Netherlands ECG Equipments Market Analysis

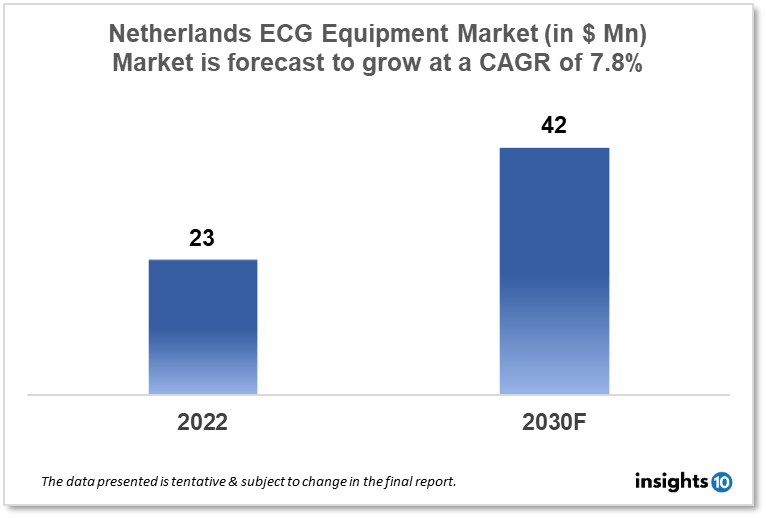

Netherlands's ECG Equipment Market is expected to witness growth from $23 Mn in 2022 to $42 Mn in 2030 with a CAGR of 7.80% for the forecasted year 2022-30. In the Netherlands, there is an increasing focus on preventative healthcare, which is anticipated to increase demand for ECG equipment as consumers take a more proactive approach to monitoring their cardiac health. The market is segmented by product type and by end user. Some key players in this market include Hy2Care B.V., InnoSer, Johnson & Johnson, Philipps Healthcare, Medtronic, GE Healthcare, and Nihon Kohden.

Buy Now

Netherlands ECG Equipment Healthcare Market Executive Analysis

Netherlands's ECG Equipment Market is expected to witness growth from $23 Mn in 2022 to $42 Mn in 2030 with a CAGR of 7.80% for the forecasted year 2022-30. Co-payments (11%), general taxation (22%), employer-paid wage taxes (46%), and general taxation (22%) combined covered 81% of the expenditures of healthcare in the Netherlands, which equaled 10.5% of GDP. 2019 healthcare costs per person in the Netherlands were $5.33 million. The increase in health spending in the Netherlands from $4.68 million in 2018 to $6 million in 2022 was calculated using a cumulative annual growth rate of 5.64%.

In the Netherlands in 2021, there were about 25,500 hospital admissions for acute myocardial infarction (heart attack). This is equivalent to 152 cases per 100,000 persons, or the incidence rate. In the Netherlands, ECG equipment is frequently utilized for heart problem diagnosis and monitoring. Arrhythmias, heart attacks, and heart failure are just a few of the illnesses that can be diagnosed with the aid of ECG equipment. ECG technology records the electrical activity of the heart, allowing specialists to identify irregularities and establish a precise diagnosis. Monitoring the electrical activity of the heart over time is another application for ECG equipment. This enables medical professionals to monitor changes in cardiac function and modify treatment strategies as appropriate. ECG equipment is a non-invasive diagnostic tool; thus, no incisions or needles are necessary. This makes it a secure and largely painless method of identifying and keeping track of heart issues.

Market Dynamics

Market Growth Drivers

In the Netherlands, there is an increasing focus on preventative healthcare, which is anticipated to increase demand for ECG equipment as consumers take a more proactive approach to monitoring their cardiac health. With the development of new and cutting-edge technology, the market for ECG equipment is continually changing. For instance, as these technologies offer more comfort and ease of use, the development of wireless ECG monitoring devices and wearable ECG monitors is anticipated to boost market expansion. The Netherlands government has started some campaigns to encourage the adoption of ECG equipment and other digital health technologies. For instance, the government has implemented reimbursement laws that simplify patient access to ECG monitoring devices, which is anticipated to increase market demand.

Market Restraints

Access to healthcare may be restricted in some areas of the Netherlands, which may affect the need for ECG equipment. This might be especially true in rural locations, where medical facilities might not be as well-equipped as those in cities. ECG equipment is subject to stringent regulatory restrictions in the Netherlands because it is regarded as a medical device. This can affect market expansion by raising the price of manufacturing and development for producers. The diagnosis and monitoring of heart diseases utilize a variety of diagnostic tools, not just ECG equipment. The demand for ECG equipment may be constrained by the potential advantages of other diagnostic techniques over ECG, such as cardiac MRI and echocardiography.

Competitive Landscape

Key Players

- Hy2Care B.V (NL)

- InnoSer (NL)

- Johnson & Johnson

- Medtronic

- Philipps Healthcare

- GE Healthcare

- Nihon Kohden

Healthcare Policies and Regulatory Landscape

The Netherlands has an advanced healthcare system that is governed by Dutch law. The Medical Devices Act, which is implemented in the Netherlands, establishes requirements for medical equipment and devices, including ECG machines. All medical devices must comply with the Act's performance standards and be both effective and safe. The Dutch government has a system in place to keep track of the efficacy and safety of medical tools and equipment as well as to look into any events or complaints involving their use. The European Union (EU) has requirements that the Netherlands must abide by in addition to the Medical Devices Act. All medical devices supplied in the EU, including those in the Netherlands, are subject to a set of rules known as the Medical Device Regulation (MDR). The MDR mandates manufacturers to disclose more thorough information about their goods and raises the bar for the effectiveness and safety of medical devices and equipment.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

ECG Equipment Market Segmentation

By Product Type (Revenue, USD Billion):

- Holter Monitors

- Resting ECG Machines

- Stress ECG Machines

- Event Monitoring Systems

- ECG Management Systems

- Cardiopulmonary Stress Testing Systems

By End User (Revenue, USD Billion):

- Hospitals and Clinics

- Diagnostic Centres

- Ambulatory Services

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The market is segmented by product type and by end user.

The Netherlands ECG Equipment Market is studied from 2022-2030.

Hy2Care B.V, InnoSer, Johnson & Johnson, Philipps Healthcare, Medtronic, GE Healthcare, and Nihon Kohden are the major companies operating in the Netherlands ECG Equipment market.