Middle East Dental Care Market Analysis

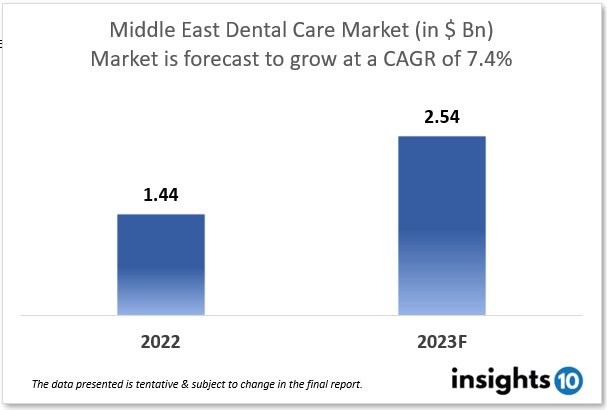

Middle East dental care market size is at around $1.44 Bn in 2022 and is projected to reach $2.54 Bn in 2030, exhibiting a CAGR of 7.4% during the forecast period. With the majority of countries relying on crude oil for crucial contributions to the economy and ongoing political crises in the Middle East, the demand as a whole remains unaffected in fact continues to rise. Major players in UAE and Kuwait tend to expat needs like Apex Medical & Dental Clinics, Dubai Smile Dental Clinic, Al-Rashid Hospital Dental Centre, and Kuwait Dental Centre. This report is segmented by treatment type, age group, clinical setup, and demography.

Buy Now

Middle East Dental Care Market Executive Summary

The economy in the countries of the Middle East varies widely. Some countries, like the United Arab Emirates and Qatar, have strong and diversified economies, while others, like Iraq and Syria, have struggled in recent years. The Middle East region has always been sensitive to the fall in oil prices; however, some countries have been able to diversify their economy, and it has not been the case for other countries that heavily rely on oil exports. Expenditure on healthcare in the Middle East also varies widely among countries. Some countries, like the United Arab Emirates (4.25%) and Kuwait (5.49%), have relatively high healthcare expenditures as a percentage of GDP, while others, like Yemen and Syria, have lower expenditures. The healthcare system in most countries in the Middle East is a mix of private and public healthcare and the majority of the funding comes from the government. Overall, the Middle East region has a relatively high level of healthcare expenditure compared to other regions of the world, but there are large disparities between countries.

Dental services in the Middle East vary in availability and utilization depending on the specific country and region. In general, dental care is more widely available in urban areas compared to rural areas, and private dental clinics and hospitals tend to be more prevalent than public facilities. However, the utilization of dental services in the Middle East may be lower than in other parts of the world due to cultural attitudes towards oral health, lack of access to care, and lack of education about the importance of regular dental check-ups. Libya's healthcare system has been affected by the ongoing political turmoil and violence since the 2011 overthrow of former leader Muammar Gaddafi. Before the conflict, the healthcare system was considered to be one of the best in North Africa, however, it has since deteriorated. Hospitals and clinics have been damaged or destroyed in the fighting, and many healthcare workers have fled the country. The supply of medicines and medical equipment has also been disrupted. Furthermore, the ongoing conflict has made it difficult for many people to access healthcare, particularly in areas that have been heavily affected by the fighting. Despite these challenges, the government has made efforts to improve the healthcare system, and some progress has been made in recent years. However, the ongoing conflict and lack of stability continue to pose significant challenges to the healthcare system and the provision of healthcare to the population. In terms of health tourism, Turkey is one of the top 10 nations in the world.

The status of oral health in the Middle East varies by country, but generally, oral health conditions are common and there is a high burden of oral disease in the region. According to the World Health Organization, common oral health problems in the Middle East include tooth decay, periodontal disease, and oral cancer. Factors that contribute to poor oral health in the Middle East include lack of access to preventive care, lack of education about oral hygiene, and high sugar and tobacco consumption. Additionally, oral health care services in the region are not always easily accessible or affordable for all people. Some governments have implemented public oral health care programs and policies to improve oral health and increase access to care, but the impact of these programs is not always clear.

Market Dynamics

Market Growth Drivers

With a high need for dental treatment, the United Arab Emirates (UAE) dentistry services industry is booming as the population size is rising as well as a huge number of foreigners or expats. Since the late King Abdul Aziz Bin Abdul Rahman Al Saud established the modern state of Saudi Arabia, his compassionate and forward-thinking vision has made public health and disease management the Ministry of Health's (MOH) top priority. The rising scope of healthcare services necessary in the Kingdom at the time, including treatment for Hajj and Umrah pilgrims (6.5 Mn visitors in 2021), necessitated the creation of a Public Health Council (PHC). The principal goals of these bodies are the establishment of professional healthcare personnel as well as the control of diseases and epidemics that were prevalent at the time. In 2021, $2.4 Bn was spent on healthcare (4.7% of GDP), putting Saudi Arabia in 55th place on the global Health Care Index. The growing diversity of the population due to the expansion of these oil economies to other service-based industries, the expansion of possibilities has shown up on the horizon. The median population of 19.4 years across the middle east, amidst the turmoil in Libya and Syria, has nevertheless not dampened the demand for dental care in the Middle East Region.

