Netherlands Cancer Immunotherapy Market Analysis

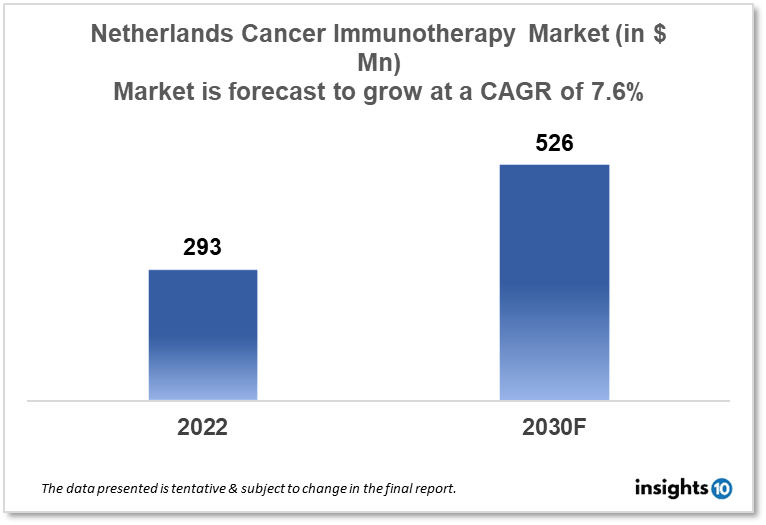

Netherlands's cancer immunotherapy market is expected to witness growth from $293 Mn in 2022 to $526 Mn in 2030 with a CAGR of 7.6% for the forecasted year 2022-30. The increased funding in research and development and the creation of novel immunotherapy options are driving the growth of the market. The Netherlands cancer immunotherapy market is segmented by type, application, and end user. Bedrocan, Pharma Line, and Bayer are the major players in the Netherlands' cancer immunotherapy market.

Buy Now

Netherlands Cancer Immunotherapy Market Executive Analysis

Netherlands's cancer immunotherapy market is expected to witness growth from $293 Mn in 2022 to $526 Mn in 2030 with a CAGR of 7.6% for the forecasted year 2022-30. As part of a $436 Bn overall budget, the Netherlands' budget provides $19 Bn to help increase purchasing power by nearly 4 %. The monthly cost of the basic health insurance package will increase by a maximum of $12, or more than 8%, to $151. The highest monthly healthcare allowance will rise to $170. Only for 2023 will there be a temporary increased healthcare allowance of $454 implemented. In 2023, the expected cost of healthcare will surpass $110 Bn for the first time.

Except for Ireland and Denmark, the Netherlands has relatively more cancer instances than any other nation in Europe, with colon, melanoma, and breast cancer being the most prevalent types of the disease. Oesophageal, bladder, and lung cancer are also far more common in the Netherlands than in the majority of other European nations. In the Netherlands, cancer strikes women more frequently, especially breast and lung cancer, whereas prostate cancer strikes males more frequently than in other European nations.

Immunotherapy is no longer the newest cancer treatment on the block. Oncologists currently use it as a common procedure to treat a wide variety of malignancies. Immunotherapy's function in treatment has changed significantly during the past couple of decades, much to what happened with targeted therapies. ICIs like pembrolizumab were initially only used to treat patients with extremely advanced malignancies that were no longer responding to conventional therapies. Many are currently employed as initial therapies for advanced malignancies, including formerly challenging cancers like kidney and lung. It is not novel to use Immune Checkpoint Inhibitors (ICIs) in neoadjuvant therapy. For some women with early-stage triple-negative breast cancer, the Food and Drug Administration (FDA) has already approved pembrolizumab paired with chemotherapy as a neoadjuvant therapy (followed by surgery and more pembrolizumab). And for early-stage lung cancer, nivolumab (Opdivo) in combination with chemotherapy is authorized as neoadjuvant therapy (followed by surgery). Neoadjuvant therapy is justified in large part by the possibility that smaller tumours may result in procedures that are more successful and less invasive. Additionally, according to some research, immunotherapy administered prior to surgical removal of the tumour results in a more potent immune response against the tumour.

Market Dynamics

Market Growth Drivers

Cancer is becoming more common in the Netherlands, which is projected to increase demand for cancer immunotherapy. The Netherlands Cancer Registry estimates that in 2020, there will be 118,000 new cases of cancer in the nation. The Dutch government and private investors are funding cancer immunotherapy research and development. This investment is anticipated to result in the creation of novel and cutting-edge cancer immunotherapy therapies, further fueling the Netherlands cancer immunotherapy market's expansion. The regulatory framework in the Netherlands is hospitable for the creation and endorsement of cancer immunotherapy medicines. Pharmaceutical companies are anticipated to invest in the Dutch market as a result of the regulatory environment.

Market Restraints

The cost of cancer immunotherapy treatments can be expensive and this may make them less accessible for some patients. This might lower the overall demand in the Netherlands for cancer immunotherapy treatments. The Dutch healthcare system offers universal coverage, although there may be restrictions on cancer immunotherapy reimbursement. This would make it challenging for patients to get these medicines, which might stop the Netherlands cancer immunotherapy market from expanding. Immunotherapy can cause negative effects, much like all other cancer treatments. Even though these side effects are frequently less severe than those related to chemotherapy, individuals and medical professionals may nonetheless be concerned about them. This might restrict the use of cancer immunotherapy in the Netherlands.

Competitive Landscape

Key Players

- Ace Pharmaceuticals (NLD)

- CanAdelaar (NLD)

- Endoca (NLD)

- Bedrocan (NLD)

- Pharmaline (NLD)

- Bayer

- AstraZeneca

- Bristol-Myers Squibb

- F. Hoffmann-La Roche

- Pfizer

- Eli Lily

- Novartis

- Johnson & Johnson

- Merck

Healthcare Policies and Regulatory Landscape

Everyone must have health insurance under the Dutch healthcare system, which is based on the solidarity principle. Although private health insurance providers offer health insurance in the Netherlands, the government establishes the fundamental package of covered services, which includes cancer treatments. A deductible is a predetermined sum that patients are responsible for paying out-of-pocket every year before their insurance coverage kicks in. The Dutch government has produced regulations that specify which therapies are covered and under what circumstances in terms of reimbursement standards for cancer immunotherapy treatments. The recommendations are based on the data that is currently available on the efficacy and safety of the treatments. In the Netherlands, health insurance generally covers cancer immunotherapy therapies; however, reimbursement regulations can change depending on the specific treatment and the patient's condition. The Dutch government also has a procedure for determining if new cancer therapies, such as immunotherapy, are cost-effective. The Zorginstituut Nederland (Dutch Healthcare Institute) examination is the name of this procedure. The evaluation takes into account the treatment's clinical efficacy, price, and effect on the total healthcare budget. The government may opt not to cover the treatment or negotiate the cost with the manufacturer based on the assessment.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Cancer Immunotherapy Segmentation

By Type (Revenue, USD Billion):

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- PD-1/PD-L1

- CTLA-4

By Application (Revenue, USD Billion):

- Lung Cancer

- Breast Cancer

- Head and Neck Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Others

By End User (Revenue, USD Billion):

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Cancer Research Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Bedrocan, Pharma line, and Bayer are the major players in the Netherlands' cancer immunotherapy market.

The Netherlands cancer immunotherapy market is expected to grow from $293 Mn in 2022 to $526 Mn in 2030 with a CAGR of 7.6% for the forecasted year 2022-2030.

The Netherlands cancer immunotherapy market is segmented by type, application, and end user.