Mexico Pharmacy Automation Device Market Analysis

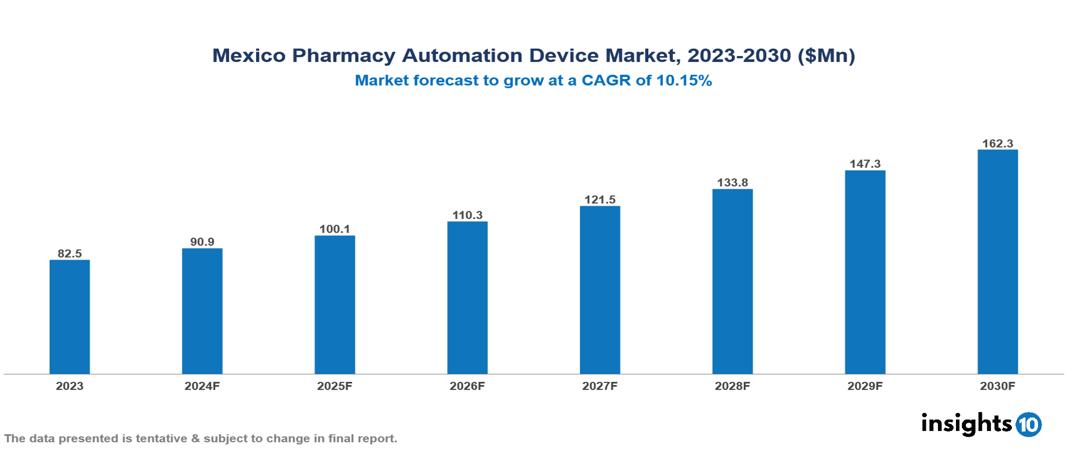

The Mexico Pharmacy Automation Device Market was valued at $82.5 Mn in 2023 and is predicted to grow at a CAGR of 10.15% from 2023 to 2030, to $162.3 Mn by 2030. Mexico Pharmacy Automation Device Market is growing due to Increasing Demand for Efficiency, Rising Demand for Pharmaceuticals, Increasing adoption among end-users. The market is primarily dominated by players such as Amerisource Bergen Corporation, Accu-Chart Plus Healthcare Systems, Omnicell, Inc., McKesson Corporation; Pearson Medical Technologies, Baxter.

Buy Now

Mexico Pharmacy Automation Device Market Executive Summary

Mexico Pharmacy Automation Device Market is at around $82.5 Mn in 2023 and is projected to reach $162.3 Mn in 2030, exhibiting a CAGR of 10.15% during the forecast period.

Prescription medication distribution, packing, counting, and sorting can all be done electronically with the use of pharmacy automation systems. Enhanced productivity, precision, and reduced labour expenses are just a few advantages of pharmacy automation technologies. Chemists can use the dispensing equipment to sync and track patients' medications without having to manually enter them. Pharmaceutical dispensing poses a serious risk to pharmacies due to the potential for multiple mistakes and contaminants. Pharmacies management can benefit from a number of pharmacy automation equipment, including enhanced inventory control, better space savings, more security for drugs, and faster and more accurate processing.

These devices have been shown to improve medication dispensing accuracy by up to 90% and reduce processing times significantly, thus increasing overall pharmacy efficiency. Several companies and startups are actively involved in this sector in Mexico, including prominent players like Omnicell and BD. These companies are leveraging technology to innovate and meet the growing demand for automated pharmacy solutions in the region. The market, therefore, is driven by significant factors like Increasing Demand for Efficiency, Rising Demand for Pharmaceuticals, Increasing adoption among end-users. However, Lack of Standardization, High Costs, and Stringent Regulatory Procedures restrict the growth and potential of the market.

“Dartmouth” Hitchcock Medical Center in Lebanon launched three new robots for pharmacy delivery in the healthcare industry. The robots will reduce time travel time for the technicians.

Market Dynamics

Market Growth Drivers

Increasing Demand for Efficiency: Healthcare providers face mounting pressure to optimize their operations amidst increasing patient volumes and medication complexities. Pharmacy automation addresses this need by automating routine tasks such as prescription filling and inventory management, freeing up pharmacists' time to focus on patient care. It streamlines workflows and reduces manual errors, which enhances operational efficiency and allows pharmacies to serve more patients effectively. These devices have been shown to improve medication dispensing accuracy by up to 90% and reduce processing times significantly, thus increasing overall pharmacy efficiency. This increased efficiency improves the overall quality of care and helps pharmacies manage costs and stay competitive in the evolving healthcare landscape.

