Middle East Diabetes Drugs Market Analysis

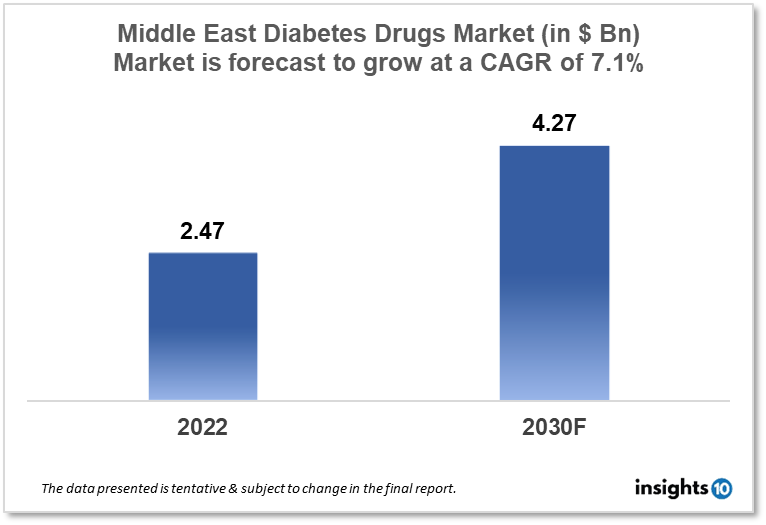

Middle East diabetes drugs market size was valued at $2.47 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.10 % from 2022-30 and will reach $4.27 Bn in 2030. The market is segmented by drug type, application, and distribution channel. The Middle East diabetes drug market will grow as patients become more aware of the importance of managing their diabetes. The key market players are Gulf Pharmaceutical Industries (UAE), Neopharma (UAE), Tabuk Pharmaceuticals (SAU), Pharaonia Pharmaceuticals (EGY), and others.

Buy Now

Middle East Diabetes Drugs Market Executive Summary

Middle East diabetes drugs market size was valued at $2.47 Bn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7.10 % from 2022-30 and will reach $4.27 Bn in 2030. According to data from the World Bank, total healthcare expenditure in the Middle East and North Africa (MENA) region was $214 Bn in 2019, up from $139 Bn in 2010. This represents a compound annual growth rate of 4.6% over the decade. The countries with the highest healthcare expenditure in the MENA region are Saudi Arabia, the United Arab Emirates (UAE), and Qatar. In Saudi Arabia, healthcare expenditure was $40 Bn in 2019, while in the UAE it was $19 Bn and in Qatar, it was $5.5 Bn. One of the factors driving healthcare expenditure in the Middle East is population growth. The region has one of the fastest-growing populations in the world, with a population of over 500 Mn in 2019, up from 350 Mn in 2000. This has created a growing demand for healthcare services, including preventive care, diagnostic services, and treatment for chronic diseases.

The Middle East region has one of the highest rates of diabetes in the world, with a significant impact on the demand for diabetes drugs. The prevalence of diabetes in the Middle East region has been increasing in recent years, driven by factors such as changing lifestyles, increasing urbanization, and genetic predisposition.

According to data from the International Diabetes Federation, the Middle East and North Africa (MENA) region has the second-highest prevalence of diabetes in the world, after the Western Pacific region. In 2019, it was estimated that over 43 Mn adults (aged 20-79) in the MENA region had diabetes, representing a prevalence rate of 9.4%. The prevalence of diabetes is particularly high in countries such as Saudi Arabia, Kuwait, Bahrain, and Qatar.

The high prevalence of diabetes in the Middle East region significantly impacts the diabetes drug market. It creates a large and growing demand for diabetes drugs, including both oral medications and insulin. This has led to an increase in the number of pharmaceutical companies operating in the region and a focus on developing new and innovative diabetes drugs.