Market Restraints

The Middle East has a limited number of dental education institutes, making it difficult to attract and retain dental practitioners. Patients may have difficulty accessing dental care if dental professionals are scarce in specific areas, particularly in rural areas. Strict restrictions and certifications for dental practitioners are required, making new experts difficult to enter the market and restricting the number of specialists available to provide treatments. The high level of competition in the market, as well as the presence of multiple notable dental clinics and centers, might make it difficult for new dental practices to establish themselves. High dental treatment costs, might be prohibitive for certain patients, particularly those without insurance. Lebanon, Libya, Syria, and Iraq are recognized for their political and economic volatility, which can stifle the growth of the healthcare sector in general, and dental clinics in particular. Dental clinics may find it challenging to attract funding or extend their services as a result of this. The country's healthcare infrastructure is not always adequate, limiting dental clinics' capacity to provide high-quality services. Dental clinics in the Middle East may experience bureaucratic hurdles, such as delays in obtaining licenses, permits, or insurance company reimbursement, which can be a limiting factor for the clinics.

Competitive Landscape

Key Players

- GMC Clinics (UAE)

- Dental Studio (UAE)

- Cosmo Health Medical Centre (UAE)

- Clover Medical Centre (UAE)

- Apex Medical & Dental Clinics (UAE)

- Dubai Smile Dental Clinic (UAE)

- Al-Rashid Hospital Dental Center (KWT)

- Kuwait Dental Center (KWT)

- Dentaprime (TUR)

- Estetik International (TUR)

- Dentimplant (TUR)

Notable Recent Deals

January 2023 - Mubadala Investment Company (Mubadala) has bought Dental Care Alliance (DCA), a substantial US-based dental services organization with around 390 affiliated practices, alongside funds managed by Harvest Partners, a well-established middle-market private equity firm. DCA, formed in 1991, employs around 5,400 people across 22 states, including over 885 dentists, and receives over 3.5 Mn patient visits per year.

January 2023 - Thumbay Dentistry Hospital (TDH), the UAE's largest academic dentistry hospital, has partnered with Gaea Cynosure, one of the region's top Continuing Medical Education (CME) providers, to extend its network of partner academic institutions. The MoU, in collaboration with Gaea Cynosure, aims to provide clinical training facilities for doctors, physicians, and surgeons, as well as collaborations in other advanced super-specialized educational programs.

November 2022 - Olive Rock Partners, an independent private equity firm based in Abu Dhabi, announced the acquisition of a majority stake in two UAE-based dentistry networks. Olive Rock Partners invested in The Dental Studio (TDS) in Dubai and Al Bustan Medical Centre in Abu Dhabi in partnership with their respective management doctors. Both of these platforms are market leaders and are well-positioned for M&A expansion in complementary catchment areas around the UAE.

Healthcare Policies and Regulatory Landscape

Through health care policies and initiatives, the Ministry of Health and Prevention (MOHAP), Emirates Health Authority (EHA), Health Authority Abu Dhabi (HAAD), and Dubai Health Authority (DHA) are collaborating to promote oral hygiene on a larger scale in the country. The Health Regulation Sector (HRS) is a division of DHA that was established to carry out the following overall strategic objectives and programs: Programs like Oral & Dental Care, which focus on raising awareness, prevention, and screening, as well as building dental procedures, are anticipated to help the UAE's dental services industry grow. The Lebanese Order of Dentists (LOD) is Lebanon's governing authority for dental services. In the Middle East, regulatory rules are provided by the Ministry of Health. In the Middle East, the Ministry of Health sets regulatory rules for dental health care for the entire population via public dental clinics. Because data on oral health is sparse, oral health service planning and development have been carried out with little evidence of the population's dental needs. Dental health services are extensively offered across the city. Many general and rural hospitals have on-site dentistry clinics. The most prevalent treatments are simple dental check-ups, minor oral surgery, tooth scaling, and restorations, with little emphasis on preventive care. Preventive services have shown almost little advancement. Rather than preventive programs, government investment has mostly concentrated on the detection and treatment of oral illness. All hospital dentistry clinics are funded by the Ministry of Health.

Reimbursement Scenario

Many people in the Middle East rely on out-of-pocket expenses to meet their dental expenses, which raises the price of care and rehabilitation. Dental service coverage is provided as part of private insurance plans by companies such as UnitedHealthcare, Cigna Global, and Allianz that allow for even international visitors to avail dental services under their insurance plans bought by them from these inter-border organizations. The UAE has unified all government health insurance programs under the "Enaya" Unified Health Insurance System, which incorporates the "Saada" program and other government insurance schemes. For UAE citizens and GCC nationals with valid Health cards, the service is free. Citizens of the UAE and GCC citizens (who do not have or have an expired health card) will be charged for the service based on the regulation and patient diagnosis. Residents of other countries (who do not have or have an expired health card) will be charged a fee based on the diagnosis. Preventive treatment, such as frequent check-ups and cleanings, is prevalent in dental insurance policies, as is basic care. More involved operations, like as root canals, crowns, and orthodontics, may also be reimbursed, albeit with a larger co-pay or a longer waiting period.

The cost of dental insurance in Qatar will most likely be determined by the precise plan and degree of coverage provided. It is best to contact insurance companies and compare policies to locate one that suits your demands and budget. Qatar Insurance Company (QIC), Qatar General Insurance and Reinsurance Company (QGIRCO), and Qatar Islamic Insurance Company are the major health insurance companies in Qatar that cover dental services (QIIC). Furthermore, several other insurance companies, such as Qatar Petroleum Insurance Company (QPIC), Doha Insurance, and Gulf Insurance and Reinsurance Company, provide dental insurance as part of their health insurance plans. In Turkey, dental services are reimbursed through the National Health Insurance System (NHIS), which is governed by the Ministry of Health. However, coverage and reimbursement for dental services under the NHIS are limited, with only basic procedures such as extractions and fillings covered. Many dental operations, like as orthodontics and aesthetic dentistry, are not covered by the NHIS and must be paid for by the patient.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Middle East Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.