deficit hyperactivity disorder (ADHD). In basic care settings, it is the childhood neurodevelopmental disorder that is most commonly seen. According to a few published research, the prevalence of ADHD in Nigeria is 7.6%. Although it can persist into maturity, ADHD typically affects children in the preschool age range. The combined type of ADHD is usually regarded as being the most prevalent across all age groups, with a higher prevalence frequently found in males. Stimulant drugs like methylphenidate and dextroamphetamine are the ones for ADHD that are most frequently used in Nigeria. The hyperactivity, impulsivity, and inattention signs of ADHD can be effectively treated with these drugs. The adverse effects of these drugs, however, can include irritability, trouble sleeping, and appetite loss. There are various forms of counseling that can be successful in treating ADHD. One of the most popular forms of treatment for ADHD in Nigeria is behavioral therapy. With the help of these skills, children and people with ADHD can better control their behavior and develop their social abilities. Cognitive-behavioral therapy (CBT) is an additional treatment option for ADHD. CBT is a form of treatment that aids people with ADHD in recognizing and altering harmful thought patterns that might be contributing to their symptoms.

Market Dynamics

Market Growth Drivers

ADHD is becoming more widely recognized in Nigeria, which is probably going to increase the number of people who seek a diagnosis and therapy for the condition. ADHD is becoming more common in Nigeria, which is expected to increase the demand for diagnosis and treatment. The pharmaceutical business in Nigeria is expanding, which will probably result in more ADHD medications becoming available thereby expanding the Nigeria ADHD therapeutics market.

Market Restraints

For many Nigerians, the expense of medication and therapy for ADHD may be unaffordable. Due to the paucity of studies on ADHD in Nigeria, it can be challenging for medical professionals to create efficient treatment plans and for pharmaceutical companies to create medications specifically for Nigerians with ADHD, therefore, limiting the Nigeria ADHD therapeutics market expansion.

Competitive Landscape

Key Players

- Fidson Healthcare (NGA)

- Taylek Drugs Company (NGA)

- Danisam Pharmaceuticals (NGA)

- Phamatex (NGA)

- LaBeta drugs (NGA)

- Eli Lilly

- Perdue Pharma

- Johnson and Johnson

- Janssen

- Takeda

- GlaxoSmithKline

Healthcare Policies and Regulatory Landscape

The National Agency for Food and Drug Administration and Control (NAFDAC) was removed from the previous Food and Drug Administration and Control (FDAC) agency in 1993, leading to the establishment of the Agency for Food and Drug Services. For the efficient delivery of healthcare in Nigeria, it is firmly committed to and focused on promoting access to healthy food, medicines, and other health products. In Nigeria, filing a trademark is a requirement before registering a medicinal product. The Commercial Law Department Trademarks, Patents, and Designs Registry of the Ministry of Industry, Trade, and Investment is in charge of filing trademarks in Nigeria. It regulates and oversees the manufacture, distribution, selling, use, advertisement, and use of drugs, cosmetics, medical devices, bottled water, chemicals, and other products. It also establishes a suitable quality assurance system, including certification of the production sites and of the regulated products, and conducts the necessary inquiry into the manufacturing facilities and raw materials used to produce food, drugs, cosmetics, medical devices, bottled water, and chemicals.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Nigeria ADHD (Attention Deficit Hyperactivity Disorder) Therapeutic Market Segmentation

By Drug Type (Revenue, USD Billion):

- Stimulants

- Amphetamine

- Methylphenidate

- Dextroamphetamine

- Dexmethylphenidate

- Lisdexamfetamine

- Others

- Non-Stimulants

- Atomoxetine

- Bupropion

- Guanfacine

- Clonidine

By Age Group (Revenue, USD Billion):

- Pediatric And Adolescent

- Adult

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Speciality Clinics

- Retail Pharmacies

- e-Commerce

By Psychotherapy (Revenue, USD Billion):

- Behaviour Therapy

- Cognitive Behavioral Therapy

- Interpersonal Psychotherapy

- Family Therapy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.