In addition to driving demand for diabetes drugs, the high prevalence of diabetes in the Middle East region has also led to a focus on diabetes management and prevention. Governments and healthcare providers are investing in diabetes education, screening, and prevention programs, as well as in the development of new technologies to improve diabetes management.

Market Dynamics

Market Growth Drivers Analysis

- Increasing Prevalence of Diabetes: Diabetes is a major public health concern in the Middle East, with a high prevalence of the disease in countries such as Saudi Arabia, Kuwait, and the United Arab Emirates. This is expected to drive demand for diabetes drugs and increase market growth.

- Rising Healthcare Expenditure: With an increasing focus on healthcare infrastructure development and the implementation of national health insurance programs, healthcare spending in the Middle East is expected to increase, which will drive demand for diabetes drugs.

- Growing Demand for Effective Diabetes Management: As patients become more aware of the importance of managing their diabetes, there is an increasing demand for effective and innovative diabetes management and treatment options. This will drive market growth and encourage pharmaceutical companies to develop new products.

- Increasing Adoption of Technology: Technology is playing an increasingly important role in diabetes management and treatment, with the development of advanced diabetes devices, apps, and platforms. This is expected to drive market growth, particularly in countries with high rates of technology adoption such as the UAE and Qatar.

Market Restraints

- Regulatory Challenges: The regulatory environment in the Middle East can be challenging for pharmaceutical companies, with complex registration processes and varying requirements across different countries. This can create barriers to market entry and slow down the development and launch of new diabetes drugs.

- Economic Challenges: Economic instability and political unrest in some countries in the Middle East can impact market growth by affecting the purchasing power of consumers and limiting investment in healthcare infrastructure.

- Availability of Alternative Therapies: Traditional and alternative therapies, such as herbal remedies, are widely used in the Middle East and may compete with diabetes drugs. This can limit market growth, particularly for pharmaceutical companies that are not able to effectively differentiate their products from existing therapies.

- Price Sensitivity: The high cost of diabetes drugs can be a barrier to market growth, particularly in countries with a large low-income population. This can limit access to treatment and create challenges for pharmaceutical companies looking to penetrate these markets.

Competitive Landscape

Key Players

- Gulf Pharmaceutical Industries (UAE)

- Neopharma (UAE)

- Tabuk Pharmaceuticals (SAU)

- Pharaonia Pharmaceuticals (EGY)

- Novo Nordisk

- Sanofi

- Merck

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Biocon ltd

- Bristol-Myers Squibb

- Boehringer Ingelheim

- Novartis

- GlaxoSmithKline

- Lupin ltd

- Piramal healthcare ltd

- Ranbaxy laboratories ltd.

Recent Developments

In 2020, the United Arab Emirates (UAE) approved the use of the drug Rybelsus (semaglutide) for the treatment of type 2 diabetes. This drug is a once-daily pill that helps to lower blood sugar levels and reduce the risk of cardiovascular disease.

In 2020, the Dubai Health Authority (DHA) announced a new research partnership with Novo Nordisk to develop new treatments for diabetes and obesity.

In 2020, the UAE-based pharmaceutical company Julphar partnered with the US-based company BD to develop a new insulin pen that can be used by people with diabetes to manage their condition more effectively.

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario

Regulations and reimbursement for diabetes drugs in the Middle East region vary by country and are influenced by a variety of factors, including government policies, healthcare systems, and the availability of resources. However, there are some common themes across the region. In general, most Middle Eastern countries require that diabetes drugs be approved by their respective regulatory agencies before they can be sold in the country. For example, in Saudi Arabia, the Saudi Food and Drug Authority (SFDA) is responsible for regulating the approval and registration of all drugs, including diabetes drugs.

In terms of reimbursement, most Middle Eastern countries have government-funded healthcare systems that provide some level of coverage for diabetes drugs. However, the level of coverage varies by country and by the specific drug. In some countries, only certain drugs or certain classes of drugs are covered, while in others, the coverage may be more comprehensive.

