Netherlands Diabetes Therapeutics Market Analysis

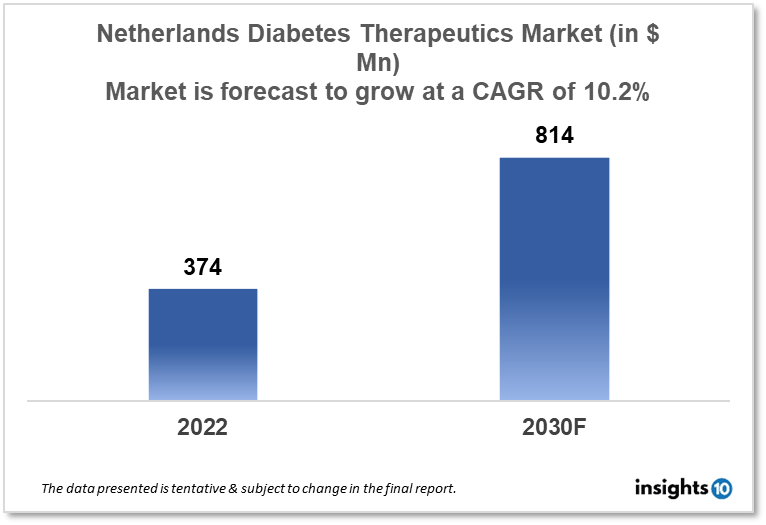

Netherlands's diabetes therapeutics market is expected to witness growth from $374 Mn in 2022 to $814 Mn in 2030 with a CAGR of 10.2% for the forecasted year 2022-30. The rising aging population of the country and the introduction of novel therapeutic options for diabetes in the Netherlands are driving the growth of the market. The Netherlands diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. Produlab Pharma, Drogisterij-Parfumerie Visser, and Boehringer Ingelheim are the major players in the Netherlands diabetes therapeutics market.

Buy Now

Netherlands Diabetes Therapeutics Market Executive Analysis

Netherlands's diabetes therapeutics market is expected to witness growth from $374 Mn in 2022 to $814 Mn in 2030 with a CAGR of 10.2% for the forecasted year 2022-30. In the Netherlands, the expected cost of healthcare in 2023 will surpass $109 Bn for the first time. The highest monthly healthcare allowance will rise to $168. Only for 2023 will there be a temporary increased healthcare allowance of $451 implemented. The monthly cost of the basic health insurance package will increase by a maximum of $12, or more than 8%, to $150.

The latest WHO data show that 2,386 deaths from diabetes mellitus, or 1.88% of all deaths, occurred in the Netherlands in 2020. The Netherlands is ranked #166 in the world with an age-adjusted death rate of 5.62 per 100,000 people. Due to different (autoimmune) processes, Type 1 diabetes mellitus (T1DM) is characterized by a (nearly) nonexistent generation of insulin. In healthy individuals, insulin works in conjunction with other hormones to keep blood glucose levels within a specific range (3–7 mm), despite variations in dietary intake, physical activity, and other (physical or psychological) factors.

With Continuous Intraperitoneal Insulin Infusion (CIPII), insulin is pumped directly into the IP space, where it is taken up by the visceral peritoneum's capillaries and injected into the portal vein.6-8 The volume, concentration, and duration of the injection all affect how quickly insulin leaves the peritoneal space, although the majority of the insulin is absorbed directly into the portal system, where it is detectable within one minute of administration.6 Since first-pass liver insulin extraction occurs immediately after absorption and there is a higher hepatic uptake of insulin as a result of portal system absorption, compared to subcutaneous (SC) insulin administration, peripheral plasma insulin concentrations are alleviated, lowered, or decreased. Insulin regulates a variety of processes in addition to its effects on glucose regulation, as is well documented. The insulin concentration in the portal vein and the peripheral plasma insulin concentrations are significantly more physiological compared to SC-administered insulin because IP insulin is absorbed to a substantial extent in the portal vein.

Market Dynamics

Market Growth Drivers

The Netherlands' ageing population is one factor fueling the demand for diabetic treatments. The prevalence of diabetes is higher in older persons, and as the population ages, so is the need for diabetic therapies. Therapeutics for diabetes have made considerable strides in recent years, and this is what is fueling the market's expansion. Patients now have more treatment options thanks to the increased availability of new drugs in the Netherlands, including SGLT-2 inhibitors and GLP-1 receptor agonists. The construction of diabetic clinics and the payment of some diabetes drugs are just two of the steps the Dutch government has put in place to enhance diabetes care and treatment. The Netherlands diabetes therapeutics market is expanding as a result of these activities.

Market Restraints

Some diabetic patients may find it challenging to pay for the necessary medications and care due to the high cost of diabetes treatments in the Netherlands. Especially for patients with lower incomes or those without adequate insurance coverage, this could restrict the Netherlands' diabetes therapeutics market expansion. Despite having a strong healthcare system, the Netherlands sometimes has difficulty accessing cutting-edge diabetes therapies because of regulatory and payment issues. As a result, patients may have fewer options for successful treatment, which could constrain market growth. Given that many diabetic therapies have been available for a while, generic versions of these medications are fiercely competitive. This could restrict the market for more recent therapies and make it more difficult for pharmaceutical firms to repay their investment in R&D.

Competitive Landscape

Key Players

- OctoPlus (NLD)

- AmbiPack (NLD)

- BModesto (NLD)

- Produlab Pharma (NLD)

- Drogisterij-Parfumerie Visser (NLD)

- Boehringer Ingelheim

- Eli Lilly

- Glaxosmithkline

- Johnson Johnson

- Merck

- Novartis

- Novo Nordisk

- Sanofi

Healthcare Policies and Regulatory Landscape

For pharmacovigilance in the Netherlands, the Medicines Evaluation Board Agency (MEB) is in charge of organizing and carrying out decisions made by the Board. The Ministry of Health, Welfare, and Sport (VWS) is responsible for it. The effectiveness of each medication is evaluated by one of four pharmacotherapeutic groups (PT groups), with the exception of veterinary medications, botanicals, and novel foods. These PT groups are divided up based on illnesses. As an example, PT group 1 evaluates the dossiers of classes of drugs that are used in conjunction with the central nervous system, such as painkillers, and PT group 3 is in charge of evaluating drugs like oncological ones. The Regulatory Information Centre (RIC) handles case management tasks like updating pharmaceutical dossiers as well as processing incoming and outgoing data. The Board decides whether to grant the pharmaceutical marketing authorization for the Dutch or European markets following the Agency's evaluation. The MEB continues to track the risks even after a pharmaceutical has been approved for the Dutch or European markets. For instance, the PT groups and the Pharmacovigilance unit evaluate indications of new hazards and/or adverse responses.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Produlab Pharma, Drogisterij-Parfumerie Visser, and Boehringer Ingelheim are the major players in the Netherlands diabetes therapeutics market.

The Netherlands diabetes therapeutics market is expected to grow from $374 Mn in 2022 to $814 Mn in 2030 with a CAGR of 10.2% for the forecasted year 2022-2030.

The Netherlands diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.