Mexico Lymphoma Therapeutics Market Analysis

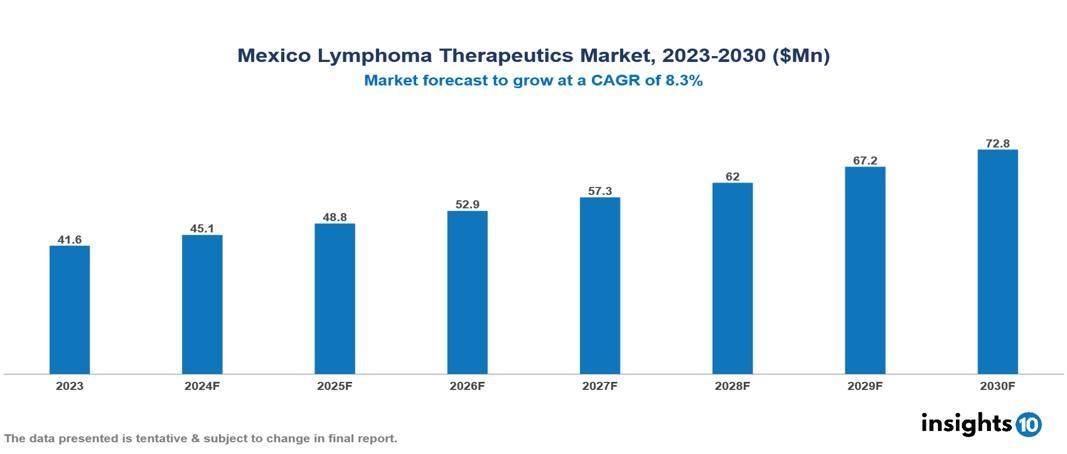

Mexico's Lymphoma Therapeutics Market was valued at $41.64 Mn in 2023 and is predicted to grow at a CAGR of 8.30 % from 2023 to 2030, to $72.76 Mn by 2030. The key drivers of this industry include high lymphoma incidence, healthcare expenditure, and the geriatric population. The industry is primarily dominated by Abbott Laboratories, Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, and Johnson & Johnson Services, Inc. among others.

Buy Now

Mexico Lymphoma Therapeutic Market Executive Summary

Mexico's Lymphoma Therapeutics Market was valued at $41.64 Mn in 2023 and is predicted to grow at a CAGR of 8.30 % from 2023 to 2030, to $72.76 Mn by 2030

Lymphoma represents a group of cancers affecting the lymphatic system, with two main types: Hodgkin lymphoma (HL) and non-Hodgkin lymphoma (NHL). HL is distinguished by the presence of Reed-Sternberg cells, whereas NHL encompasses various subtypes originating from lymphocytes. Common symptoms include swollen lymph nodes, fever, weight loss, fatigue, and itching. Treatment options encompass a range of therapies such as chemotherapy, radiation therapy, immunotherapy, targeted therapy, and stem cell transplant, customized to suit the type, stage, and individual health condition. Regular monitoring and follow-up care play a vital role in managing treatment outcomes and addressing potential side effects.

The Mexico lymphoma therapeutic market, particularly focusing on non-Hodgkin lymphoma (NHL), demonstrates robust growth and considerable market size. Valued at $41.64 Mn in 2022, it is projected to expand further at a compound annual growth rate (CAGR) of 8.30 % from 2023 to 2030, reaching approximately $72.76 Mn by 2030. B cell-targeted therapies dominate the market, given that NHL frequently originates from B cells. Epidemiologically, NHL ranks among the 5th to 9th most common cancers globally, with significant regional disparities in incidence rates, with the highest rates observed in Australia, New Zealand, and North America, and the lowest rates in South-Central Asia. The key drivers of this industry include high lymphoma incidence, healthcare expenditure, and the geriatric population. Restraints include the high cost of lymphoma treatments, drug resistance, adverse effects, etc.

