Mexico Medical Digital Imaging System Market Analysis

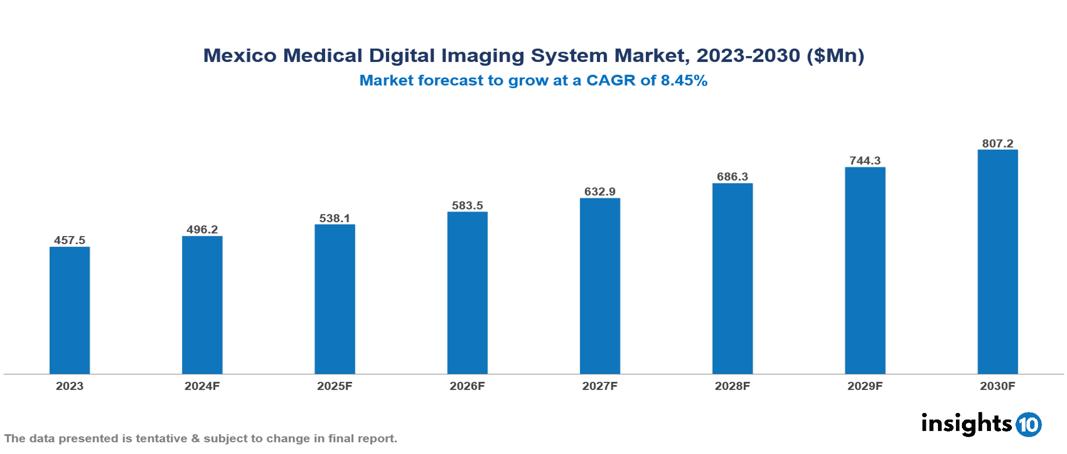

The Mexico Medical Digital Imaging System Market was valued at $457.5 Mn in 2023 and is predicted to grow at a CAGR of 8.45% from 2023 to 2030, to $807.23 Mn by 2030. The key drivers of this industry include an aging population, technological advancements, and rising chronic diseases. The industry is primarily dominated by players such as Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems among others.

Buy Now

Mexico Medical Digital Imaging System Market Executive Summary

The Mexico Medical Digital Imaging System Market was valued at $457.5 Mn in 2023 and is predicted to grow at a CAGR of 8.45% from 2023 to 2030, to $807.23 Mn by 2030.

Medical digital imaging systems comprise various technologies employed in healthcare to create visual representations of the body's internal structures for clinical analysis and medical interventions. These systems have evolved considerably and are crucial in contemporary medicine, assisting in the diagnosis and treatment of diseases. Medical imaging encompasses ultrasound, x-rays, computed tomography (CT scans), Magnetic Resonance Imaging (MRI), and nuclear medicine technologies.

There are approximately 4,000 radiologists at 7,000 medical facilities caring for the entire population in Mexico. That averages to less than one radiologist per facility, which limits the imaging interpretation capacity. The major contributors of market growth include an aging population, technological advancements, and rising chronic diseases. However, regulatory compliance, skill shortage, and limited healthcare spending restrict the growth and potential of the market.

Prominent players in this field include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems among others.

Market Dynamics

Market Growth Drivers

Aging Population: The proportion of people 65 or older is expected to triple to 20.2% by 2050, which drives the market demand for advanced imaging systems. This demographic shift signifies a growing proportion of elderly individuals requiring enhanced healthcare services, including advanced medical digital imaging systems for diagnosis, monitoring, and treatment planning.

Technological Advancements: Ongoing developments in medical imaging technologies, such as digital radiography, 3D imaging, and AI-powered image analysis, improve diagnostic precision and efficiency and boost market expansion.

Rising Chronic Diseases: More than 10% of Mexican adults suffer from Diabetes whereas around 32% Mexican adults have high cholesterol indicating a surge in non-communicable conditions. The digital imaging system market is driven by the rising prevalence of chronic diseases including diabetes, cancer, and cardiovascular diseases, which all require regular diagnostic imaging for early detection, diagnosis, and treatment monitoring.

Market Restraints

Regulatory Compliance: Innovation and market expansion may be hampered by the need to comply with strict regulations and approval procedures set forth by organizations like COFEPRIS (Comisión Federal para la Protección contra Riesgos Sanitarios).

Skill Shortages: The number of physicians in Mexico has risen to upwards of 300,000. However, there is a low number of radiologists compared to the size of the overall population with roughly one radiologist per 100,000 people. The successful use and acceptance of modern imaging technologies are hampered by a lack of qualified radiologists, technicians, and healthcare personnel who are skilled in operating and interpreting digital imaging systems.

Limited Healthcare Spending: According to the Center for Economic and Budgetary Research (CIEP), almost half of medical costs in Mexico are paid for out of pocket by the country's inhabitants due to limited government financing for the country's healthcare system. Due to the lack of affordability and accessibility of therapeutic choices for many patients, this financial pressure acts as a market barrier for the medical digital imaging system market.

Regulatory Landscape and Reimbursement Scenario

The regulation of pharmaceuticals and medical devices, as well as national health policy, is within the responsibility of the Mexican Secretariat of Health. The Federal Commission for Protection against Sanitary Risk (COFEPRIS) regulates medical devices, including those used for medical imaging. Organizations such as the Mexican Institute of Social Security - Instituto Mexico de Seguro Social (IMSS), the Institute of Safety and Social Services for Public Sector Workers or Instituto de Seguridad y Servicios Sociales de los Trabajadores del Estado (ISSSTE), and the Secretary of Health - Secretaria de Salud (SSA) are in charge of managing public healthcare services.

Competitive Landscape

Key Players

Here are some of the major key players in the Mexico Medical Digital Imaging System Market:

- Siemens Healthineers

- GE Healthcare

- Philips Healthcare

- Canon Medical Systems

- Hitachi Medical

- Fujifilm

- Samsung Medison

- Konica Minolta

- Shimadzu

- Hologic

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Mexico Medical Digital Imaging System Market Segmentation

By Type

- X-Ray

- MRI

- CT Scan

- Ultrasound

- Others

By Technology

- 2D Imaging System

- 3D/4D Imaging System

By Application

- Orthopedics

- Oncology

- Cardiology

- Neurology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.