Rising Demand for Pharmaceuticals: Chronic diseases like cancer and diabetes are becoming more common, affecting a staggering 60% of adults globally. These conditions often require long-term medication use. Secondly, as healthcare improves and people live longer, the population is aging, leading to a greater need for medical attention. Finally, advancements in research and development are leading to the creation of new, targeted drugs for specific illnesses, further fueling the demand for pharmaceuticals.

Increasing adoption among end-users: Pharmacy automation systems are used by hospitals to improve patient care and reduce overall costs. The pharmacy staff won't be required to count medications in the hospital basement thanks to automation in the medical setting. Hospitals must be old enough to build floors that support pharmacy automation. In order to make the best use of available space, new dispensing cabinets are currently being developed around hospital floor plans. Over the past 10 years, the development of more effective and versatile drug-dispensing cabinets with high-capacity drawers that can be combined in different ways to fit the individual needs of a facility has been a major advancement in pharmacy automation

Market Restraints

Lack of Standardization: Missing universal protocols and data exchange standards. Without these, it's difficult to expand or connect these systems together, causing compatibility headaches and challenges when integrating them into pharmacies. Furthermore, the lack of standardized processes makes it hard to develop a complete automation plan, limiting pharmacies from fully benefiting from these technologies.

High Cost: Pharmacy automation offers a powerful tool, but the initial investment can be a steep climb, especially for smaller pharmacies. Installing these systems can cost anywhere between $300,000 and $800,000. That's a tough pill to swallow for small and medium pharmacies with limited budgets. And it doesn't stop there - maintenance and upgrades add to the ongoing costs. This high initial hurdle can be a major turn-off, slowing down the adoption of automation technology. In areas with tight healthcare budgets, the cost of automation might be simply out of reach, further limiting its spread.

Stringent Regulatory Procedures: Drug distribution to the general people is a critical function of hospitals and pharmacies in the country's drug supply chain. The public and industry practitioners are protected and secure under three significant statutes, in addition to the numerous state and federal rules that govern pharmaceutical dispensing methods. Controlled substance regulation and safety, pharmaceutical hazardous waste management, and drug supply chain protection are all covered by these regulations. Pharmaceutical manufacturers who produce automated systems must consequently adhere to a number of rules; this can cause delays in the launch of new products and is

Regulatory Landscape

Regulatory landscape for pharmacy automation devices is shaped by stringent standards overseen by COFEPRIS (Federal Commission for the Protection against Sanitary Risk). These devices must comply with specific norms and regulations to ensure safety, accuracy, and reliability in pharmaceutical operations. Market entry requires thorough registration processes, including demonstrating adherence to Mexican Official Standards (NOMs) and proving efficacy through clinical trials or equivalent certifications. Manufacturers and distributors navigate a complex framework that prioritizes patient safety and operational integrity. Adherence to these regulations is crucial for gaining market approval and maintaining compliance throughout the lifecycle of pharmacy automation devices in Mexico healthcare sector.

Competitive Landscape

Key Players

Here are some of the major key players in Mexico Pharmacy Automation Device Market:

- Amerisource Bergen Corporation

- Accu-Chart Plus Healthcare Systems, Inc.

- Omnicell, Inc.

- McKesson Corporation

- Pearson Medical Technologies

- Baxter

- Talyst, LLC

- Scriptpro LLC

- Becton Dickinson and Company

- Fulcrum Pharmacy Management, Inc.

- Medacist Solutions Group, LLC

- Aesynt, Inc

- Capsa Healthcare

- Cerner Oracle

- ARxIUM

- Touchpoint Medical

- Swisslog Healthcare

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Mexico Pharmacy Automation Device Market Segmentation

Based on Pharmacy Type

- Independent

- Chain

- Federal

Based on Pharmacy Size

- Large Size Pharmacy

- Medium Size Pharmacy

- Small Size Pharmacy

Based on Application

- Drug Dispensing and Packaging

- Drug Storage

- Inventory Management

Based on End-user

- Retail Pharmacy

- Inpatient Pharmacies

- Outpatient Pharmacies

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.