The industry is primarily dominated by Abbott Laboratories, Bristol-Myers Squibb Company, Eli Lilly and Company, F. Hoffmann-La Roche Ltd, and Johnson & Johnson Services, Inc. among others.

Market Dynamics

Market Growth Drivers

High Lymphoma Incidence: The rising occurrence of lymphoma in Mexico is a key factor driving market expansion, fueled by a growing need for effective treatments to meet the demands of an increasing patient population. This trend underscores the importance of developing and providing accessible therapies to manage this disease effectively.

Healthcare Expenditure: Mexico's escalating healthcare expenditure is instrumental in strengthening the lymphoma treatment market. This heightened investment facilitates broader accessibility to advanced therapies and the enhancement of healthcare infrastructure, thereby contributing significantly to the market's growth trajectory. The evolving healthcare landscape underscores the country's commitment to improving treatment outcomes for lymphoma patients.

Geriatric Population: The growing geriatric population in Mexico contributes to the increasing incidence of lymphoma. As individuals age, they become more susceptible to developing lymphoma, thereby fuelling the demand for therapies tailored to the unique healthcare needs of older adults.

Advancements in Therapies: Ongoing advancements in T-cell lymphoma-specific treatments represent a significant driver for market growth. With continuous progress in therapeutic innovations, there is a greater potential to improve patient outcomes and expand treatment options in Mexico.

Market Restraints

High Cost of Lymphoma Treatment: The high cost associated with lymphoma treatment poses a significant barrier to access for many patients in Mexico. Affordability issues can hinder patient adherence to treatment regimens, thereby limiting market growth potential.

Drug Resistance: Over time, lymphoma cells can develop resistance to existing treatment options, particularly for some types of Hodgkin's lymphoma. This resistance poses a significant challenge. The market is driven by the need for new treatment options that can overcome drug resistance and remain effective for longer periods.

Adverse Effects: Safety concerns associated with lymphoma drugs serve as a significant restraint for market growth. Adverse effects and potential risks associated with certain therapies may deter patients from seeking treatment or impact treatment adherence, thereby influencing market dynamics.

Regulatory Landscape and Reimbursement Scenario

In Mexico, the oversight of drugs, biologicals, and medical devices is within the purview of the Federal Commission for the Protection against Sanitary Risk (COFEPRIS). This regulatory body plays a crucial role in evaluating and approving new treatments, including those targeted at addressing lymphoma. COFEPRIS's responsibilities entail ensuring that these therapies adhere to rigorous safety and efficacy criteria before they become accessible to patients.

In terms of reimbursement, Mexico operates a system that encompasses both public and private sectors. Public reimbursement efforts are primarily overseen by institutions like the Mexican Institute of Social Security (IMSS) and the Institute of Security and Social Services for State Workers (ISSSTE). These entities thoroughly assess therapies for their clinical effectiveness and economic viability before incorporating them into reimbursement schemes. Moreover, private insurance companies also contribute to reimbursing lymphoma treatments, albeit through distinct evaluation processes. This holistic reimbursement framework aims to grant patients access to vital therapies while upholding financial prudence and quality standards.

Competitive Landscape

Key Players

Here are some of the major key players in the Mexico Lymphoma Therapeutic Market:

- Abbott Laboratories

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- F. Hoffmann-La Roche Ltd.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Novartis International AG

- Spectrum Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

- Roche Holding AG

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Mexico Lymphoma Therapeutic Market Segmentation

Type of Lymphoma

- B-Cell Lymphomas

- T-Cell Lymphoma

Treatment Type

- Radiation

- Chemotherapy

- Light Therapy

- Surgery

- Medication

- Others

Diagnosis

- Blood Cell Counts

- Tissue Biopsy

- Computed Tomography (CT) Scan

- Positron Emission Tomography (PET) Scan

- Magnetic Resonance Imaging (MRI) Scan

- Other

End-Users

- Hospitals

- Homecare

- Speciality Centres

Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.