In the United Arab Emirates (UAE), for example, the government provides free healthcare services to all UAE nationals and subsidizes healthcare services for expatriates. This includes coverage for a range of diabetes drugs, including insulin, oral medications, and injectable medications. In other countries, such as Saudi Arabia, the level of reimbursement for diabetes drugs may be more limited. In these cases, patients may need to pay out of pocket for some or all of their diabetes medications.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Drugs Market Segmentation

By Drug Type (Revenue, USD Bn):

The drug types considered, in this report include Injectable Drugs and Oral Drugs. Injectable drugs are further classified into insulin-based and non-insulin-based injectables. Oral drugs are further classified into various classes as per their mechanism of action as mentioned below :

- Injectable Drugs

- Insulin Based Injectables

- Non-insulin Based Injectables

- Exenatide (Byetta)

- Dulaglutide (Trulicity)

- Semaglutide (Ozempic, Wegovy)

- Liraglutide (`Saxenda, Victoza)

- Lixisenatide (Adlyxin)

- Pramlintide (Symlin)

- Tirzepatide (Mounjaro)

- Albiglutide (Tanzeum)

- Oral Drugs

- Biguanides - Metformin (Glucophage and Glucophase XR)

- Sulfonylureas - Glimepiride (Amaryl), Glyburide (DiaBeta), Glipizide (Glucotrol), Gliclazide (Diamicron), Chlorpropamide (Diabinese)

- Meglitinides and D-Phenylalanine Derivatives - Repaglinide (Prandin), Nateglinide (Starlix)

- Thiazolidinediones (TZDs) - Rosiglitazone (Avandia), Pioglitazone (Actos)

- Dipeptidyl peptidase-IV (DPP-4) inhibitors - Sitagliptin (Januvia), Saxagliptin (Onglyza), Linagliptin (Tradjenta), and Alogliptin (Nesina and Vipidia), Teneligliptin (Tenelia), Vildagliptin (Galvus)

- Alpha-glucosidase Inhibitors - Acarbose (Precose), Miglitol (Glyset), Voglibose (Voglib)

- Sodium-glucose co-transporter-2 (SGLT2) inhibitors - Canagliflozin (Invokana), Dapagliflozin (Farxiga), Empagliflozin (Jardiance), Ertugliflozin (Stelgatro)

- Dopamine D2 agonist – Bromocriptine (Parlodel and Cycloset)

- Glucagon like peptide 1 (GLP-1) receptor agonists - Semaglutide (Rybelsus)

- Bile Acid Sequestrants (BASs) - Colesevelam (Welchol)

- Others (Fixed Dose Combination Drugs)

By Application (Revenue, USD Bn):

Based on application, the market is segmented into Type 1 and Type 2. The 2 types of diabetes drugs are segmented and dominate the market. The Type 2 diabetes segment accounts for the largest sales of the worldwide market a few different kinds. The excessive prevalence of type 2 because of sedentary lifestyles and obesity in all age groups is attributed to the current situation. Around 10% of all diabetes cases are type 1, and approximately 90% of all cases of diabetes in UK are type 2. Hence, it is estimated to the diabetes drugs market will grow across the globe during the forecast period.

- Type 1 diabetes (due to β-cell destruction, usually leading to absolute insulin deficiency)

- Type 2 diabetes (due to a progressive insulin secretory defect on the background of insulin resistance)

- Other diabetes types

By Distribution Channel (Revenue, USD Bn):

Based on distribution channels, the market is classified into hospital pharmacies, rental pharmacies, and online pharmacies. The hospital pharmacies captured the highest market share, owing to the availability of trained & qualified personnel and favorable reimbursement structure. Online pharmacies are estimated to register the highest CAGR in the forecast period, it is attributed to the technological adaptation and acceptance of online pharmacies. Retail pharmacies showed a moderate market share improvement in the healthcare facilities in developing countries is anticipated to propel the popularity of retail pharmacies during the forecast period.

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.